Michigan’s Automotive R&D Part II

The automotive industry is somewhat synonymous with Michigan. This relationship was born of an explosion of technological innovation in Southeast Michigan, including the assembly line and key developments in the internal combustion engine and transmission system. Looking at innovative activity today, a hundred years later, it is not far-fetched to state that the geography of automotive innovation in North America resembles that of yesteryear, with Michigan retaining its dominant role. The state has been highly successful to date in sustaining its leading automotive R&D concentration. Yet, for good reason, policy initiatives in the state are aimed at retaining and building on its strength.

The research and development (R&D) activity of private industry is increasingly being recognized as an important part of the innovation that spurs economic growth and competitiveness. Companies undertake R&D both to improve their production processes for cost and quality and to create wholly new products and services.

Among mainstay U.S. industries, automotive remains one of the most innovative in this regard. R&D that was both financed and performed by U.S. domiciled automotive companies amounted to $11.7 billion in 2011, representing 5.2 percent of total R&D spending. The R&D intensity of automotive manufacturing (as a share of the industry’s value added) is 15.3 percent, compared with 9.2 for all manufacturing, and 1.7 percent for all private industry.1

The importance of innovation to automotive companies remains paramount. A recent report by the Boston Consulting Group cited nine automotive companies among the world’s most innovative companies in 2013. The report names several factors behind the innovative burst among automotive companies, including the quickly tightening fuel-efficiency and environmental standards, which have spurred interest in electric and hybrid vehicle technologies. At the same time, auto companies continue to strive to meet ongoing demands for safety, comfort, and performance. Today’s vehicles increasingly comprise advanced electronic and IT components, which are developed both by automotive companies and purchased from technology companies in other industry sectors. By one estimate, “Electronics make up nearly 40% of the content of today’s average new automobile, and their share will continue to grow.” R&D initiatives to enhance the performance and to lower the cost of batteries that may power many of tomorrow’s autos are one example of an important and emerging R&D direction; automatic guidance systems for tomorrow’s (driver-less) cars is another.

Today, Michigan remains the epicenter of automotive R&D in the U.S. The state has maintained its leading place even while production has dispersed throughout the nation. According to data from the National Science Foundation that has been assembled for recent years only, R&D that is both funded and performed by auto companies in Michigan held fast at between 70 and 80 percent of the nation’s total from 1998 to 2011, amounting to $8.87 billion in 2011.

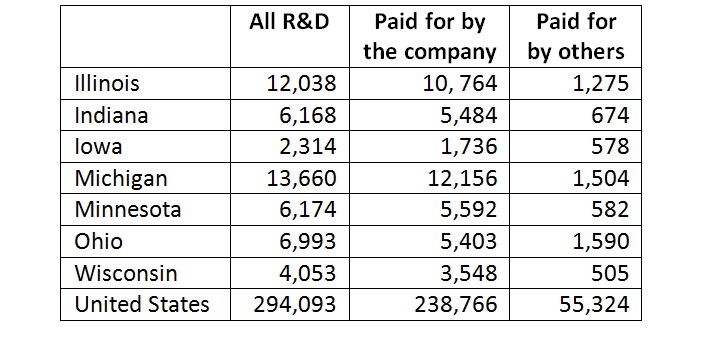

Automotive R&D has propelled Michigan to a leadership position among Midwest states. The table shows Michigan leading the region with $13.7 billion in total business-performed R&D by all industries in 2011, closely followed by Illinois ($12.0 billion), but far ahead of Ohio, Indiana, and Minnesota.2

Table 1. Business R&D Performance in the United States 2011 ($millions)

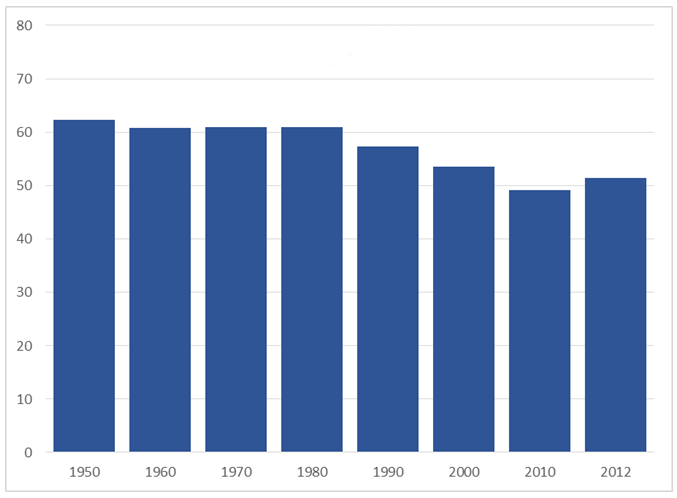

Michigan is also a leader in employment of auto engineers to support long-term R&D and innovation. Drawing on data from the Census and the more recent American Community Survey, we can see how large Michigan’s share of the nation’s automotive engineers is relative to its share of the nation’s work force. Michigan employs over one-half of the nation’s automotive engineers, but its work force overall represents just 3 percent of the nation’s. Granted, Michigan’s share of the nation’s automotive engineers has fallen by ten percentage points since 1980; nonetheless, the state has added 18,000 (two thirds) of its engineers since 1980.

Michigan's Share of US Auto Engineers (percentage)

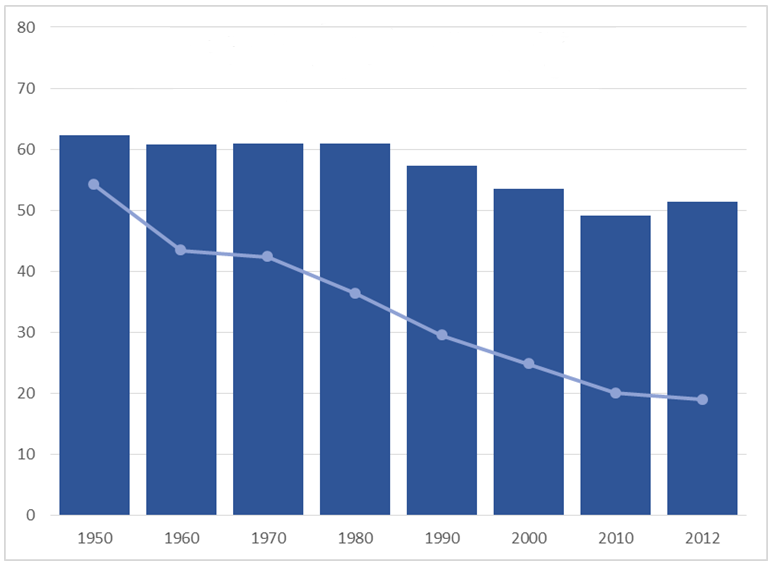

The remarkable importance of automotive technology in Michigan (as represented by engineering workers) can also be understood by comparing it with Michigan’s eroding share of automotive production. By overlaying Michigan’s automotive production workers as a share of the nation on the chart above, the strong role of automotive technology becomes clearer. Since 1950, Michigan’s share of production workers has fallen from 54 to 19 percent, a loss of approximately 255,000 jobs.

Michigan's Share of US Auto Engineers and Production Workers (percentage)

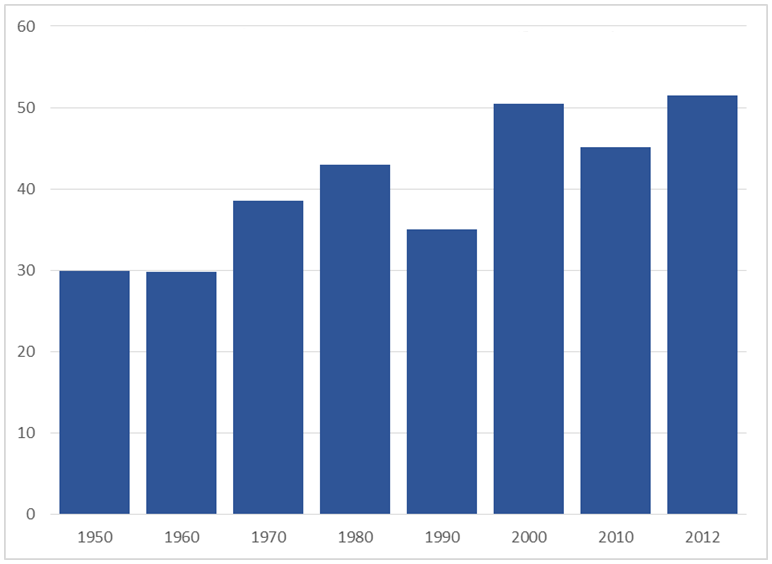

And while there are many technologically advanced industries in Michigan—including bio-pharma, medical equipment, industrial chemicals, and office furniture—automotive engineering has come to dominate further in recent decades. As the chart shows, automotive engineers once comprised 30 percent of engineers in all industries in Michigan. By 2012, their share had risen to 51 percent.

Share of Michigan Engineers in Auto Industry

What is the future of automotive R&D in Michigan; will the region’s extreme concentration in the activity continue? There are no hard and fast answers, yet there are identifiable features that will come into play. On the one hand, there are many historical instances of geographically concentrated centers being very cohesive and long-lived. Once established, such “clusters” tend to grow and feed on themselves. Technology activity is drawn to technology activity. Skilled workers are drawn to activity-rich cities, and companies are, in turn, drawn toward pools of skilled workers. For example, global financial centers such as New York and London have held their dominant positions for many decades, even centuries. The San Francisco Bay area has enjoyed a long run of dominance in the areas of IT and biotech. In a similar way, Michigan’s established leadership in automotive R&D may persist.

On the other hand, company reorganizations and the geographical shifting of activities that tend to be interdependent with technological activities represent risks to Michigan’s position. It may be beneficial for some industries to locate technology and production in close proximity to facilitate (and reduce the cost of) communication and transportation between the two activities. Thus, the fact that Michigan has lost automotive production in recent decades may have negative implications for automotive R&D in the state.

Similarly, co-dependence between R&D and company headquarters activities such as marketing and strategic planning has also been seen as important in some industry sectors. Thus, any major shift in corporate headquarters activity away from Michigan would raise the concern that it might be accompanied by a shift in R&D activity.

Finally, mature industries such as automotive are often severely disrupted by the emergence of wholly new and sometimes unexpected technologies that greatly shake up their organization and geography. For example, the development of aerospace technologies for military uses shifted the locus of related U.S. production from the Northeast to the Southwest and West during the course of the twentieth century. So far, this has not yet taken place as Michigan continues as the U.S. leader in automotive innovation and R&D activity.

Footnotes

1 For 2011, National Science Foundation, National Center for Engineering and Scientific Statistics, Business R&D and Innovation Survey, and U.S. Department of Commerce, Bureau of Economic Analysis.

2 Latest data from the National Science Foundation, available here.