The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

On December 13, 1989, 26 business economists from around the Midwest attended the third annual Economic Outlook Symposium, sponsored by the Federal Reserve Bank of Chicago. The participants submitted forecasts before the meeting and gathered to discuss U.S. economic growth in 1990. This Fed Letter reviews their key points. The forecasts do not necessarily represent the views of the Federal Reserve Bank of Chicago or the Federal Reserve System. They do, however, represent invaluable expertise on industries that are important to the Midwest.

Consensus-a slower economy

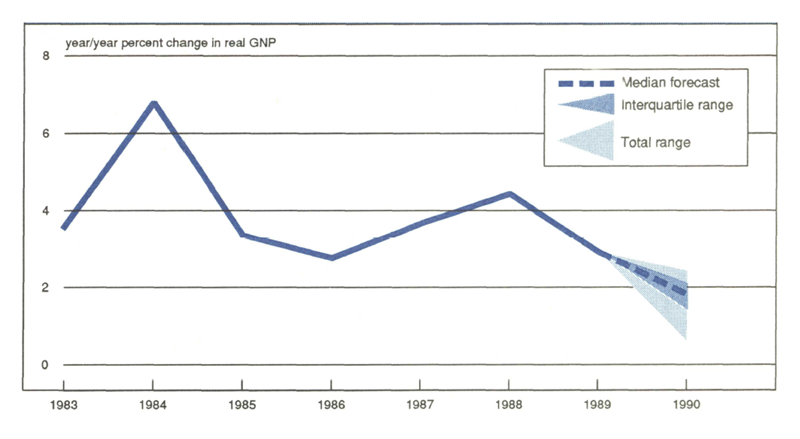

The consensus outlook, based on the median of 25 forecasts submitted, showed real gross national product (GNP) in 1990 growing at a 1.7% pace (see figure 1). This means economic growth in 1990 will be roughly half as great as in 1989 and, in fact, the lowest it has been since the current expansion began in 1983. Moreover, the forecasts ranged from a low of 0.6% to a high of only 2.4%. Thus, even at its best, 1990’s growth is expected to be at least half a percentage point slower than the previous year’s. And at worst, two forecasts called for the economy to enter a recession (that is, two or more back-to-back quarters of negative growth).

1. GNP growth forecast: Down but not out

Although year-over-year expected growth in real GNP was below 2%—a level typically associated with “normal” growth potential—the quarterly pattern of GNP growth cast a brighter light on the 1990 outlook.

Much of the expected weakness in the economy is concentrated in the first half of the year. Expected growth in the first two quarters averages around 1.5%, but the pace accelerates to roughly 2.5% over the last two quarters of the year. At the high end of the forecast range (that is, the upper quartile), GNP growth would be exceeding 3%, a very respectable pace under any circumstances. Underlying this pattern are the expectations that short-term interest rates will fall in 1990 and, by over half of the group, that long-term rates will fall as well.

Industrial production also is expected to exhibit weakness in the first half and strength in the second half of 1990. Indeed, the manufacturing sector is a major source of the expected weakness of the economy. The median forecast of industrial production (which now makes up less than one-third of the economy) showed a pattern similar to the GNP forecast—but the weakness in industrial production is substantially worse than in the rest of the economy. In fact, one-third of the forecasts had at least two quarters of negative growth occurring between the fourth quarter of 1989 and the second quarter of 1990. By the second half of the year, industrial production resumes the role of the engine of growth that it has been playing throughout much of the current expansion. This forecast is a testimonial to the restructuring of the U.S. economy, because it suggests that the industrial sector can have a downturn without pulling the entire economy into a recession.

The consumer takes the driver’s seat

If not from manufacturing, where is the strength in the economy expected to come from? Breaking down the GNP forecast into its major components, the consensus forecast indicates that the investment and export booms that propelled the economy in 1987 and 1988 had run their course by the end of 1989. The median forecast for investment spending in 1990 is 1.7%, just keeping pace with the rest of the economy, compared to roughly 8% in 1988 and 4% in 1989. Similarly, net exports are expected to add about $5 billion to GNP in 1990, after adding $17 billion to $18 billion in the previous year. With inventory investment continuing to decline and housing starts unchanged from their 1989 level of 1.4 million units, consumer spending emerges as the sole factor in keeping the expansion running.

Thoughts of a consumer boom were quickly dispelled by the group, however; their median forecast was a mere 2.2% growth in personal consumption expenditures in 1990—roughly half the pace set over the first half of the expansion. But, despite fears of debt burden consumers curtailing their spending, the consensus forecast has the consumer continuing to buy goods and services. One major exception: automobiles.

…but takes a pass on autos

The auto industry ended 1989 with slumping sales and bulging inventories. A rise in sticker prices and the curtailment of sales incentives earlier in the year, coupled with a slowing economy, reduced auto sales in the final quarter of 1989 to their lowest levels since the early 1980s. Interestingly, by the end of the year imports were also struggling for sales, suggesting that consumers were simply not in a mood to buy new cars. Production has been adjusted, but these cutbacks were less dramatic than the sales slump. As a result, inventories of each of the “Big Three” domestic producers swelled to a 90-day-plus supply, compared to the preferred 60-day supply. A return to heavy sales incentives late in 1989 foreshadows what the auto market is expected to be like in 1990.

The median forecast for auto sales in 1990 was 9.9 million units, compared to 10 million in 1989 and 10.6 million in 1988. That forecast is surprisingly upbeat—sales around 10 million units are generally considered a healthy year for the industry. And, indeed, sales are likely to be far better than the 6-8 million-unit volume associated with economic downturns. Yet, the forecast conceals the extent to which incentives will be required to generate that sales volume. Several economists at the meeting expected domestic producers to be under tremendous pressure to lower prices (through incentives), in order to reduce their inventory overhang by springtime. In fact, one auto economist projected auto sales in 1990 to be as low as 9.4 million units.

The weakness in auto markets did not appear to dampen Christmas sales at the end of 1989, however, and is not expected to spill over into other consumer goods markets in 1990. A point made by one retail economist was that the “middle-aging” of the Baby Boomers, shifting markets toward a more family-oriented population, would generate steady demand for both durable and nondurable goods throughout the 1990s. While retail sales growth would weaken between the last quarter of 1989 and the first quarter of 1990, retail sales (excluding autos) should grow by 7-8% in current dollars in 1990. Shipments of major appliances from the factory are expected to follow a similar pattern. Growth in appliance shipments is expected to decline 3-4% over the first half of the year and to rebound to only 1-2% over the second half.

A bumpy landing for manufacturers

Autos and appliances were not the only industries that were expected to be slowing over the first half of 1990. Among capital-goods producers, for example, an economist for an electronic-goods producer expects shipments to slump to a 2-3% growth range in 1990, well below the double-digit rates attainable under normal conditions. Office and computer equipment markets are particularly hard hit by weak cash flow expected in 1990. But sales of electronic equipment are expected to rebound to double-digit rates in 1991. Similarly, a machine tool industry analyst anticipates a decline in shipments of roughly 10% in 1990, although new orders could be as much as 25% below 1989’s rate. Part of the weakness in machine tool orders can be traced to the end of major investment programs in the auto and aerospace industries. But stiff foreign competition was also cited, despite recent declines in the dollar.

Demand for steel is already feeling the impact of a slowing economy. Operating rates declined to 75% of capacity by the end of 1989 (compared to an 85% average for the year). A key source of the softness in steel demand is reductions in new plant and equipment investment projects, which peaked in the second quarter of 1989, according to a steel economist. Auto plant shutdowns in January to control inventories will further soften steel demand. Steel shipments are expected to decline about 5% in 1990 to 80 million tons, still a respectable year.

Among other producers of basic materials, operating rates are expected to be high, relative to consumer- or capital-goods industries, but backing away from the flat-out, full-capacity operating rates of recent years. Growth in chemicals production, driven by strong export demand, product substitution, and an increase in demand for chemically based goods, continued to outpace overall industrial production in 1989. However, production of most types of chemical products in 1990 is expected to grow at less than half the 1989 pace (itself down from 1988).

The paper industry, supplying products ranging from newsprint to packaging, is coming off seven years of solid growth. Operating rates exceeded 100% in some segments of the industry as recently as 1988 but ended 1989 at about 93% of capacity. Shipments in tons are expected to grow only about 1% in 1989 and another 2% in 1990.

Finally, the cement industry, which has been weak for several years, is expected to see continued declines in 1990. The industry has been affected by overbuilding in the commercial market in the early 1980s. Recent changes in the tax laws and a slowdown in industrial building account for much of the expected decline in cement consumption in 1990.

Despite a somewhat bumpy landing, the perception emerging from the meeting was that the manufacturing sector remains on the whole healthy and should finish 1990 in reasonably good shape. The bumps will be hardest in the first half of the year and much depends on how well the auto industry manages its inventories. Operating rates will be more in line with long-run averages than with the peak levels of recent years. Profit margins will be narrowed.

On the bright side—inflation eases

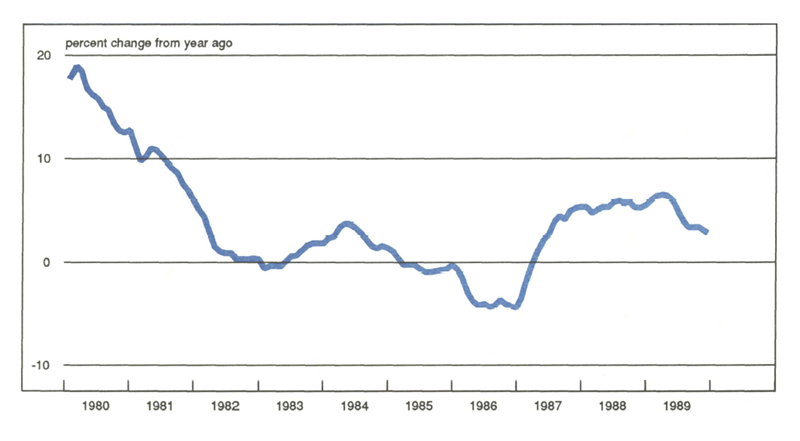

What gave the widespread expectation of a soft landing credibility was the evidence of a slowdown in price increases. This slowdown is already appearing in price measures, such as the Producer Price Index for intermediate goods (see figure 2). The economists noted that:

- Fear of inventory building will hold down effective prices (purchase prices, as opposed to list prices) among retailers at least in early 1990.

- Automobile prices (based on constant equipment and adjusted for incentives) declined in 1989, relative to the Personal Consumption Deflator, and are expected to continue that decline in 1990.

- Increases in appliance prices, introduced early in 1989, have been wiped out by sales incentives.

- Declining demand for steel has increased price competition, particularly among service centers, and producers are having difficulty in passing on labor cost increases.

- Both the chemical and paper industries are experiencing a slowdown in demand as new capacity is coming on stream. This should keep downward pressure on price increases for some time in the future.

2. Producer Price Index—intermediate materials: Trending down in 1989

When asked to forecast the GNP implicit price deflator, however, the group of business economists responded with a median inflation rate of 3.9% in 1990, compared with 4.2% in the previous year. This improvement seems surprisingly modest for all the downward inflationary pressures described at the meeting. Yet, it is important to remember that the manufacturing sector now generates less than 25% of the nation’s output and, thus, has a limited ability to influence aggregate measures of price movements. Other areas of price pressure (such as health and educational services) are also important sources of inflation and tend to be more insulated from the impact of short-term monetary policy than the manufacturing sector. Indeed, the modest improvement suggested by the median inflation forecast is indicative of the dilemma facing monetary policy—attacking producer price increases to bring down aggregate inflation requires such a severe slowing of the economy that producers may not be able to make the necessary investments that allow them to contain prices in the future.

Aiming between the horns

For now, it is fair to say that most business economists at the meeting believe progress is being made toward reducing inflationary pressures in an orderly fashion. This should extend the current economic expansion at least one more year. Far greater concern was expressed about the risk of recession in the months ahead than about a reacceleration of inflation. Extending the expansion by overstimulating the economy and raising inflationary pressures, however, is a risk that cannot be ignored by any policymaker. If the business economists are correct in their forecasts for 1990, policymakers may feel that they have successfully passed between the horns of their dilemma.

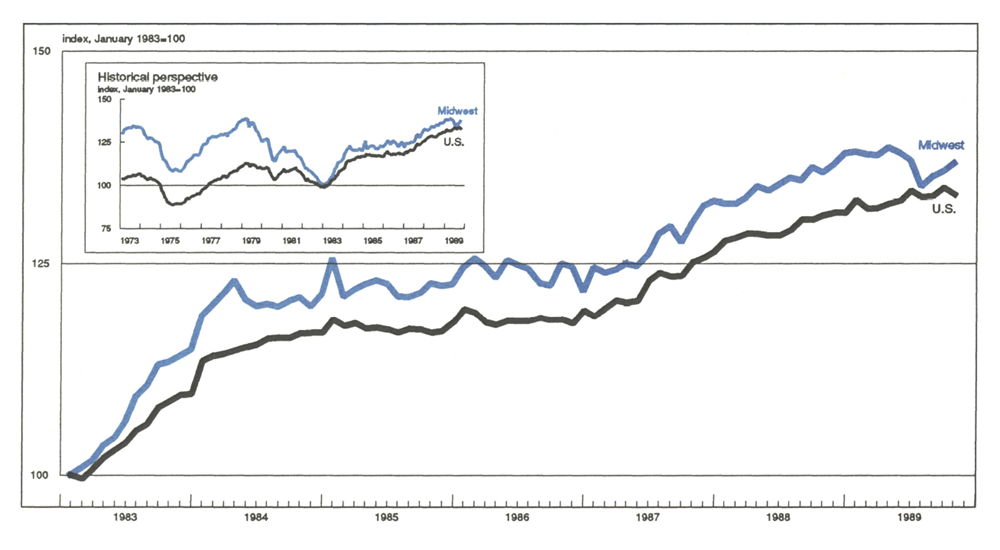

MMI-Midwest Manufacturing Index: Current expansion

Manufacturing activity in the Midwest continued to edge upward in October, after a mid-year slump. The MMI rose 0.7% in October, marking the third monthly gain in a row. However, the index remains below levels attained in the first six months of the year. Food processing accounted for roughly half of the monthly gain. Machinery also showed improvement. The metalworking and transportation sectors, however, weakened. The auto industry has announced sizable production cutbacks, which could depress the region’s transportation sector over the remainder of the year.

Manufacturing activity in the nation (measured on a comparable basis to the MMI) declined 0.6% in October, coming off its highest level of the year. The Boeing strike and San Francisco earthquake may have contributed to the decline.