The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

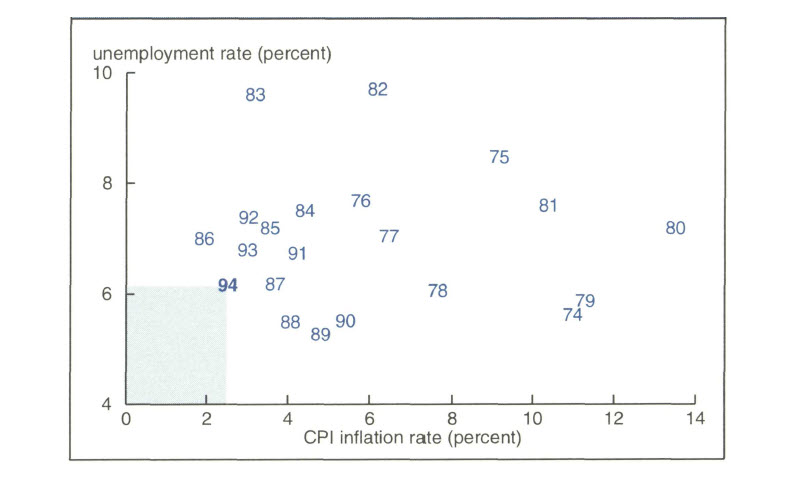

Economic forecasting is an uncertain task, but 1994 is certain to be a tough act to follow. Last year, the economy yielded one of its best performances in the past two decades, with perhaps the most favorable mix of real growth, low unemployment, and low inflation for a single year since the early 1970s. Over this interval, in only one year (1978) did higher real growth of gross domestic product (GDP) combine with a lower unemployment rate. However, that combination helped set the stage for such high and accelerating inflation that real growth proved unsustainable in subsequent years. The final data for 1994 are yet to be compiled, but it appears that the nation has not had a combination of higher GDP growth and lower inflation than in 1994, nor a combination of lower unemployment and lower inflation, in any single year in the past two decades (see shaded area in figure 1).

1. Unemployment and inflation, 1974-94

Amid accelerating growth and signs of some strain on domestic productive capacity, economists and businesspeople from around the Midwest met in December at the Federal Reserve Bank of Chicago to discuss economic prospects for the coming year. The consensus forecast of participants predicted somewhat slower real economic growth, slightly faster inflation, and somewhat higher interest rates in 1995. At the same time, it called for a modest decline in the average unemployment rate for the year as a whole. This Fed Letter discusses that forecast as well as presentations on labor market trends and prospects for Midwest industries.

National outlook still favorable for the Midwest

The consensus forecast called for real GDP growth to decline from an estimated 3.9% in 1994 to 2.7% in 1995, and for the CPI inflation rate to rise from an estimated 2.7% in 1994 to 3.4% in 1995. The forecast also calls for the prime lending rate to rise faster than in 1994, reaching 9% by the latter half of the year. Even so, the economy is expected to grow at a fairly consistent pace throughout the year.

Expectations for the underlying components of GDP still paint a positive picture for the Midwest, albeit not as positive as 1994.

Historically, the combination of interest rate increases, higher inflation, and slower growth in real fixed investment has dampened the relative performance of the durable goods manufacturing-intensive Midwest economy. Some modest waning in the region’s relative performance would not be too difficult to bear, however, after the improvement of the past decade.

Other features of the national outlook still look favorable for the Midwest, and the regional economy should continue to expand under the consensus scenario. Industrial output is expected to rise more slowly in 1995 than in 1994. But at a forecasted rate of 3.9%, this still-appreciable increase would remain above the GDP growth rate and continue to benefit the Midwest. Likewise, growth in business fixed investment is expected to back off slightly from its double-digit pace during 1993 and 1994 but still remain substantially above overall GDP growth. Car and light truck sales—so important to the regional economy—are expected to grow in line with their 1994 increase, above the forecasted rate for overall real consumption spending.

Consumer spending growth: Slower but still healthy

Consumer spending sped up considerably during the latter half of 1994, although high and increasing retail capacity, fierce competition, weather effects, and cost-conscious consumers cut into many retailers’ profit margins. The 1995 forecast shows real consumption growth slowing in line with overall GDP growth but still positive. While the forecast does not specify spending on durable goods within total consumption, the forecast for car and light truck sales implies that durable goods spending will continue to outstrip overall consumption growth.

In the first presentation at the December conference, an economist with a large retail chain stated that the company had successfully planned for a very strong 1994 holiday season. Increased credit utilization helped boost sales late in the year, but the speaker expected that the willingness to use credit would wilt somewhat in 1995. The direct effects of higher interest rates were partly responsible, but the speaker also noted that a significant share of variable-rate loan agreements would begin carrying higher interest rates in the first quarter of 1995 after short-term rates began escalating in early 1994. The speaker also noted that consumer spending has been growing more slowly in recent years than in previous recoveries. However, growth in consumption of durable goods has closely matched that of previous recoveries.

Motor vehicle production and related component and materials output accounts for a large share of the Midwest‘s durable goods sector. An economist with the National Automobile Dealers Association (NADA) gave a cautious but upbeat assessment of trends in auto sales. NADA’ s survey showed dealer optimism rising strongly in the latter half of 1994, and the year was quite profitable for most of the association’s members. Consumer confidence surged in late 1994, boosting auto sales still higher.

This speaker offered some cautionary notes on the longer-term pace of personal income growth and its implications for auto affordability, however. Consumer confidence is an important factor, but “the proper way to understand consumer demand for automobiles is to act like a doctor. Never check their pulse until you check their wallet.” Affordability and income constraints have so stretched the consumer, he argued, that “this apparent surge in industry activity may be a bit like a mouse running on a treadmill.” Demand for new vehicles has been boosted in recent years by provisional solutions such as the extension of loan maturities and increasingly aggressive leasing subsidies, as well as declining interest rates and mortgage refinancing.

Auto industry momentum currently remains quite strong, however, and in light of past cyclical experience, the speaker stated that vehicle sales could remain relatively high for another year or two. Over the longer term, however, he remained cautious because of what he viewed as the temporary, stop-gap nature of attempts to deal with the challenge of waning affordability.

Some other industry experts have discounted the affordability issue. For example, an economist with one of the Big Three automakers observed that mix shifts toward more costly vehicles have boosted affordability measures such as the weeks of median income required to purchase a vehicle. Thus, changes in simple ratios may actually reflect stronger as well as weaker patterns in demand and affordability.

Capital goods prospects still seem bright

Growth in investment has been in line with or stronger than its historical relationship to overall GDP growth since 1988, and investment spending has surged in recent years. Over the 1992-94 interval, business fixed investment grew at its fastest annual average rate over a three-year period since the mid-1960s, even eclipsing the three-year interval following the brutal recessions of the early 1980s. This performance has been all the more remarkable given the extended weakness in structural investment after the commercial real estate implosion of the late 1980s and early 1990s. Capital spending on computers and other information processing equipment has been quite strong, with falling prices amplifying the growth in inflation-adjusted data. Other forms of capital goods spending have also contributed to the upsurge, however, and 1994 growth in real spending on industrial equipment, transportation equipment, and other capital goods was in line with growth in spending on information processing equipment.

Looking ahead, the consensus calls for somewhat slower but still appreciable growth in business fixed investment in 1995. An economist with a manufacturer closely linked to capital spending and export trends presented a broad overview of the worldwide investment environment. Recoveries began to take a stronger turn in previously weak economies of several important overseas trading partners during 1994. The possibility of even greater export gains next year has bolstered Midwest capital goods producers, although recent events in Mexico have tempered their attitudes somewhat. The speaker anticipated slower economic growth in the United States during 1995, but faster growth in Asia, Europe, and most of Latin America. In turn, he expected business fixed investment to grow faster than overall GDP in each of these regions (as well as in North America) in 1995, which would prove a continuing favorable backdrop for the Midwest economy. Worldwide pressures to substitute capital for labor should prompt even stronger export gains to the economies of trading partners with relatively high labor costs, such as Germany. The speaker added a cautionary note, at least in the near term, about trends in China. The potential for growth in capital goods and other exports to that populous, evolving, and potentially massive economy may be threatened by growing inflationary pressures.

Consistent with the favorable outlook for consumer durable goods and capital goods output, a steel industry consultant offered an upbeat appraisal of the prospects for this important Midwest industry. He expected income growth to prompt continued sales gains in 1995 for autos and appliances, and these products carry significant steel content. The consensus forecast suggests that housing construction could flatten out or even decline, but this speaker identified new marketing opportunities in homebuilding, new strengthening in multi-family residential construction, continued growth in retail development, and capacity expansion in the manufacturing sector as important avenues of growth for steel producers in the coming year.

Basic materials producers have been operating under sold-out conditions for many months, according to this speaker, and wider margins could combine with continued strength in demand to justify higher investment spending among basic materials producers during 1995. More generally, capacity expansion projects have already been announced by automakers, electronics producers, and manufacturers of communications equipment. Inquiries for construction engineering consulting (an early indicator of subsequent development activity) continue to run high, and the speaker remained optimistic about prospects for nonresidential construction spending in 1995 despite the 1994 interest rate increases.

“The American job machine”: Broken or overheating?

Investment spending on capital goods has boomed in recent years, but what effect has this had on personal income? Certainly in the short run, the wages and profits accruing to increased capital goods output benefit the employees and stockholders in these specific industries, as well as those of their suppliers. In addition, the productive application of new investment boosts efficiency and, in turn, the long-run growth potential of the aggregate economy. Many have wondered, however, whether heightened capital spending may be substituting for labor resources at an increasingly rapid pace, and whether the higher spending may have combined with heightened international competitive downward pressure on wages to actually depress overall job opportunities and personal income growth, on balance.

The public’s perception of labor market conditions has lagged the improvement implied by the available data, at least until most recently. Nationally, the unemployment rate declined faster in 1994 than in 1993, and by year-end it rested at a level comparable to the lows of the late 1970s and late 1980s. Unfortunately, both of those earlier periods were also characterized by faster increases in prices, rising interest rates, and subsequent economic slowdowns. In recent months, labor markets actually seem to be operating at or near levels believed consistent with a nonaccelerating inflation rate, particularly in the Midwest, where reports of wage increases due to labor shortages have become increasingly frequent.

Is the great American job machine broken, or is it overheating? A presentation by the chairman of one of the largest temporary help companies in the world offered insights into the changing nature of the employment relationship and the possible implications for the long-run generation of wealth. The pattern of job creation is indeed shifting fundamentally, he said, as a slower rate of increase in labor force participation has combined with rapid market changes and technological progress to constrain and restructure labor costs. In particular, the speaker characterized the announcement of the first-ever layoffs at the International Business Machines Corporation in early 1993 as a watershed in workforce management practices. Until the late 1980s, IBM had a tradition of virtual lifetime employment. When jobs at one of the largest computer manufacturers in the world are no longer “permanent,” is there any such thing as a permanent job?

Even so, the speaker stated that “the American job machine is alive and well.” The employment relationship is being reengineered so as to prompt both lower unemployment rates and lower inflationary pressures. The rapid growth in the temporary help industry is one aspect of this larger phenomenon. A number of factors have promoted the use of temporary employment in recent years. Primary has been the push to promote efficiency and reduce risk by transforming previously fixed costs into expenses that vary directly with output. In addition, the temporary employment relationship enables many employers to economize on recruitment costs and offers employer and employee a try-out period before they commit to a more permanent relationship.

Many workers have had to adjust their expectations in the competitive labor market of the late 1980s and early 1990s, and the restructuring process was not without pain. At the same time, wages paid in similar occupations are increasingly reflecting their relative value, and the speaker counseled patience, expressing confidence in the long-run capability of freely functioning labor markets to rebuild themselves and reward initiative and results.

Conclusion

The recovery from the 1990-91 recession has been maturing, with continuing improvement in job opportunities, personal income, and confidence in future income stability. So far, we have yet to witness evidence of such acceleration in inflation that would threaten another slowdown in real activity, despite higher commodity prices and signs of wage pressures due to labor shortages. Accelerating technological progress, heightened domestic and international competition, associated improvement in productivity, and measured but firm monetary policy seem to be laying the basis for continuing growth in real income and the general welfare during 1995.

Tracking Midwest manufacturing activity

Manufacturing output indexes (1987=100)

| November | Month ago | Year ago | |

|---|---|---|---|

| MMI | 138.5 | 137.0 | 125.3 |

| IP | 122.6 | 121.6 | 114.8 |

Motor vehicle production (millions, seasonally adj. annual rate)

| November | Month ago | Year ago | |

|---|---|---|---|

| Cars | 6.5 | 6.4 | 6.5 |

| Light trucks | 5.5 | 5.0 | 5.2 |

Purchasing managers’ surveys: net % reporting production growth

| December | Month ago | Year ago | |

|---|---|---|---|

| MW | 67.3 | 66.8 | 65.3 |

| U.S. | 62.0 | 66.7 | 61.5 |

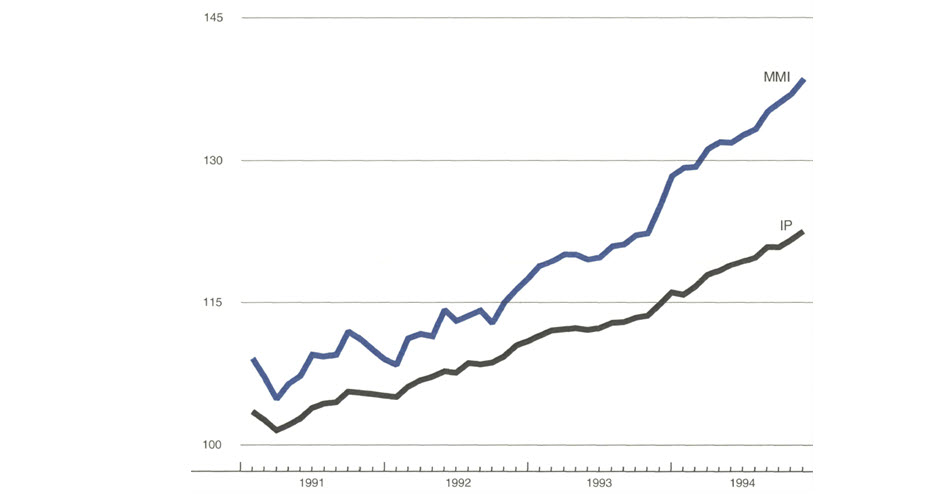

Manufacturing output indexes, 1987=100

Midwest industrial output expanded at a vigorous pace in recent months. The Midwest Manufacturing Index indicates that regional output growth has exceeded the national average since May. Production of industrial machinery and transportation equipment (including light vehicles, trucks, motor vehicle parts, and railroad cars) has led recent gains in the region.