The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

After nearly becoming effective for fiscal years beginning after June 15, 1999, Financial Accounting Standard No. 133, “Accounting for derivative instruments and hedging activities” (FAS133) has been delayed once again. First out for comment in 1996, the Financial Accounting Standards Board’s (FASB’s) draft version was met by strong objections from end users, banks, dealers, industry groups, exchanges, and several regulatory agencies. Congress even stepped into the debate by introducing legislation to delay or bar the proposed accounting standard. The comment process produced numerous suggestions, many of which were incorporated. In the end, the FASB appeared to have moved significantly closer to its goals of increased financial statement transparency, consistency, and comparability. In the final hour, however, at the request of many banks and corporate end users, the FASB postponed the effective date for another year.

In this Chicago Fed Letter, we describe the most notable aspects of FAS133, outline industry objections, and explore some of the possible short- and long-term effects on banks and the derivatives industry of implementing the standard.

Key features of the standard

The FASB’s ultimate objective is fair value accounting; that is, reporting all financial assets and liabilities at fair value on the financial statements. FAS133 is an interim step in this direction. Greater transparency for derivatives is the FASB’s intermediate focus. Derivatives currently appear predominantly in the footnotes of corporate annual reports and supplemental schedules of quarterly bank regulatory reports. However, the amount and format of information varies from firm to firm, except in the structured bank regulatory reports. Even in the case of trading derivatives, which are reported in some manner on the balance sheet, several different treatments have evolved based on limited guidelines issued by the FASB for futures and foreign currency contracts.1 Therefore, the FASB identified a need for increased consistency and comparability for the benefit of investors, counterparties, and regulators.

FAS133 fundamentally changes the accounting treatment for derivatives. The new standard requires all derivatives to be recorded at fair or current market value as assets or liabilities on the balance sheet. Subsequent gains and losses on these instruments must be reflected on the income statement as they occur. The only exception to this treatment applies to derivatives used for certain types of qualified hedges. Allowable hedges fall into two categories: fair value hedges and cash flow hedges. Foreign currency hedges are classified and treated similarly.

Fair value hedges protect against a change in the market value of existing assets, liabilities, or firm commitments. FAS133 requires that gains and losses on both the hedged item and the derivative hedge be recognized in current period earnings. This requires market value accounting of the hedged item.

Cash flow hedges protect against the variability in the cash flows associated with assets, liabilities, and forecasted transactions. For this category of hedges, the standard allows gains and losses on the derivative to be deferred in comprehensive income until the corresponding cash flow or forecasted transaction affects earnings. This applies only to the “effective” portion of the hedge; that is, the change in value of the derivative that exactly tracks the change in value of the cash flow being hedged. The difference is referred to as the “ineffective” portion and must be recognized in earnings.

FAS133 requires extensive disclosure requirements. Firms must show that a hedge is and will continue to be effective. The statement also requires certain derivatives embedded in other financial contracts to be bifurcated and treated in the same manner as other derivative contracts. FAS133 precludes common practices such as cross hedging using derivatives on similar but not identical underlying assets—for example, Treasury bond futures to hedge a mortgage portfolio. Furthermore, except for a few cases, hedging must be done for individual assets or liabilities. Hedging treatment for portfolio risks is severely restricted. Portfolio or other unqualified hedging may still be done for purely economic reasons, of course, but may result in increased volatility of reported earnings.

These narrow restrictions on hedge requirements will mean that many derivatives positions will not qualify as hedges under the standard. Gains and losses on these derivatives must be run through the income statement or the positions must be restructured to qualify. All these measures mean that the new accounting procedures will be more labor intensive and that, given the preclusion of portfolio hedging, may require a greater number of individual contracts.

Objections—timing and volatility

Prior to the latest delay in implementation, some of the strongest objections to the standard concerned the timing of implementation. For most derivatives users, FAS133 was to be effective at the start of the new millennium. The timeframe in which to make the necessary accounting, risk-management, and valuation systems changes would have coincided with the recent resource commitments and expenditures on year 2000 preparedness, a deadline that could not be delayed. Petitioners to the FASB strongly objected to the standard’s effective date, citing the number of implementation issues still unresolved by the FASB, the lack of time remaining to educate staff on the complex new standard, and the internal freezes on computing systems mandated by many firms. Only the last of these objections was cited by the FASB in its decision to delay implementation of the standard.

Aside from timing issues, the most significant concern of derivatives users is that FAS133 will increase reported earnings volatility. Volatility may increase for two distinct reasons. First, fewer derivatives will qualify for hedge treatment. These derivative gains and losses will now be reflected in current income. However, changes in the value of the hedged item, for instance a bank’s loan portfolio, may continue to be carried at book value because there is no generally accepted accounting procedure for marking these to market (or model). Second, even for qualifying hedges, the ineffective portion must be recognized in current income, potentially causing volatility on the income statement.

Why should firms care about accounting induced earnings volatility? Management may fear that investors and analysts will not be able to disentangle the effects of the accounting change and so may conclude that the economic risk of the firm has changed. However, there is little evidence that analysts and investors are misled by accounting conventions. On the contrary, research suggests that analysts and investors are able to incorporate both book and fair value data for securities into their bank valuations.2 Thus, they should be able to incorporate the accounting changes into their valuations and see through the increased volatility.

Another reason that managers may care about increased volatility is based on personal rather than firm concerns. Demarzo and Duffie (1995) find that managers may incorporate private interests such as career and future wage considerations when determining the optimal hedge strategy for the firm.3 Because managers’ compensation is frequently tied to reported earnings, increased volatility may affect managers’ compensation and reputation. This may also have a real impact on managers’ hedging decisions.

Short-term effects of FAS133

There are several one-time costs associated with the implementation of FAS133. Most notable is the cost of revising accounting, risk-management, and valuation systems. Meanwhile, the FASB has not yet resolved many of the implementation details. This in turn is impeding the progress of firms trying to implement the standard and reprogram their systems.

Another potential short-term effect of FAS133 is a temporary increase in derivatives activity prior to implementation. Hedging firms will have an incentive to terminate their existing hedge positions in order to take advantage of current treatment that allows them to amortize the gain or loss over the life of the hedged item. After the new standard takes effect, some of these firms will enter into new derivative contracts. In this way, firms can minimize their current income recognition. This strategy is likely to lead to a one-time flurry of derivatives activity. Firms will also have the incentive to replace unqualified hedges with derivatives contracts that are more customized and of the types favored by the new standard. Other firms may find the new standard too costly to implement and simply terminate their old derivative contracts without replacing them. Those firms choosing to remain unhedged will be taking on greater economic risk.

Long-term effects of FAS133

Ongoing costs associated with the standard include its extensive disclosure requirements. These include documentation of the hedge relationship, the risk-management strategy, and the risk-management objective. The perceived need to use over-the-counter (OTC) derivatives to obtain customization required for qualified hedge treatment will result in higher transactions costs, including fees paid to derivatives intermediaries.

Over the longer horizon, if the stricter hedge accounting rules and changed management incentives lead to less hedging, corporate risk may increase. Because of the need to match derivative positions to individual hedged items to meet requirements for “effective” hedges, FAS133 may also exacerbate the ongoing shift from exchange-traded derivative products to OTC derivative products. As of December 31, 1998, only 13% of banks’ derivatives were exchange-traded.4 Customized OTC products are more costly and less liquid than exchange-traded instruments. During a financial crisis, it may be more difficult to liquidate or dynamically manage these positions. As exemplified in the recent collapse and recapitalization of Long-Term Capital Management, highly illiquid positions can raise systemic risk issues.

Higher costs associated with customized hedges is good news for derivatives dealers only if the volume of derivatives usage by end users does not fall off markedly as a result of these and other increased costs. There is nothing in the standard that is good news for the derivatives exchanges.

Bank regulatory capital requirements may also be affected. Under current risk-based capital guidelines, banks must hold capital equivalent to 8% of their risk-weighted assets to be considered adequately capitalized. The Federal Financial Institutions Examination Council, a consortium of bank regulators, has issued guidelines to minimize the effects of FAS133 on regulatory capital. However, the new treatment will ultimately affect reported assets and earnings, which in turn will affect banks’ leverage and risk-based capital ratios, although it is unclear whether these will increase or decrease.

The possible magnitude of these effects can be judged by examining the output of the banks’ regulatory report, known as the “Report of condition and income,” or Call Report. Among other data, this report collects quarterly information on the notional and fair value of all derivatives and breaks these numbers down into contracts used for trading purposes and contracts used for hedging purposes. Table 1 highlights some interesting statistics. Most strikingly, nearly 96% of derivatives held by all banks are in their trading accounts. Derivatives held for trading purposes are already accounted for on the balance sheet at fair value, with gains and losses reflected on the income statement. Therefore, for banks at least, the new standard will affect only the small percentage of derivative positions that are used for risk-management purposes. As of December 31, 1998, the 447 commercial banks and trust companies with derivatives positions reported a gross positive fair value of $17 billion for derivatives used as hedges.5 Under the FASB’s new proposal, this amount would be recorded on the balance sheet as assets. The increase in assets that would result from the new treatment for all 447 banks represents a minuscule 0.004% of assets.

1. Notional value of derivatives, December 31, 1998

| Derivatives held for trading | Derivatives as % of total derivatives |

Derivatives held as hedges | Hedges as % of total derivatives |

Hedges as % of total assets | |

| ($ billions) | ($ billions) | ||||

| Largest 25 banks | 31,374 | 96.5 | 1,147 | 3.5 | 44.8 |

| Remaining 422 banks | 71 | 21.4 | 259 | 78.3 | 15.5 |

| All banks reporting derivatives | 31,445 | 31,445 | 1,406 | 4.3 | 33.2 |

These statistics may lead one to believe that the standard will have a relatively small direct impact overall on bank balance sheets, income statements, and capital requirements. However, the effects will not be the same for small and large banks. The 422 smaller banks hold only 1% of all derivatives. Of these, 78.3% are held for hedging purposes (see table 1). Therefore, while these banks only hold a small percentage of all derivatives, hedges represent a dominant percentage of their derivatives portfolios. Because the systems changes required to value and account for derivatives positions may have large fixed costs, FAS133 is likely to have a disproportionately higher impact on smaller banks.

The 25 largest bank derivatives users, with 99% of bank-held derivatives, hold only 3.5% of their derivatives as hedges. While the notional value of these positions represents almost half of the large banks’ total assets, the fair value of these contracts is significantly smaller.6

FAS133 will also affect the financial ratios of nonbanking firms used by analysts and investors, such as return on assets and return on equity. This will cause discontinuities in the time series of these numbers, making cross-year comparisons difficult. Existing bond covenants, tied to levels for financial ratios, may also require adjustment.

Conclusion

The changes firms will face in implementing FAS133 have the potential to increase earnings volatility and costs of hedging. However, our analysis suggests that for most banks this impact will be small. Furthermore, the empirical evidence suggests that concerns about the volatility of accounting numbers are overblown. However, managers may fear that investors and analysts will not be able to decipher the changes or managers may not tolerate the effect of the volatility on their reputation and compensation. Thus, the new accounting standard may have unintended real effects on hedging behavior and risk exposures.

In the short term, the standard will surely increase the transaction costs of hedging. It may lead to one-time costs, as firms close out existing positions prior to the effective date of the new standard and replace them afterward. On a more permanent basis, costs will rise if firms match each hedge item as required by the standard rather than hedging on a portfolio basis, as has been the general practice heretofore and as financial theory suggests is optimal. End users, shifting away from exchange-traded derivatives, which are less likely to qualify under the standard, will face higher costs associated with customized OTC derivatives and reduced liquidity.

Bank capital requirements appear unlikely to change significantly even as the new accounting standard affects balance-sheet and income-statement items. However, firm valuation models and contractual restrictions tied to accounting ratios may require restructuring.

All firms with derivative portfolios will face choices: They can incur the costs of converting their derivatives portfolio to qualify for hedge treatment; they can put their existing derivatives on the balance sheet, without qualifying them as hedges, and accept the increased earnings volatility; or they can unwind their positions, cease hedging, and take on economic risks. The accounting and valuation systems of the larger derivatives users will be less costly to modify to accommodate these changes.

For now, the good news for derivatives users is that they have succeeded in deferring FAS133 one more year while the numerous unresolved implementation issues are addressed.

Tracking Midwest manufacturing activity

Manufacturing output indexes (1992=100)

| April | Month ago | Year ago | |

|---|---|---|---|

| CFMMI | 131.4 | 130.1 | 128.6 |

| IP | 138.4 | 137.5 | 134.9 |

Motor vehicle production (millions, seasonally adj. annual rate)

| May | Month ago | Year ago | |

|---|---|---|---|

| Cars | 5.5 | 5.7 | 5.5 |

| Light trucks | 7.2 | 6.8 | 6.5 |

Purchasing managers' surveys: net % reporting production growth

| May | Month ago | Year ago | |

|---|---|---|---|

| MW | 61.4 | 68.8 | 63.5 |

| U.S. | 59.2 | 57.6 | 54.1 |

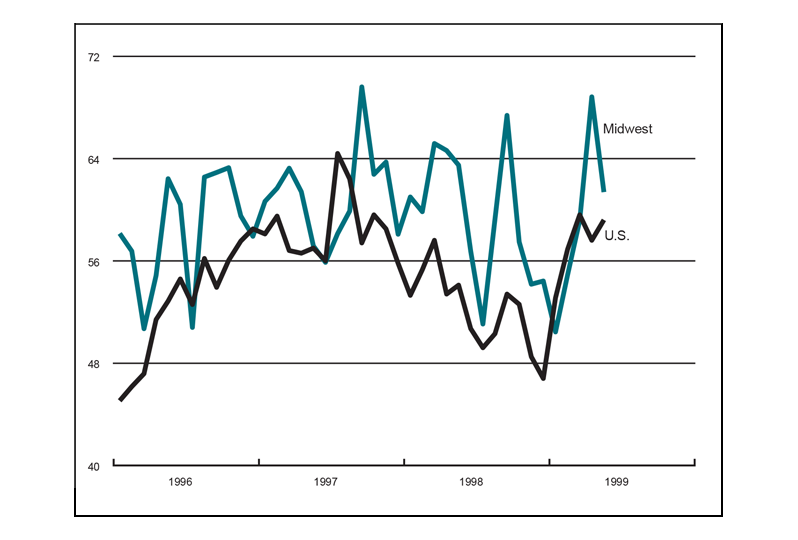

Purchasing managers’ surveys (production index)

The Chicago Fed Midwest Manufacturing Index (CFMMI) rose 1% from March to April, to a new record seasonally adjusted level of 131.4 (1992=100); revised data show the index rose 0.8% in March. The Federal Reserve Board’s Industrial Production Index for manufacturing (IP) increased 0.6% in April after having risen 0.4% the prior month. Light truck production increased from 6.8 million units in April to 7.2 million units in May, and car production decreased slightly from 5.7 million units for April to 5.5 million units for May.

The Midwest purchasing managers’ composite index (a weighted average of the Chicago, Detroit, and Milwaukee surveys) for production decreased to 61.4% in May from 68.8% in April. The purchasing managers’ indexes decreased for all three surveys. The national purchasing managers’ survey for production increased from 57.6% to 59.2% from April to May.

Notes

1 Financial Accounting Standards Board, 1984, “Accounting for futures contracts,” Statement No. 80, August, and Financial Accounting Standards Board, 1981, “Foreign currency translation,” Statement No. 52, December.

2 See for instance Mary E. Barth, Wayne R. Landsman, and James W. Wahlen, 1995, “Fair value accounting: Effects on banks’ earnings volatility, regulatory capital, and value of contractual cash flows,” Journal of Banking and Finance, Vol. 19, No. 3–4, pp. 577–605.

3 Peter M. Demarzo and Darrell Duffie, 1995, “Corporate incentives for hedging and hedge accounting,” Review of Financial Studies, Vol. 8, No. 3, pp. 743–771.

4 Board of Governors of the Federal Reserve System, 1998, “Report of income and condition,” various banks, December 31.

5 Board of Governors of the Federal Reserve System, 1998, “Report of income and condition,” various banks, December 31, Schedule RC-R.

6 Board of Governors of the Federal Reserve System, 1998, “Report of income and condition,” various banks, December 31, Schedule RC-L, reveals positive fair values for hedging derivatives around 1% of total assets.