The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

How the internet will affect banking is one of the most intriguing questions in the ongoing evolution of the U.S. banking industry. Internet banking gives customers the ability to access virtually any type of banking service (the main exception for now being cash) in any place and at any time. If customers adopt this new way of banking in large numbers, banks may be able to shed much of their investment in expensive brick and mortar branches. But internet banking remains a work in progress, and for many U.S. banks the initial internet experience has been disappointing.

In this Chicago Fed Letter, I argue that the internet is chiefly a new delivery channel—not a new product—and based on this argument, I propose a simple framework for analyzing the strategic interactions between physical branches, automated teller machines (ATMs), the internet, and other bank delivery channels. For most banks, the future of the internet lies in how well it can be integrated with more traditional delivery channels. But in the end, profitability will depend primarily on the quality of the products and services banks deliver to their customers, and not necessarily on how those products and services are delivered.

Changing delivery channels

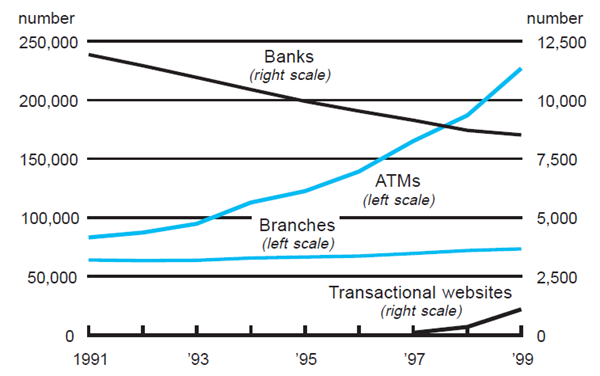

The way that U.S. commercial banks deliver products and services to their customers has changed substantially over the past decade (figure 1). Bank mergers—many of which combined two banks from different geographic markets—reduced the total number of banks by about one-third during the 1990s. But despite having fewer banks, the U.S. now has more banking “points of sale” than a decade ago. The number of branch locations has increased from about 60,000 to about 70,000, and the number of ATMs has skyrocketed. The typical bank now has a greater geographic reach and covers those markets with a denser network of branches and ATMs.

1. Bank delivery channels, 1991-99

More recently, banks have augmented their distribution networks with transactional websites, which allow customers to open accounts, apply for loans, check balances, transfer funds, and make and receive payments over the internet. The number of banks with transactional websites is increasing rapidly—from near zero just a few years ago, to 1,100 at year-end 1999, to an estimated 2,000 plus by the end of 2001. And the recent introduction of wireless internet banking promises to further increase the convenience of web-based banking.1

The internet is also transforming traditional bank distribution channels. For example, the recent increase in ATMs includes the introduction of automated banking machines (ABMs). Often deployed at banking “kiosks,” ABMs combine at a single location an ATM for getting cash and depositing checks, an internet connection to the bank’s website, and often a telephone for accessing customer service. Similarly, the increase in bank branches over the past decade includes the introduction of “mini-branches,” in which internet kiosks are placed side by side with teller windows.

New product or new package?

When a retailer like Eddie Bauer sells a pair of jeans, the point of sale might be a physical store, a telephone order, or an internet purchase. Regardless, the customer’s choice of a delivery channel does not affect the nature of the product. This analysis can be applied to most banking services, regardless of whether the point of sale is a physical branch, an ATM or ABM, or the web. With a few exceptions, a transactional internet website is not a new financial product—rather, it is a new delivery channel for existing financial products.

In some ways, the introduction of the internet banking channel parallels the introduction of ATMs several decades ago. ATMs did not introduce any new financial services, but they offered customers more convenient access to a limited array of existing financial services, primarily the safekeeping of deposits, liquidity services, and information on account balances. Like ATMs, internet banking (supported by other developments like credit scoring technology, check imaging, and check truncation) has increased the convenience of accessing an even wider array of existing banking services.

However, some of the financial services that banks offer over the internet are new. For example, some banks are using the internet to offer account aggregation, which organizes in one place all the data from a customer’s multiple relationships with banks, insurance companies, and brokerage firms. (Prior to financial deregulation, customers tended to have relationships with fewer financial institutions, so account aggregation was less necessary. And prior to the internet, the logistics of collecting data and mailing it to customers made this a less cost-effective service.) Another example is the business-to-business marketplace, where banks use the internet to bring together prospective buyers and sellers of standardized business inputs (e.g., chemicals or paper products). If these markets are constructed efficiently, buyers and sellers benefit from better prices and more timely delivery, and banks can benefit by providing financing for the deals that result.

Choosing a distribution strategy

Not all banking products, and not all banking customers, adapt well to the internet channel. Transferring funds, paying bills, and applying for a credit card do not require personal contact or a large physical space, and are therefore well suited for internet delivery. But applying for a business loan, closing on a home mortgage, and estate planning are complex transactions, which typically require a secure physical space and / or person-to-person communication. And getting cash is impossible over the internet, requiring either branches or ATMs. Because of such limitations, most banks that offer internet delivery do not rely on it entirely.

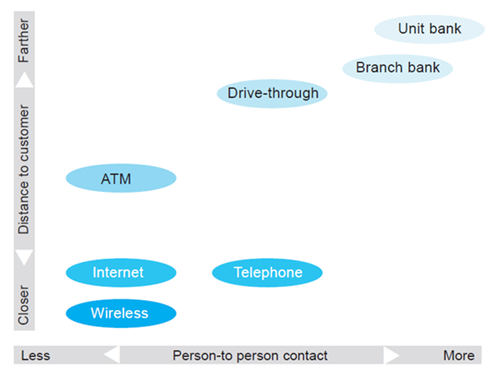

The mix of delivery channels a bank chooses has consequences for its expenses, the convenience of its customers, and the quality of the products and services it delivers. Figure 2 categorizes bank delivery channels according to the distance that customers typically must travel to use them (vertical axis) and the amount of in-person service that customers receive (horizontal axis).

As a bank’s mix of delivery channels shifts vertically from the top of the figure toward the bottom, there are benefits for both the customer and the bank: Convenience increases because customers don’t have to travel as far to perform transactions, and bank expenses tend to fall because less physical overhead is necessary to facilitate the transaction. According to some recent estimates, branch banking costs about $1.07 per transaction, telephone banking costs about $0.55 per transaction, ATM banking costs about $0.27 per transaction, and internet banking costs about $0.01 per transaction.2 But there is a trade-off: Shifting to a more convenient, lower cost mix of delivery channels also tends to reduce person-to-person contact with the customer. As a bank’s mix of delivery channels shifts horizontally from right to left in figure 2, some customers will experience a reduction in (either actual or perceived) service quality.

2. Bank delivery channels: A set of choices

Note that the data displayed in figure 1 indicate that the mix of bank delivery channels has been shifting from the top right corner of figure 2 toward the bottom left corner of figure 2. Does the resulting increase in customer convenience offset the decline in service quality? This shift may or may not be a profitable move for any given bank, depending on the nature of the financial services it sells, the preferences of its customers, and the amount of cost savings from the new distribution strategy.

One potentially successful distribution strategy is to occupy the entire space in figure 2. A click-and-mortar bank augments its existing brick-and-mortar branches, ATM locations, and other delivery channels with a transactional internet website. This approach arguably avoids the trade-off between customer convenience and in-person quality by allowing customers to choose the mix of delivery channels that works best for them. The click and mortar strategy has been adopted by all the largest U.S. banks. An increasing number of full- service community banks are also implementing this strategy, chiefly as a defensive move aimed at retaining high-value customers who want to use the internet for some of their banking transactions.

Another potentially successful strategy is to occupy only the bottom left corner of figure 2. An internet-only or pure play internet bank operates no brick-and-mortar branches. With the exception of arrangements for customers to get cash and deposit checks at ATM machines, banks using this distribution strategy deliver all their products and services over the internet. The very nature of this delivery channel precludes person-to-person customer service, and although this can limit the ability of a pure play internet bank to charge premium prices, reduced spending on physical overhead may potentially offset these revenue limitations. Internet-only banking is often regarded as a niche strategy that focuses only on the most internet-savvy banking customers and / or delivers only a limited array of financial services.

A final strategy is to occupy only the top right corner of figure 2. A brick-and-mortar bank does not operate a transactional website but may operate a nontransactional website where customers can check account balances and get information on products and prices. Banks that use this distribution strategy deliver all of their products and services through traditional full-service branches, augmented by ATM machines. Although this traditional approach is likely to remain a profitable strategy for some community banks into the near future, any strategy that completely excludes internet banking options is unlikely to be profitable in the long run. As time passes and a greater percentage of the population want to do at least some of their banking on the web, these banks are likely to lose an increasing number of their high-value loan and deposit customers.

Is internet banking profitable so far?

Just a few years ago, pundits were predicting that the internet channel would soon eclipse brick-and-mortar branches, and that internet-only banks would quickly capture a large share of the banking market. More recently, these predictions have swung like a pendulum. Indeed, some analysts now argue that pure play internet banking is a flawed business model.3

The reality probably lies somewhere between these two extreme positions. To date, only a handful of serious studies have examined the performance of the internet banking channel. Not surprisingly, the assessments of these studies tend to be less extreme than conclusions drawn in the financial press.

Two of these studies—one performed at the Office of the Comptroller of the Currency, the other at the Federal Reserve Bank of Kansas City—compare the performance of click-and-mortar banks with that of brick- and-mortar banks.4 These two studies find a number of similar results. Most importantly, they find that profitability at the internet banks tends to be higher than, or is at least comparable to, profitability at the more traditional banks. While the direction of causation in these studies is not completely clear—for example, it may be that well-managed, profitable banks are more likely to start up transactional websites—these studies suggest that the internet delivery channel can be part of a profitable banking strategy.

A third study, performed at the Federal Reserve Bank of Chicago, compares the performance of internet-only banks and thrifts with that of banks and thrifts that operate branches (after controlling for a number of outside factors).5 The study finds relatively low profits at the internet-only institutions, caused in part by high labor costs, low fee-based revenues, and difficulty generating deposit funding. However, rather than concluding that internet-only banks are necessarily unprofitable, the study stresses that it may simply be too soon to judge this business model—both internet-only banks and their customers are still learning how to efficiently use this delivery channel, and overall demand for internet-only banking is likely to grow.

The internet’s (eventual) place in banking

Although internet-only banks may eventually become profitable, evidence is mounting that banks using this business model are unlikely to capture a dominant share of the full-service banking market. A growing number of internet-only banks are specializing in niche product markets or customer groups. For example, iVantage Bancorp focuses on college students and their parents; UmbrellaBank.com attempts to build long-term relationships with traditionally “unbanked” consumers; AeroBank.com concentrates on selling loan and cash management services to small business owners; BMW Bank cultivates an upscale customer base at BMW auto dealerships; and State Farm Bank markets online banking services through State Farm insurance agents. Meanwhile, a number of large banking companies that launched high-profile internet-only ventures—including Wingspan (Bank One), mbanx (Bank of Montreal), and Citi f/i (Citigroup)—have been integrating these ventures back into the main bank, giving their internet customers full access to their branch distribution networks. Similarly, Royal Bank of Canada purchased a Chicago-based mortgage company with 150 branch offices so that customers of its U.S. internet-only bank, Security First Network Bank, could access banking services at brick-and-mortar locations.

At the other extreme, it seems even less likely that traditional brick-and-mortar banks will retain a large market share in the long run without offering their customers an internet banking option. Today, it is difficult to imagine a successful bank that operates without ATMs. In the near future, it may be just as difficult to imagine a successful bank that operates without a transactional website.

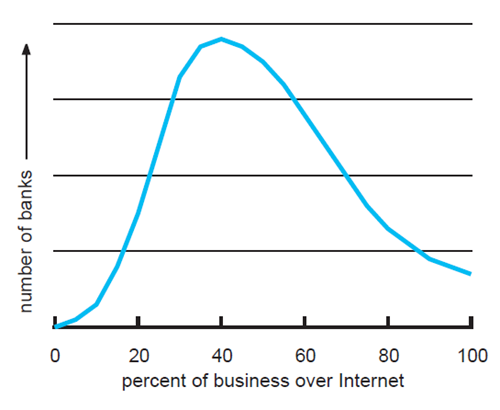

These developments suggest that the majority of internet banking customers will be served by click-and-mortar banks, not by internet-only banks. Figure 3 maps out a hypothetical future distribution of bank delivery channels: a handful of pure play internet banks at one extreme, virtually no brick-and-mortar banks at the other extreme, and a continuum of click-and-mortar banks in the middle. The percentage of business that any given click-and-mortar bank delivers over the internet channel is likely to be determined by the mix of products it offers and the preferences of the customers it serves.

3. Hypothetical distribution of banks

Conclusion

For most banks, and for most of their customers, banking over the internet is still a relatively new phenomenon. Because the pace of technological change is so fast, it can be difficult to evaluate the strategic importance and the financial impact of internet banking. This Fed Letter argues that the internet, much like the ATM that came before it, is fundamentally a new distribution channel over which banks can deliver traditional banking products and services. Banks that successfully integrate this new channel with their pre-existing branch and ATM networks, choosing the mix of channels that best complements their product mixes and customer bases, will gain a strategic advantage. But the business of banking remains the provision of credit, safekeeping, transactions, insurance, and investment services—banks that are unable to provide these services efficiently in an increasingly competitive environment will not flourish, regardless of the delivery channels they use.

Notes

1 Currently, wireless devices are used most often for a limited array of brokerage (e.g., monitoring financial markets, executing trades) and banking (e.g., transferring funds, checking account balances) transactions.

2 See Luxman Nathan, 1999, “Community banks are going online,” Communities and Banking, Federal Reserve Bank of Boston, Fall, No. 27, pp. 2–8. Also see The Economist Newspaper Limited, 2000, “Branching out,” The Economist: A Survey of Online Finance, May 20, pp. 19–23.

3 For example, see Dow Jones & Company, 2001, “Online banks fail to realize cyber-goals,” Wall Street Journal, January 10, p. C18.

4 The first of these studies looks at national banks. See Karen Furst, William W. Lang, and Daniel E. Nolle, 2000, “Who offers Internet banking,” Quarterly Journal, Office of the Comptroller of the Currency, Vol. 19, No. 1, June, pp. 1–21. The second looks at banks in the Tenth Federal Reserve District. See Richard J. Sullivan, 2000, “How has the adoption of Internet banking affected performance and risk in banks?,” Financial Industry Perspectives, Federal Reserve Bank of Kansas City, December, pp. 1–16.

5 Robert DeYoung, 2001, “The financial performance of pure play Internet banks,” Economic Perspectives, Federal Reserve Bank of Chicago, Vol. 25, No. 1, First Quarter, pp. 60–76.