The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Despite the storied advantages of the community bank business model—at generating local market information, at building personal financial relationships, at lending to small businesses—the numbers and market shares of community banks continue to decline in the U.S. A recent conference at the Chicago Fed brought together small bankers, government regulators, and research economists to consider the viability of the community banking model in the information age.

On March 13–14, 2003, the Federal Reserve Bank of Chicago and the Journal of Financial Services Research sponsored a research conference titled “Whither the Community Bank?” The conference brought together approximately 50 community bankers from across the Midwest, 50 bank supervisors from state and federal regulatory agencies, and 50 research economists from universities and government, to share their views on the future viability of community banks in a rapidly changing banking industry.

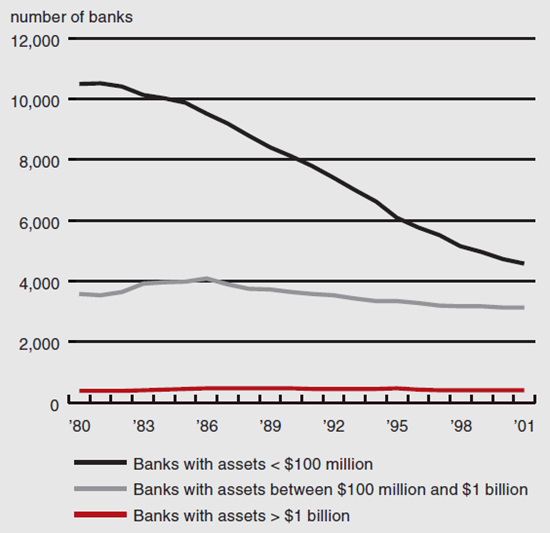

The issue of what the future may hold for community banking is certainly a timely one. Both the number of community banks in the U.S. (see figure 1) and the share of industry assets held by these banks have diminished dramatically over the past two decades. These trends show little sign of abating. The driving forces of change in the financial services industry over the past two decades remain firmly in place—continuous technological change and a regulatory environment that encourages rigorous competition—and, at least on the surface, these forces appear to favor large banks over small community banks. Given these trends, it is natural to wonder how much further the community banking sector will shrink, and how the business strategies of tomorrow’s community banks will differ from those of today’s community banks.

1. Number of community banks

Sources: Call Report data and author’s calculations.

The goal of the conference was to foster interaction between two parties who (ironically) seldom meet: community bankers and research economists who study community banks. The presentations and formal discussions exposed community bankers to high-level banking analysis performed from the viewpoint of objective outsiders, while the question and answer sessions provided researchers with valuable feedback from “the real world” of community banking. This Chicago Fed Letter provides a brief summary of the ideas and issues presented at the conference. All the research papers, presentations, and keynote speeches are available at www.chicagofed.org/newsandevents/conferences/CommunityBank/index.cfm. The Journal of Financial Services Research will publish selected papers from the conference in a special proceedings issue in early 2004.

Introduction to the conference

The conference opened with a paper by Robert DeYoung, William C. Hunter, and Gregory Udell. The authors presented a theoretical framework that predicts the separation of the banking industry into two strategic groups. One of these groups is community banks, which will continue to practice locally focused, relationship-based retail and small business banking. The other group contains large commercial banks that take advantage of the scale economies embedded in automated underwriting processes (e.g., credit scoring, asset securitization) and distribution channels (e.g., internet banking) to sell financial commodity products like online brokerage, credit cards, and mortgage loans to a geographically diverse market. (For details, see DeYoung, Hunter, and Udell, 2002, “Whither the community bank? Relationship finance in the information age,” Chicago Fed Letter, Federal Reserve Bank of Chicago, No. 178, June.)

The data displayed in figure 2 illustrate some of the differences predicted by the authors’ theoretical framework. These data show that community banks practice a relationship-based business strategy. Both well-managed community banks (i.e., those with average return on equity [ROE] above the median for their peer group) and poorly managed community banks raise more of their funds from core deposits, and lend more of their funds to small businesses, than do large commercial banks. However, while the well-managed and poorly managed community banks practice almost identical business strategies, their financial performances vary considerably. The well-managed community banks outperform the poorly managed community banks—and in some cases outperform even the large commercial banks—in terms of loans-to-assets, net interest margins, noninterest income, cost efficiency, and most importantly, ROE.

2. Averages for various groups of U.S. commercial banks, 1996–2001

| Large banks (assets over $1 bil.) |

Medium community banks (assets $100-$500 mil.) |

Small community banks (assets under $100 mil.) |

|||

|---|---|---|---|---|---|

| ROE above median |

ROE below median |

ROE above median |

ROE below median |

||

| Business strategies | |||||

| Core deposits to assets | 32.2% | 50.3% | 52.0% | 58.1% | 57.2% |

| Small business loans to assets | 8.0% | 14.9% | 14.5% | 17.7% | 15.8% |

| Performance targets | |||||

| Loans to assets | 62.2% | 63.4% | 59.3% | 60.3% | 56.1% |

| Net interest margin | 3.9% | 4.3% | 3.9% | 4.3% | 4.1% |

| Noninterest income to operating income |

29.2% | 19.3% | 16.9% | 16.9% | 15.9% |

| Cost efficiency ratio | 60.1% |

58.4% |

67.8% | 63.1% | 75.9% |

|

|

|||||

| Overall profitability | |||||

| Return on equity | 16.1% | 17.0% | 8.8% | 14.8% | 2.7% |

These data have two implications. They suggest that the banking industry is likely to experience further reductions in the number of small, inefficient, poorly managed community banks unable to survive in highly competitive, post-deregulation banking markets. But they also suggest that the community bank business model is financially viable, and that thousands of well-managed community banks will survive.

Diversification

The conference featured four academic paper sessions. Each presentation of a paper at these sessions was followed by a formal discussion by an expert in the field. The first of these sessions explored the effects of product mix on the riskiness of community banks.

Over the past two decades, noninterest income has accounted for an increasing share of total income in the banking industry. Kevin Stiroh measured the risk-adjusted profitability of community banks in the 1990s and showed that this measure of overall bank performance tended to decline when banks shifted away from traditional interest-based activities and into less traditional fee-based activities (e.g., investment services, insurance products, loan securitization, and trading). However, he found that risk-adjusted profitability tended to improve at banks that diversified their activities within either of these two broad areas. He attributed his findings to a potential “dark side” of noninterest income—community banks that entered just one or two noninterest activities in a big way may have strayed into areas that were beyond their managerial expertise or experience. Mitchell Petersen discussed this paper and pointed out that some community banks may simply lack the size required to diversify across a variety of noninterest activities and, as a result, may be precluded from capturing the diversification benefits identified by Stiroh.

Mataj Blasko and Joseph Sinkey examined the financial performance of community banks that specialized in real estate lending from 1989 through 1996. The authors showed that these relatively undiversified banks are accepting higher interest rate risk (i.e., funding long-term, fixed-rate assets with short-term, variable-rate liabilities) in exchange for lower credit risk and, hence, lower regulatory capital requirements. Although these banks mitigate interest rate risk to some extent by holding substantial amounts of adjustable-rate mortgages, the authors concluded that these banks still have a higher-than-average risk of insolvency. Discussant Marsha Courchane pointed out that while the balance of credit risk, interest rate risk, and bank capital may put individual real estate-intensive community banks at risk, this does not raise a concern for systemic risk to the banking system or the economy. Moreover, she encouraged the authors to extend their analysis using more recent data in order to better assess current levels of risk.

Keynote speakers

The first day of the conference closed with a keynote address by Federal Reserve Board Governor Mark W. Olson on “Community Bank Performance in the 21st Century.” Olson reinforced many of the themes mentioned during the afternoon presentations. He especially emphasized the robust financial performance of the community banking sector in recent years—even as the nation’s largest financial institutions were experiencing earnings uncertainty—as evidence that “the community banking franchise remains vital and vibrant.” The key to this vitality, Olson stressed, is the ability of community banks to attract stable deposits and identify profitable lending opportunities by leveraging their connections with the local community. Continued success will require community banks to avoid some key missteps of the past, such as risky concentrations of commercial real estate loans, undue exposure to unexpected swings in interest rates, and lax internal controls.

The second day of the conference opened with a breakfast keynote address by Federal Reserve Bank of Kansas City President Thomas M. Hoenig on “Community Banks and the Federal Reserve.” Hoenig focused on the importance of community banks to the three missions of the Federal Reserve: the transmission of monetary policy, the supervision of commercial banks, and oversight of the payments system. Although community banks account for only small portions of the economy’s banking assets and financial flows, Hoenig stressed that community banks are disproportionately important because of their central role in local and rural economies, especially in funding small businesses. Hoenig expects the number of community banks to continue to decline but to remain in the thousands, and he foresees no decline in the importance of community banks as providers of financial services in local markets.

Economic growth

Community banks specialize in lending to small businesses, and small businesses are an important source of new job creation. Allen Berger, Iftekhar Hasan, and Leora Klapper extended this financial chain one step further by testing whether countries with large numbers of community banks experience more rapid macroeconomic growth. The authors examined data from 49 countries and found stronger gross domestic product growth in both developed and developing nations in which small, efficiently run, privately owned banks held a relatively large share of banking industry assets. Discussant Philip Strahan stressed the potential importance of this study, as it provides the first cross-country evidence linking small banking institutions to macroeconomic growth. If the results of this study are accurate, Strahan concluded, they raise an important question for economic policymakers: Should we provide financial or regulatory subsidies to encourage more community banks to enter the market or should we rely on the crucible of market competition to determine the optimal number of community banks?

Business lending

The local geographic focus of community banks makes them a natural clearinghouse for information that is valuable to small businesses, and the high-touch, relationship-based approach of community banks makes them effective at underwriting and monitoring loans to informationally opaque small businesses. As a result, small business lending should be a profitable line of business for community banks; indeed, this line of business should be more profitable for community banks than for large banks. The research findings presented at this session were consistent with both these expectations.

Jonathan Scott used survey responses from 2,000 small businesses to measure the amount of “soft information” produced for these firms by their primary banks. (Soft information is information that is not easily quantifiable—for example, the reliability of individual businesspeople.) Based on Scott’s interpretation of the survey data, small businesses received more and better soft information when their banks were relatively small and when they worked with the same loan officer for a long time. These findings suggest that locally focused, relationship-based community banks deliver extra value-added to their small business borrowers. Discussant Mitch Berlin applauded this study for its contribution to the relationship lending literature, but considered these issues within the context of a wider question: As it becomes increasingly less expensive to produce, process, and disseminate hard information, is soft information production worth paying for?

David Carter and James McNulty provided some evidence for considering Berlin’s question. They found that between 1996 and 2001, community banks earned a higher risk-adjusted rate of return on small business loans than did large commercial banks—consistent with the notion that small banks are better than large banks at evaluating and monitoring loans to informationally opaque small businesses. Discussant Larry Wall characterized the study’s findings as “suggestive” rather than “compelling,” and he stressed that these findings may not persist into the future. All agreed, however, that soft information is a main stock-in-trade for community banks, and whether small businesses are willing to pay a premium for it is a crucial determinant of how community banks will operate in the future.

Bankers’ panel

A midday panel comprising four community bankers and one finance professor reflected on the presentations made and topics discussed up to this point in the conference. The panelists were in unanimous agreement that the community bank business model faces a long and healthy future. George G. Kaufman, Loyola University Chicago, drew a lesson for the future of the banking industry from the history of the grocery industry. Similar to banking, grocery retailing has experienced periods of substantial technological and environmental change (e.g., transportation, refrigeration, sub-urbanization), and an industry once characterized by small, owner-operated “Mom and Pop” grocery stores now features regional and national chains of supermarkets. But, small grocery retailers have not disappeared. Today, they thrive in the form of convenience stores and mini-marts, not just because they adapted to the changing environment, but because they provide convenient service—a core business strategy that small banks and small grocery retailers have shared for generations.

This lesson of adaptation in the face of change, while remaining focused on a traditional core business strategy, was echoed by the four community bankers on the panel: Robert Atwell, Nicolet National Bank in Green Bay, WI; Lowell Stahl, Labe Bank in Chicago; Alan Tubbs, Maquoketa State Bank and Ohnward Bancshares in Maquoketa, IA; and Robert Yohanan, First Bank & Trust of Evanston, IL. They discussed how small banks can maximize the performance of the community banking business model going forward. On one hand, they stressed general business axioms that are crucial for any small business, like the paramount importance of choosing a good physical location and the central role of personal service. On the other hand, they offered numerous examples of how locally focused community banks offer a clear alternative for households and small businesses that are not well-served by increasingly large banking franchises.

Industry consolidation

The final conference session was devoted to bank mergers and industry consolidation. There have been over 9,000 bank mergers during the past two decades, and about half of these mergers combined two community banks. These mergers increase the size of the participating banks, create the potential for enhanced financial performance, and often alter the manner in which the post-merger banks serve their local markets.

To study the potential impact of mergers on the riskiness of community banks, William Emmons, Alton Gilbert, and Timothy Yeager created 1,000 “simulated” community banks by randomly combining the financial statements of actual community banks from the 1990s. They found that the simulated banks were less risky on average than the actual pre-merger banks, and that these risk reductions stemmed mostly from increases in bank size (i.e., reduced exposure to idiosyncratic risk) and only to a lesser degree from greater geographic diversification (i.e., reduced exposure to local market risk). Discussant Frederick Furlong agreed with the general finding that risk reduction begins with idiosyncratic risk, but he cautioned that the actual community bank mergers that occur in the coming years may behave somewhat differently from simulated mergers based on 1990s data. In particular, bank managers do not select merger targets randomly, but with an eye toward the synergistic benefits a particular target will bring to the acquiring bank.

In the final paper of the conference, Robert Avery and Katherine Samolyk examined how bank mergers affect small business lending in local markets. The study utilized branch-level banking data, an innovation that allowed the authors to measure more carefully post-merger changes in local market lending caused by mergers of multi-market banks. Their results illustrated the important role of community banks: Small business lending tended to increase in local markets after two local community banks merged, especially if a third community bank also operated in those markets. Discussant Richard Rosen stressed that the relationships between local economic conditions, bank merger activity, and bank lending behavior are complex, and that the nature of these relationships may not be fully understood until the banking industry completes its ongoing structural adjustments and settles into a new equilibrium.