The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Economists sometimes argue that recessions promote activities that ultimately contribute to long-run growth. But evidence suggests research and development, one important source of economic growth, falls rather than rises during recessions, even for firms that do not appear to be credit constrained. The author discusses an alternative explanation for this pattern.

In recent years, economists have revived the notion, often associated with the late economist Joseph Schumpeter, that economic downturns play an important role in promoting long-run productivity growth. In this Chicago Fed Letter, I report on my work in Barlevy (2005), which examines how recessions affect one particular channel for growth— namely, research and development (R&D).1

The modern formulation of Schumpeter’s idea builds on the observation that production is less profitable during recessions. As a result, recessions are an ideal time for firms to engage in activities that enhance their productivity but tend to interfere with production. Examples of such activities include retraining workers, retooling a shop floor, upgrading capital equipment, and experimenting with ways of providing better products at lower costs. If slack periods encourage firms to undertake needed improvements that they were reluctant to start earlier, these periods will lead to higher eventual productivity.

The reallocation of resources from production to enhancing future productivity can occur both within firms—whereby resources are redirected from the production floor to improving innovation—and between firms, as some firms shed workers who are in turn hired by budding entrepreneurs developing new ideas and trying to start up competing firms. Since product development requires support staff as well as skilled labor, it is not unreasonable that the production workers who are let go by some established firms will be of value to emerging firms that are developing new products.2

Following this logic, one would expect that more resources should be allocated to formal R&D during recessions. In particular, as noted by Griliches (1990), recessions do not seem to affect the ability of researchers to come up with new ideas, at least as measured by the number of new patents that result from a given research effort.3 If production suffers during recessions while R&D does not, then recessions should be an ideal time to actively seek out and develop new ideas and products.

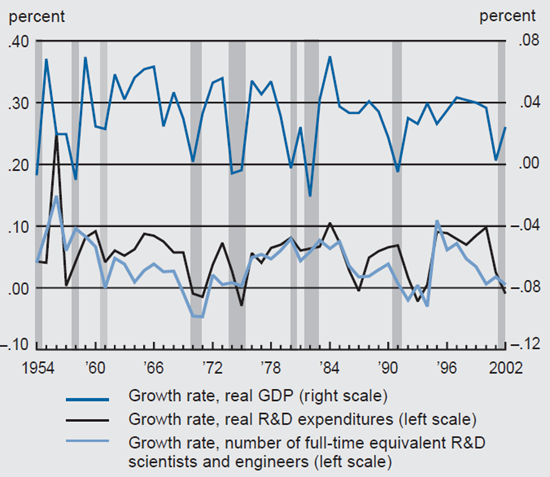

Nevertheless, the empirical evidence shows that R&D tends to fall during recessions, not rise. The primary data source on R&D activity in the U.S. is the National Science Foundation (NSF), which compiles data on annual R&D expenditures by sector and by source of funding. Figure 1 plots the growth rate of R&D expenditures identified by the NSF as financed and performed by private industry, adjusted for the rate of overall inflation. It also plots the growth rate in the number of full-time equivalent scientists and engineers employed by private industry, which is one of the primary inputs into R&D. Although the latter series only captures a part of R&D activity, it has an advantage in that it does not depend on the price of R&D inputs. This is important, since inflation adjustments to nominal R&D expenditures may not accurately reflect changes in the price of R&D. The two data series track each other closely, suggesting changes in inflation-adjusted R&D expenditures truly reflect changes in the extent of R&D.

1. R&D growth over the business cycle

Source: National Science Foundation.

To appreciate how R&D activity varies over the business cycle, figure 1 also depicts the growth rate of real gross domestic product. The shaded regions correspond to recessions as defined by the National Bureau of Economic Research. As can be seen in the figure, periods of economic growth are associated with a more rapid increase in R&D. In almost all recession years, at least one measure of R&D activity falls. The one exception is the early 1980s, when R&D activity continued to grow at the same rate as just before the recession. Thus, there is no evidence that recessions encourage R&D, and there is some evidence that they actually discourage it.

Credit constraints

One possible explanation for why R&D falls during recessions involves credit constraints.4 According to this argument, firms would indeed like to concentrate innovative activity such as R&D during recessions. However, like all investment, R&D entails an initial expenditure for labor and equipment, and this expenditure, if it pays off, will only do so in the future. Unless the firm has ready cash to pay for its R&D, it will have to borrow against future profits in order to cover these costs, and so its R&D activity will depend on credit market conditions.

During recessions, when profits are low, firms tend to have less available cash at their disposal. Consequently, firms have to turn increasingly to outside funding to finance their planned R&D. At the same time, credit is typically scarcer during recessions, as households respond to income losses by drawing down their savings. These two forces will act to increase the cost of borrowing for firms, and firms may face more difficulty in securing the funds they need to cover their R&D costs. Therefore, firms that have already initiated R&D projects might be forced to suspend them, while firms that have yet to begin R&D projects might decide not to initiate them.

To gain insight on the importance of such credit constraints, I analyze data on the R&D expenditures of individual firms. In particular, if firms were prevented from undertaking more R&D during recessions because of credit constraints, one would expect that firms that are relatively less credit constrained would tend to concentrate their R&D expenditures during recessions. Fortunately, the Standard & Poor’s Compustat database contains detailed balance sheet information on publicly traded companies, including R&D expenditures. I use this data set to get at precisely this prediction.

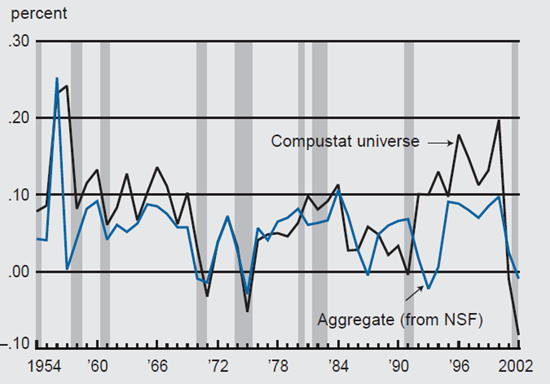

I should note at the outset, however, that the Compustat database comprises disproportionately large firms compared with those that make up the economy as a whole. How representative of overall R&D are the R&D expenditures of the firms in the Compustat database? Figure 2 shows two data series. The blue line represents the growth in inflation-adjusted R&D expenditures by private industry reported by the NSF, the same series as in figure 1. The black line represents the unweighted average growth rate of inflation-adjusted R&D expenditures each year across all Compustat firms that report some spending on R&D. Note that the two series are quite similar to one another. This reflects the fact that large firms account for the bulk of R&D expenditures. For example, between 1957 and 1998, the NSF estimates suggest that 81% of all R&D expenditures financed and performed by private industry were undertaken by firms with at least 5,000 employees. The fact that the R&D expenditures of publicly traded firms do not look very different from total R&D expenditures already raises doubts as to whether credit constraints can entirely account for why recessions fail to encourage R&D spending, since publicly traded firms are less constrained in their ability to raise funds than the typical private firm.

2. R&D growth, aggregate vs. Compustat firms

Sources: National Science Foundation and Standard and Poor's Compustat database.

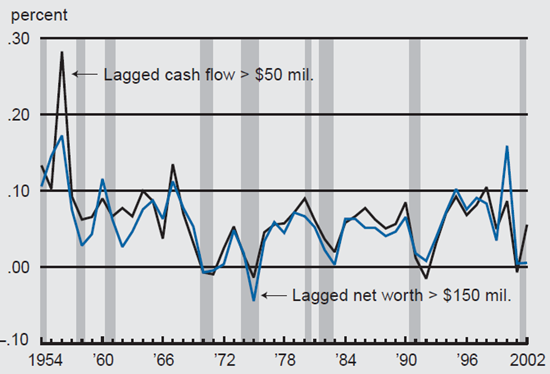

Even among the publicly traded firms in the Compustat database, some firms seem less financially constrained than others. In particular, some firms have large amounts of ready cash they can use to finance R&D or have considerable net worth against which they can borrow. So, are the firms that are less credit constrained more likely to undertake R&D during recessions? Figure 3 plots the unweighted average growth of inflation-adjusted R&D expenditures among all firms that had at least $50 million in cash in the year in which they undertook R&D. It also shows the unweighted average growth rate of inflation-adjusted R&D expenditures among all firms with a net worth of $150 million in the year in which they undertook R&D. These cutoffs roughly correspond to the top one-third of the firms in my sample in each category. There is considerable overlap between the two, i.e., firms with a high net worth also tend to have a high cash flow, although the overlap is not perfect.

3. R&D growth in relatively unconstrained firms

Source: Standard and Poor's Compustat database.

As shown in figure 3, the tendency for R&D growth to dip during recessions is even more pronounced among firms that are less likely to be credit constrained. For example, the average growth rate in R&D for such firms falls during the two recessions of the early 1980s, when aggregate R&D expenditures continued to grow at the same rate as before.

Figure 3 suggests credit problems cannot entirely account for why firms fail to take advantage of recessions to undertake more R&D. To put it another way, a policy that serves to ease borrowing conditions during recessions may not be able to reverse the tendency of firms to reduce their R&D activity during recessions, since even firms that have easy access to credit appear to cut back on their R&D during recessions.

An alternative explanation

If credit constraints do not entirely explain the pattern of reduced R&D spending during recessions, what does? One explanation I explore in Barlevy (2005) relates to firms’ tendency to act in a shortsighted manner, focusing on the immediate profits they can reap from a successful innovation. This is driven by the fact that when an entrepreneur discovers a new idea, rival producers can learn from their original insights and build on them. This is especially true if the new idea is patented, since a patent requires a detailed description of the new insight to avoid duplication. Over time, rivals may be able to use the patent to come up with their own ideas, which they can use to cut into the profits of the original innovator or even displace the original innovator altogether. Entrepreneurs, fearing they will only earn profits on an innovation over a relatively short period, might be reluctant to allocate significant resources to R&D during a recession, especially if recessions herald weaker economic conditions in the near future.

According to this logic, growth-enhancing activities that do not involve spillovers to other companies, thereby cutting into the originating firm’s profits, would be concentrated in recessions. Examples of this type of activity might include upgrading to a machine that is already widely available or training workers in some established skill. Francois and Lloyd-Ellis (2003) cite various studies that show that these sorts of activities—retooling, retraining, and reorganization—do in fact appear to be concentrated in recessions.5

Shleifer (1986) already pointed out that firms would find it in their best interest to introduce innovations during boom periods.6 However, he drew a distinction between when firms conduct R&D and when they implement these ideas, i.e., when they make them public and allow rivals to learn from their inventions. In particular, he argued that firms would wait until the economy was booming to introduce their ideas. However, this does not imply that R&D activity would itself occur in booms. As Francois and Lloyd-Ellis (2003) point out, when firms delay implementation, it is optimal for them to engage in R&D during recessions—when it conflicts less with production—and to wait until economic conditions improve before introducing them. But in practice, it seems that, for various reasons, firms prefer not to delay implementing their new ideas. As Griliches (1990) observes, innovators tend to take out patents very early in the research process, soon after discovery. Given that firms plan to reveal their ideas immediately, they will choose to both research and roll out their new ideas during booms in order to enjoy higher short-term profits.

Conclusion

Even though many firms prefer to concentrate R&D during booms, including those firms that do not seem forced to do so by financial constraints, it should be understood that this pattern is probably not in society’s best interest. In particular, it leads society to devote more resources to R&D when R&D is most disruptive to production rather than when it is least disruptive. The actions of private entrepreneurs thus make productivity growth more costly than it needs to be. This suggests there may be some scope for policy intervention.

One possible remedy is to subsidize R&D during recessions. Of course, there are many caveats to implementing such a policy. Firms may try to take advantage of these subsidies, especially when it is difficult to anticipate whether a particular research program will be successful. Entrepreneurs may have an incentive to pocket the subsidy and not invest serious efforts in making progress on their research while economic conditions are weak. An ill-conceived subsidy program could easily end up doing more harm than good.

At the same time, the evidence above does caution against relying on easing access to credit to encourage more R&D during recessions. The data suggest that the bulk of R&D is carried out by large, well-financed firms, and even among the firms with ready access to funds, R&D spending appears to decline during recessions. Allowing recessions to properly serve as an incubator for new ideas should probably not be seen as the responsibility of financial overseers who can affect credit market conditions.

Notes

1 G. Barlevy, 2005, “On the timing of innovation in stochastic Schumpeterian growth models,” Federal Reserve Bank of Chicago, working paper, No. WP-2004-11, revised August 9, 2005.

2 For example, the National Science Foundation reports that 40% of wage payments in R&D go to support staff.

3 Z. Griliches, 1990, “Patent statistics as economic indicators: A survey,” Journal of Economic Literature, Vol. 28, No. 4, December, pp. 1661–1707.

4 See, for example, P. Aghion, G. M. Angeletos, A. Banerjee, and K. Manova, 2005, “Volatility and growth: Credit constraints and productivity-enhancing investment,” National Bureau of Economic Research, working paper, No. 11349.

5 P. Francois and H. Lloyd-Ellis, 2003, “Animal spirits through creative destruction,” American Economic Review, Vol. 93, No. 3, June, pp. 530–550.

6 A. Shleifer, 1986, “Implementation cycles,” Journal of Political Economy, Vol. 94, No. 6, pp. 1163–1190.