February 5, 2026

The Chicago Fed Labor Market Indicators combine real-time private sector data with official labor statistics to provide a timely and comprehensive view of labor market conditions. Updated twice monthly ahead of the U.S. Bureau of Labor Statistics (BLS) Employment Situation report, the Chicago Fed Labor Market Indicators include a layoffs and other separations (discharges and quits) rate, a hiring rate for unemployed workers, and a forecast of the monthly BLS unemployment rate.

January 2026 (Final)

Here are the latest estimates for January 2026 (reference week ending on January 17, 2026):

| Latest Release (Jan 2026) |

Previous Month (Dec 2025) |

Year-Ago Month (Jan 2025) |

|

| Real-Time Unemployment Rate Forecast | 4.36% | 4.38%**BLS actual |

4.02%**BLS actual |

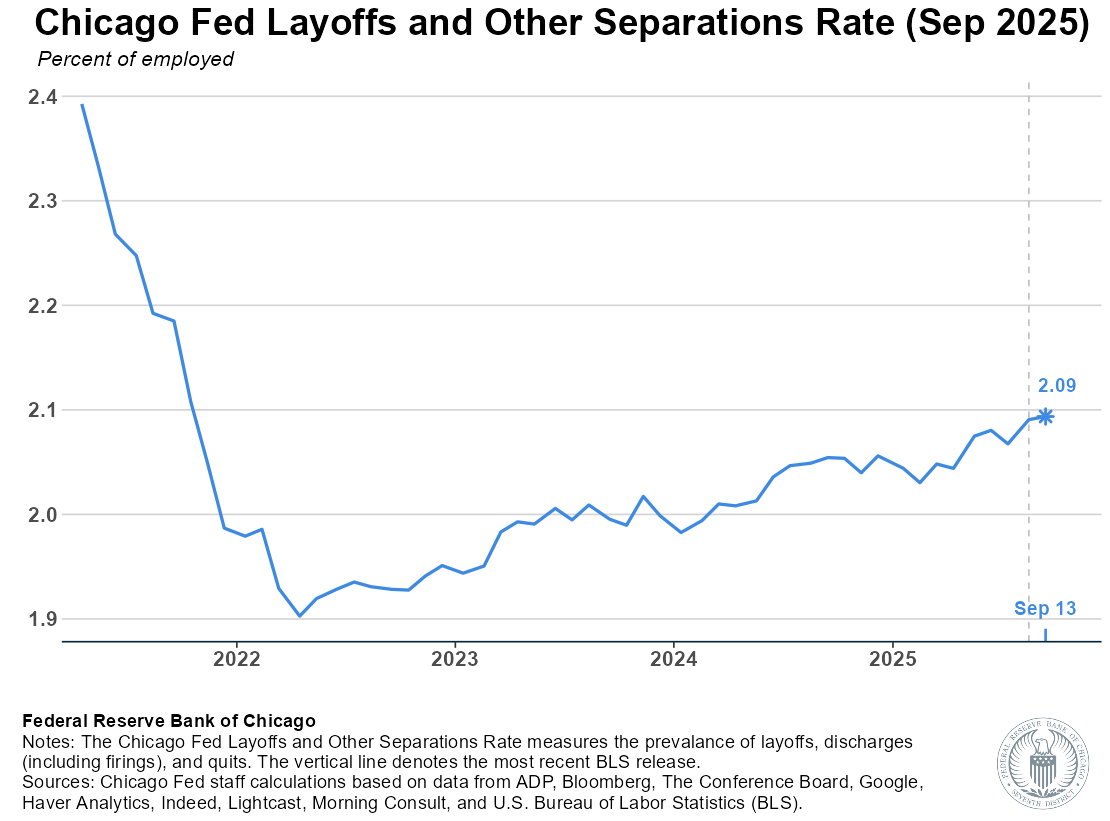

| Layoffs and Other Separations Rate | 2.08% | 2.10% | 2.05% |

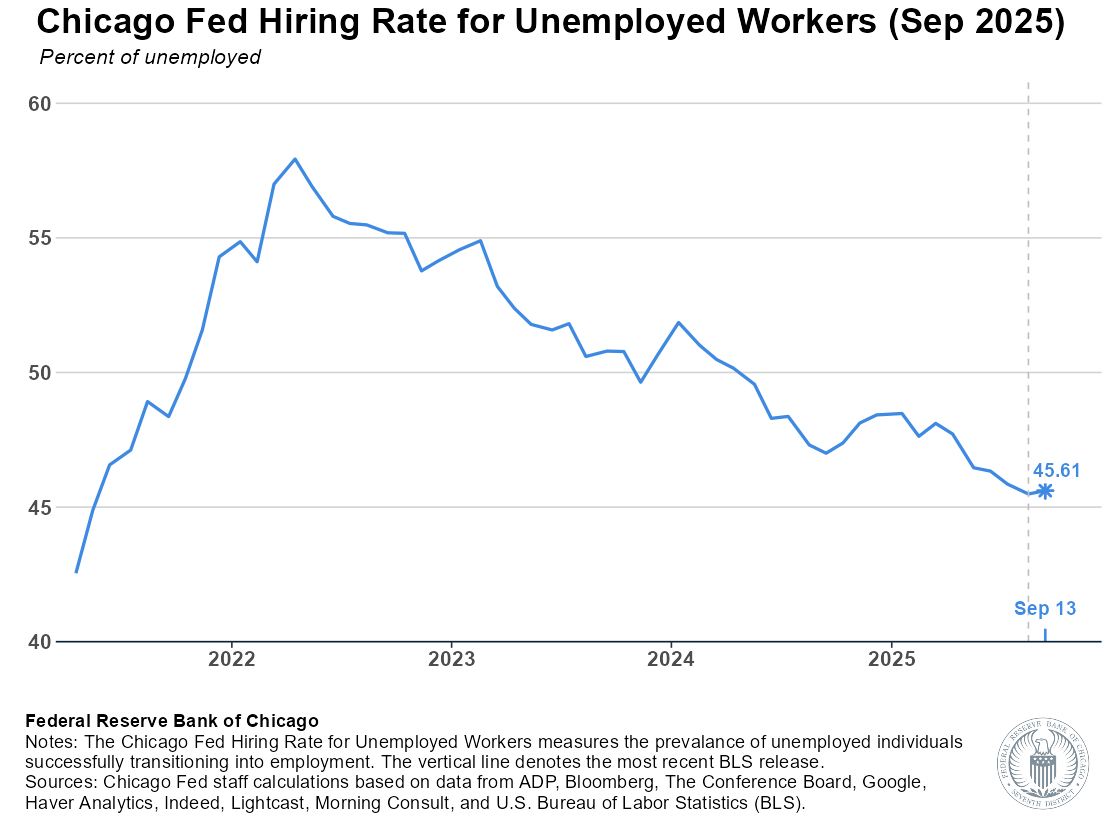

| Hiring Rate for Unemployed Workers | 45.10% | 45.20% | 47.53% |

The Chicago Fed Real-Time Unemployment Rate Forecast for January is 4.36%, down slightly from the BLS value for the previous month. This forecast is a product of slight changes in hiring and separations, as measured by the Chicago Fed’s Hiring Rate for Unemployed Workers and the Chicago Fed’s Layoffs and Other Separations Rate.

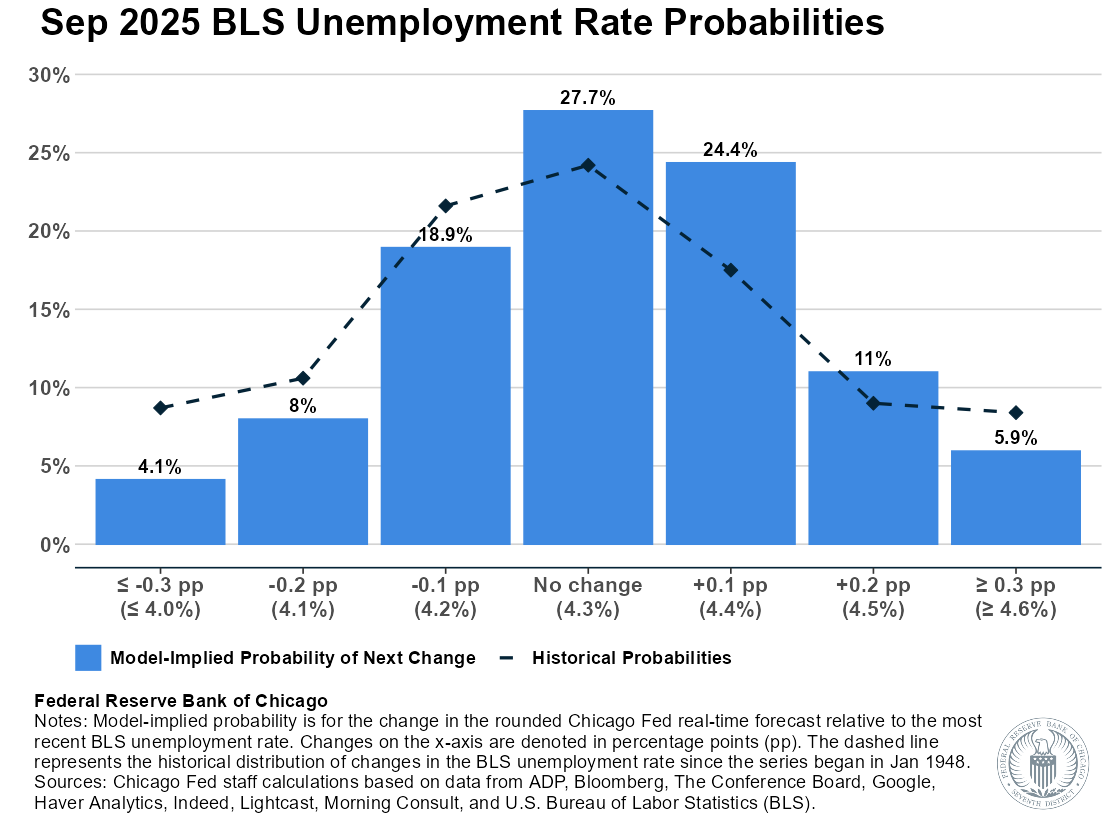

The Chicago Fed Real-Time Unemployment Rate Forecast is a median estimate of the unrounded BLS unemployment rate from a statistical model. The BLS follows the convention of reporting the official unemployment rate rounded to the nearest tenth. Applying this same convention to the Chicago Fed model, we can predict the likely direction of change in the official BLS unemployment rate. The current forecast implies 47% odds of a decrease, 28% odds of no change, and 25% odds of an increase.

The figure below shows the model-implied probabilities for various possible values for the January 2026 (rounded) unemployment rate. A model-implied probability that exceeds its historical benchmark (black dashed line) reflects an above-average likelihood for that particular range of unemployment changes and values.

Download Center

| Chicago Fed Labor Market Indicators Data | Data file | XLSX |

| Chicago Fed Labor Market Indicators Dashboard | Package containing interactive dashboard and data files | ZIP |

| Government Shutdown FAQs | November 6, 2025 |

Additional Details

The Chicago Fed Labor Market Indicators include estimates of two rates summarizing flows into and out of unemployment that provide context for changes in the unemployment rate:

- Chicago Fed Layoffs and Other Separations Rate (inflow rate)

- Chicago Fed Hiring Rate for Unemployed Workers (outflow rate)

These rates are scaled in such a way that the ratio of the inflow to the sum of the inflow and outflow rates is in similar units to the BLS unemployment rate (i.e., percent of labor force unemployed).

Layoffs and other job separations (such as quits and discharges) represent the most common ways in which workers experience voluntary and involuntary unemployment. The Chicago Fed Layoffs and Other Separations Rate is an estimate of the percentage of previously employed workers that experienced a separation event (layoff, quit, or discharge) leading to non-employment in the reference week of the month used by the BLS in its Employment Situation report. As the Layoffs and Other Separations Rate increases, it puts upward pressure on the unemployment rate.

The Chicago Fed Hiring Rate for Unemployed Workers is an estimate of the percentage of previously unemployed workers that transitioned into employment (or out of the labor force) during the BLS reference week. When unemployed workers successfully find a job (or leave the labor force), it reduces the upward pressure on the unemployment rate coming from layoffs and other job separations. As such, an increase in the Chicago Fed Hiring Rate for Unemployed Workers puts downward pressure on the unemployment rate.

Our measures of the inflow and outflow rates of unemployment will generally differ from other similar constructs for three reasons. First, we use data from the Current Population Survey to construct our measures versus the BLS establishment survey (Current Employment Statistics). Second, our measures are constructed from aggregates and scaled in order to preserve a direct relationship with the BLS unemployment rate. Finally, we combine official statistics from the BLS with private sector data to create estimates of both rates that jointly reflect these different types of data sources.

For additional information, see Forecast Details.