Economists and Rising Energy Prices

With energy price spikes grabbing the headlines, economists are rushing to provide perspectives and context on the impacts of today’s fossil fuel scarcity. Because energy prices were so low for such a very long time, some of us had gotten out of the habit of focusing in our policy discussions on the role of markets in determining price and availability, and how market prices can help economies adjust to temporary scarcity. Now, to our general horror, there are scenes of people picketing gasoline stations in protest of high prices and the like. Perhaps we have neglected to educate the public about how energy prices are generally set competitively in global markets. More importantly, from a longer term perspective, we need to remember that rising energy prices are often the best policy to encourage conservation by consumers and to enhance supply by producers.

By the standards of recent history, households are not generally in an energy crisis. In a recent Chicago Fed Letter, staff economists David Cashin and Leslie McGranahan examined U.S. household energy consumption over time and across groups. They report that recent shares of household expenditure on energy have not approached their historic highs. Energy consumption amounted to roughly 7% of household expenditures between 1990 and 2004, on average, versus the highs of 11% experienced in the early years of the 1980s. As of 2005, the share had only crept up to 8.5%. While the authors offer no projection for 2006, I can offer a rough appraisal.

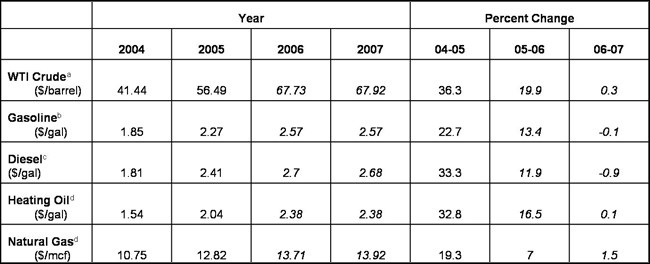

Rising prices for gasoline will likely raise these 2005 consumption shares somewhat, though not up to the 11% range. The most recent forecast of gasoline prices for this year by the U.S. DOE suggests a 13.4% increase over 2005 (below). Motor fuel comprises the largest share of consumers’ annual average expenditure share, at about 4% of annual household expenditures. The second largest energy consumption share, at 3% to 4%, is spent on home electricity. Price averages for electricity across the U.S. for 2006 are forecast to be essentially flat. Home heating fuel costs are up moderately, but their shares of household energy consumption are modest in comparison to gasoline and electricity. Accordingly, if recent DOE forecasts hold for 2006, energy consumption shares would rise by another one-half percentage point, to the 9.0% range.

1. Fuel price summary

b Average regular pump price.

c On-highway retail.

d Residential average.

Of course, averages often belie the varying impacts that high energy prices exert on different households. Cashin and McGranahan address these impacts by examining the consumption shares of identifiable groups. For example, poorer households—especially the working poor—tend to spend a larger share on energy both because energy in general is a necessity that comprises a large share of modest incomes and because of the more specific necessity of driving to the workplace. Accordingly, the working poor are being more sharply impacted by recent hikes in gasoline prices and home heating fuels. In contrast, elderly households tend to spend more on home heating, yet this is largely offset by lower motor fuel spending on transportation, presumably because commuting to work is less common. Such findings suggest that individual circumstances will vary considerably with respect to price hikes of particular fuels.

The impacts of energy price changes also vary geographically. A few regions remain energy producers, whose economies may be helped by rising energy prices. Texas has long been notable as a petroleum and natural gas producer. Yet Steve Brown and Mine Yucel of the FRB of Dallas have found that the salutory impact of rising oil prices on the Texas economy is now a small fraction of what it was in the years from 1970 to 1987. Apparently, the Texas economy that we once thought of in terms of oil fields and cattle has given way to computer peripheral production and semi-conductors.

Chicago Fed economist Rick Mattoon has recently examined energy markets and the Midwest economy. From a household consumption side, there are offsetting factors across regions that dampen price and price-impact differences. On the household side, Midwest households demand more fuel (principally natural gas) for home heating, but also benefit from fewer cooling degree days in non-winter seasons.

From the perspective of the energy impact on a region’s industries, Mattoon finds that there are again offsetting effects that tend to mitigate overall regional differences in economic impact. As an input to production, manufacturing activity tends to consume more energy than other major sectors. But, while manufacturing remains much more concentrated in the Midwest, the sector’s share of total output has been falling (as it has elsewhere), even while the sector’s energy efficiency is much better in comparison to the early 1980s. So too, there are significant producers of mining and petroleum extraction equipment found in parts of the industrial Midwest, and their business activity is booming.

Still, several individual industries continue to be energy-gobblers in the Midwest, such as steel and aluminum production in Indiana and forest products in Wisconsin. Moreover, the automotive fleet composition of the domestic automakers—Ford and GM—tends toward larger energy-hungry SUVs and full-sized pickup trucks in comparison to competitor fleets. To some extent, rising motor fuel prices are holding back sales of these particular products and softening Midwest automotive production.

In general, economists are correct in concluding that the sky is not (yet?) falling with respect to rising energy prices. Yet, Mattoon may have put his pen down on the important element—energy price volatility. Energy shocks—should they take place—remain a prominent risk to the forecasts of most economists. Adjustments to higher prices for fuels such as gasoline are fairly small and ineffective in the near-term period following energy price spikes. For example, at least for the first year or two, household driving behavior is little affected by rising gasoline prices. And on the supply side, as the early OPEC experience showed, it can take several years before (inevitably) fossil fuel discovery and enhanced delivery take place. In some cases, such as for the liquified natural gas that is globally available for importation to the U.S., it will take years to site and construct the docking and unloading infrastructure.

And so, while current energy price impacts are not yet outsized, concern and worry over potential energy shocks that may arise from political instability around the world are not misplaced. And unlike previous price shocks, rising global demand for energy rather than supply interruptions has helped to bring about energy scarcity. Such market pressures may prove to be more long-lived than the cartel-induced oil price spikes of the 1970s.

Even so, if fuel scarcity does develop, we must be patient in allowing markets themselves to untangle the knot. As Tim Schilling has recently brought to our attention in a quote by Charles Woodruff Yost, one time writer for the Christian Science Monitor, in his book The Age of Triumph and Frustrations, “Any system that doesn’t take the long run into account will burn itself out in the short run.”

If we are to avoid policy blunders by political leaders, we economists need to educate the public about how well markets can work to solve problems of scarcity when left to their own devices. When a commodity such as fossil fuels is scarce, the market mechanisms by which rising prices encourage producers to eventually supply more fuels and encourage households and industry to conserve energy will typically bring about the best result. That result is (1) greater energy conservation (2) expanded supplies of fuels and (3) lower price and greater availability at lower overall cost in comparison to any other policy.

On the other hand, mis-informed policies to short-circuit rising prices through the legal system and populist legislation frequently prove to be counter-productive. Palliatives such as the wellhead natural gas controls that were in effect for much of the 1970s and early 1980s only aggravated scarcity and ultimately drove prices higher for consumers.