Exports: A Source of Strength

Public sentiment for trade between the U.S. and other countries has seemingly eroded in recent years because of concerns about domestic job upheaval from international trade. While some of these concerns about job displacement have validity, it is also true that U.S. exports abroad continue to pull along economic growth in the nation and in the Midwest, where manufacturing plays a large role. Globalization has helped boost economic growth rates and lift the standards of living in developing nations. In turn, peoples of the world are demanding U.S. and Midwest-produced goods such as food products and advanced machinery.

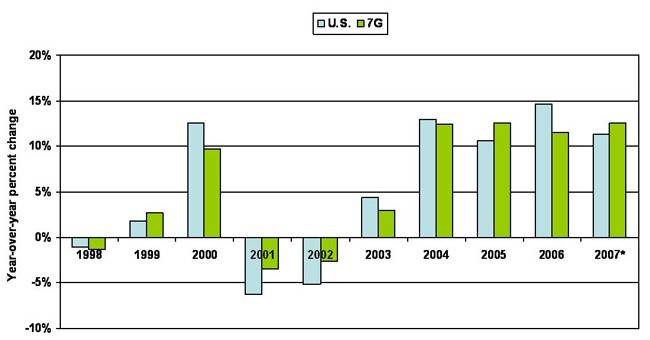

1. Total exports

Source: WISERTrade, Origin of Movement.

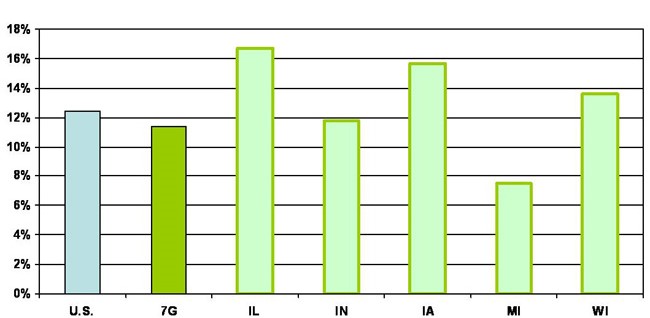

As seen in the chart above, exports have generally grown over the past few years and at an especially strong pace since 2004. Since then, exports for the western Seventh District states—Illinois, Iowa, and Wisconsin—have grown on average at a faster pace than those for the nation; the eastern Seventh District states—Indiana and Michigan—have had on average positive growth in exports, although at a slightly lower pace than the national average (see chart below). (A ranking of the Seventh District exporting industries can be found in a previous blog.) Exports from Michigan in particular are dominated by automotive trade in parts and vehicles with Canada. Such trade has grown slowly, in large part because of flat vehicle sales in North America.

2. Average annual growth (2004-2007*) — Total exports

Source: WISERTrade, Origin of Movement.

In contrast to Indiana and Michigan, each western Seventh District state hosts companies in particular sectors that have a strong export component. While export sales can be volatile, especially when observed at a specific state-industry level, these industries’ exports have been growing consistently over the past few years. Illinois’ electrical equipment (including machinery and computers), chemicals, transportation equipment, and food industries make up most of the manufacturing and exportable goods of the state—about three-quarters of Illinois’ exports. Chemical, machinery, and computer industries in Illinois have grown, on average, over 10% for the past three years, while the transportation equipment industry has grown about 40% over the same period. The transportation equipment industry’s major manufacturers in the state include Navistar and Tenneco Automotive—two companies listed in Industry Week’s U.S. 500 top manufacturers. Other large companies in Illinois’ electrical, chemical, and food industries include Caterpillar, John Deere, Abbott, and, ADM (Archer Daniels Midland Company).

Similar to those of Illinois, Iowa’s food and machinery industries and Wisconsin’s machinery, computer, and transportation industries represent about 50% and 60% of each state’s exports, respectively. Iowa’s top commodity exports are corn (except seed corn), pork, and tractors. Wisconsin has many major manufacturing companies, including Manitowoc, Briggs and Stratton, Plexus, Harley-Davidson, and Oshkosh Truck, that help boost exports.

As forecasts of U.S. economic growth for the year ahead are weakening, world economic growth is expected to remain robust. Although advanced economies have GDP projected growth of approximately 2% to 3%, this weakness is bolstered by the other developing regions with projected growth of more than 5% for the coming years. Accordingly, export growth will continue to be an important part of overall U.S. and Midwest growth in 2008.

Note: Vanessa Haleco-Meyer contributed to this blog.