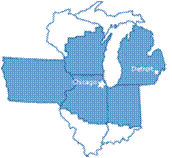

Seventh District Update, January 2016

First, a special announcement: As a Midwest Economy blog reader, you may also want to sign up to follow our new Chicago Fed Survey of Business Conditions (CFSBC), which is a survey of business contacts conducted to support the Seventh Federal Reserve District’s contribution to the Beige Book. The Chicago Fed produces diffusion indexes based on the quantitative questions in the survey. Click here to sign up for email alerts and click here to view the latest release.

And now, a summary of economic conditions in the Seventh District from the latest release of the Beige Book and from other indicators of regional business activity:

- Overall conditions: Economic activity continued to increase at a modest pace, but contacts were optimistic that growth would pick up some over the next 6 to 12 months.

- Consumer spending: Growth in consumer spending continued at a modest pace, though new and used vehicle sales continued to be strong.

- Business Spending: Most retailers reported comfortable inventory levels. Current capital spending and plans for future outlays both picked up some, but growth remained modest. The pace of hiring remained slow, though more contacts noted plans to increase their workforces over the next 6 to 12 months than in the previous reporting period.

- Construction and Real Estate: Residential construction edged up, and residential rents, home sales, and home prices increased slightly. Although commercial real estate activity slowed some, it remained strong and broad-based. Commercial rents increased slightly.

- Manufacturing: Gains in manufacturing production picked up to a moderate pace. Growth remained strong in the auto and aerospace industries and picked up slightly in most other industries.

- Banking and finance: Financial conditions tightened slightly on balance. Contacts noted greater illiquidity in the bond market, growth in small and middle-market business loan demand slowed slightly, and consumer loan demand was little changed.

- Prices and Costs: Cost pressures continued to be subdued. Commodity prices remained low, retail prices were little changed, and wage and nonwage cost pressures remained mild.

- Agriculture: District farm incomes declined as the large harvest pushed product prices down faster than input costs.

The Midwest Economy Index (MEI) moved down to –0.17 in November from –0.14 in October. The relative MEI rose to +0.13 in November from –0.32 in October. November’s value for the relative MEI indicates that Midwest economic growth was slightly higher than what would typically be suggested by the growth rate of the national economy.

The Chicago Fed Survey of Business Conditions (CFSBC) Activity Index declined to –17 from –12, suggesting that growth in economic activity continued at a modest pace in late November and December. The CFSBC Manufacturing Activity Index rose to –20 from –37, and the CFSBC Nonmanufacturing Activity Index fell to –16 from zero.