CDPS Update

In Community Development and Policy Studies (CDPS) field work throughout the Seventh District, CDPS contacts – in varying contexts – have voiced concerns about conditions impacting low- and moderate-income (LMI) populations and communities. CDPS conducts regular surveys of people representing organizations that serve LMI communities in varying ways. Our survey respondents represent organizations in the fields of: real estate development; finance; financial counseling; economic development; banking; consumer advocacy; small business development; philanthropy; law; higher education; agriculture; manufacturing; and human services. This blog is a summary of responses from the latest CDPS survey.

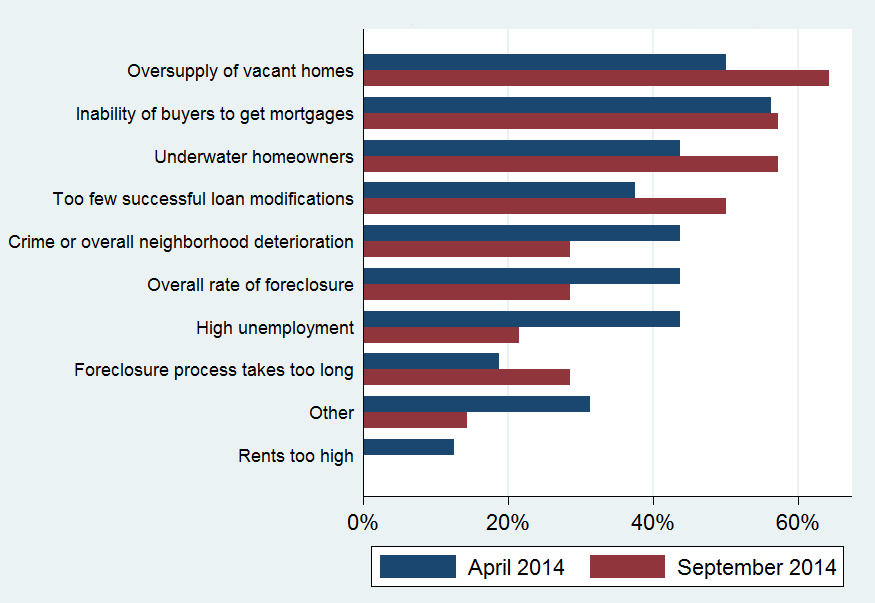

As indicated by the chart below, contacts believe that many issues impact the single family (1-4 units) housing market in their region. Some contacts explained that lenders are finding the new rules and regulations too cumbersome to continue lending at the same rate as before the recession. However, many home owners are still underwater and there is little home buyer demand given: job losses; wage stagnations; neighborhood deterioration; and vacant homes that blight many LMI communities.

1. Biggest issues impacting single-family housing market

In the rental market, there were mixed comments, depending on the area the contact was describing. In stronger markets, where new rentals have recently come on the market, occupancy and rents are high. However, in LMI areas, occupancy rates are lower and rents are more affordable.

Many contacts also mentioned in open ended questions that the housing market (e.g., vacant building and foreclosures), in conjunction with employment issues (e.g., high unemployment and low wages), are still two of the biggest challenges to sustained growth/revitalization in their communities.