Community Development and Policy Studies (CDPS) Update

In Community Development and Policy Studies (CDPS) field work throughout the Seventh District, CDPS contacts – in varying contexts – have voiced concerns about conditions impacting low- and moderate-income (LMI) populations and communities. CDPS conducts regular surveys of people representing organizations that serve LMI communities in varying ways. Our survey respondents represent organizations in the fields of real estate development; facilities financing; financial counseling; economic development; banking; consumer advocacy; small business development; philanthropy; law; higher education; agriculture; manufacturing; and human services. This blog is a summary of responses from the latest CDPS survey.

While the survey provides, by virtue of its nature and scope, more qualitative than quantitative insights, most contacts noted that in their communities many people lack skills that are needed in the workforce. Additionally, the contacts highlighted that community colleges are partnering with industry and non-profits to make sure they are customizing their curricula to correspond with skills sought by local employers. A recent ProfitWise News and Views article, Community Colleges and Industry: How Partnerships Address the Skills Gap provides more information about community college and industry partnerships in the Seventh Federal Reserve District states of Iowa, Illinois, Wisconsin, and Michigan.

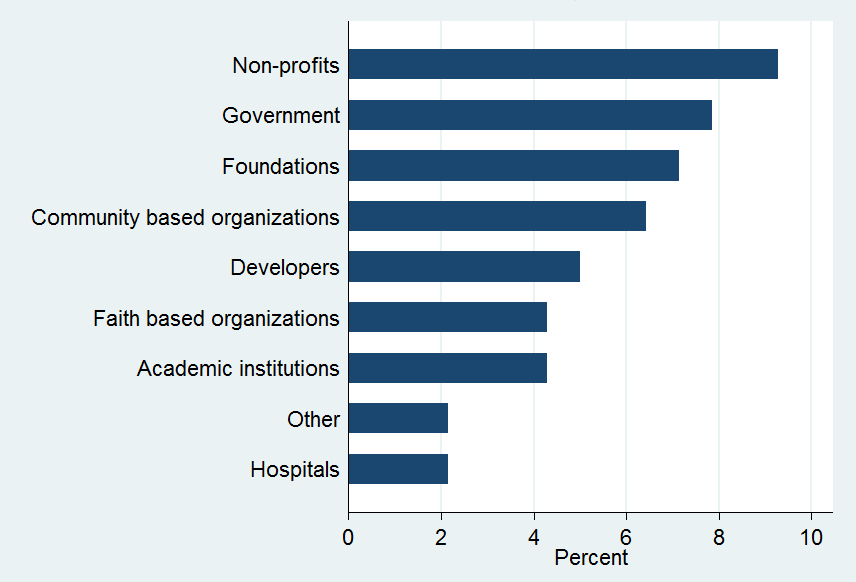

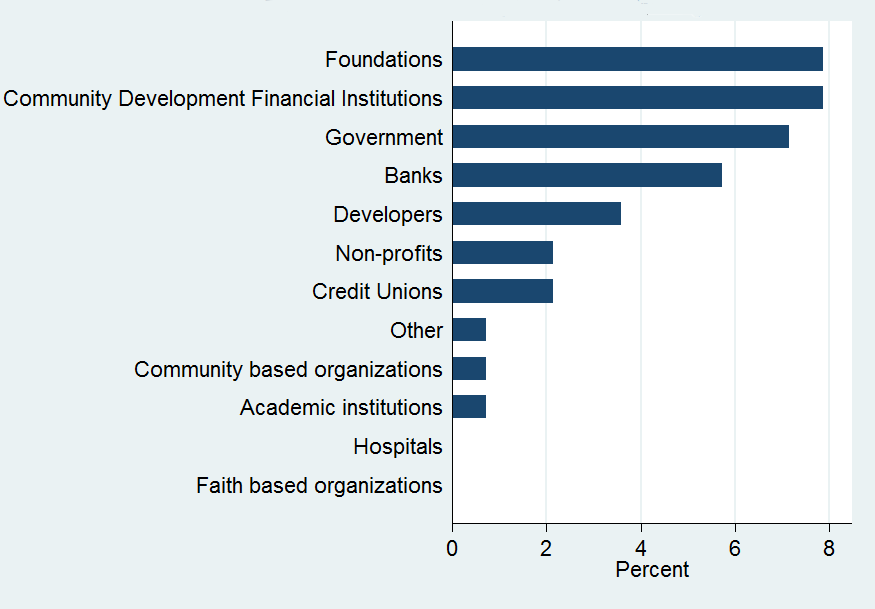

On a different note, CDPS is interested in learning about the institutions in your community that create, lead, and finance community development. The two charts below break down which organizations create and lead community development and organizations that help to finance community development. Additionally, it was noted that Community Development Financial Institutions (CDFIs) and farm service agencies helped create, lead, and finance community development, respectively.

1. Primary sources of community development financing

2. Institutions involved in leading community development efforts