CDPS Update

Every year, Community Development and Policy Studies (CDPS) researches issues that affect low- and moderate-income (LMI) communities in the Seventh District that relate to, among other topics, economic/worker mobility; access to competitively priced credit and financial services; small business development; health disparities by socioeconomic cohort; bank closure/consolidation; and affordable housing availability. Throughout 2016, CDPS will again engage individuals whose work in LMI communities can help us find ways to address the challenges faced by lower-income populations. A key tool in this endeavor is online surveys. This year, CDPS will again explore facets of various topics as they impact lower-income and lower-wealth populations including workforce development, student loan debt, small business and mortgage credit availability, and affordable rental housing, among others. Survey respondents represent a broad range of voices from the private and public sectors. This blog summarizes responses from the latest CDPS survey.

For the second survey of 2016, CDPS focused on two topics: (1) community bank closures/acquisitions and (2) student debt.

Smaller, locally-based banking institutions often have close ties to customers and communities. If the bank closes or changes hands, this can have significant ramifications on a community. Since the financial crisis, numerous community banks have been rendered insolvent and either closed or acquired by other banks.

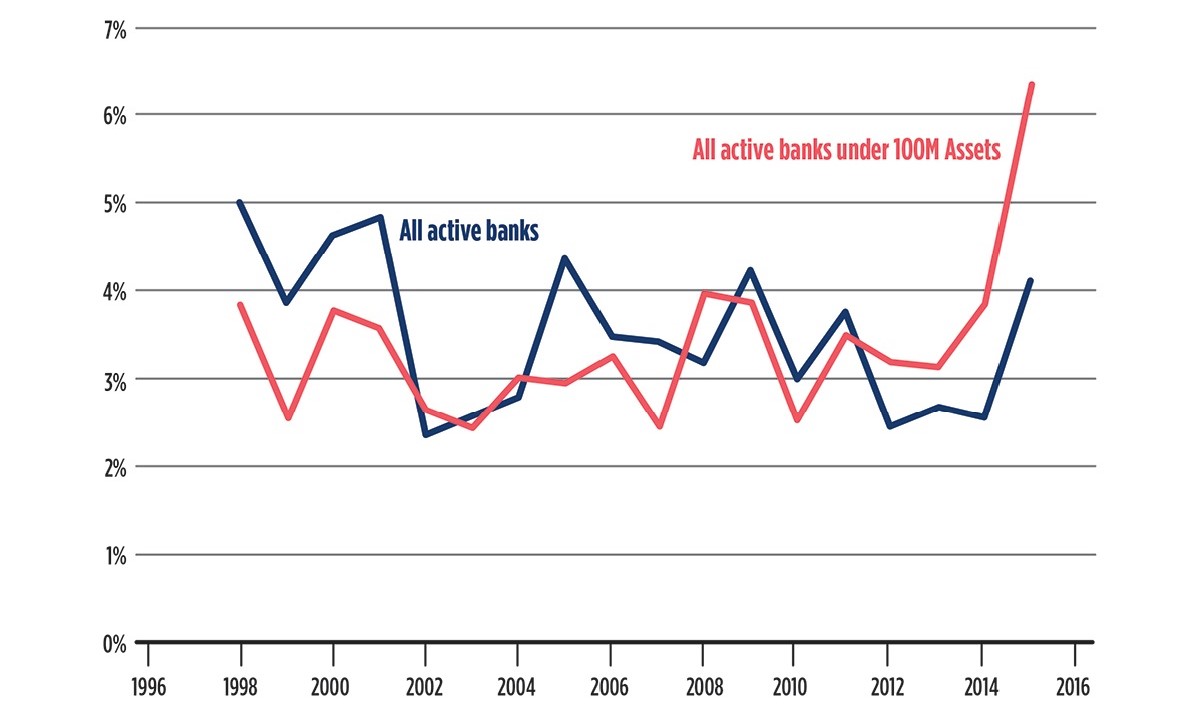

As the chart below illustrates, close/acquire rates for all banks within the five states in the Seventh District have recently increased. The trend is more pronounced for banks with under 100 million in assets, which includes many community banks that serve remote, rural, or lower-income urban and suburban markets.

1. Close/acquire rates for banks active in Illinois, Indiana, Iowa, Michigan and Wisconsin

CDPS wanted to get a sense of the perceptions of practitioners related to bank closings and consolidations. Some contacts noted that the transitioning or closing of banks had impacted the whole community. One contact summarized the economic impact for their whole community best: “Households and businesses don't get the same kind of service from the large banks; they don't get personalized attention (which they often need to succeed) from the large banks; and support for local foundations, charities, schools, and youth programs all decline because the big banks don't support those initiatives the way that the local community banks did.” However, other contacts noted that closures or acquisitions have not happened in their communities or people have changed banking relationships with little to no impact.

For the second question, all respondents (who answered the question) agreed that an area of increasing concern among consumer advocates is the extent to which student debt burdens preclude or forestall major financial decisions for people in their communities. The item that was mentioned most often is housing. Our contacts noted that student debt is impacting the whole housing market. It affects the rental market because people are living at home longer and impacts home sales because people do not want to take on more debt. Respondents also mentioned that student debt affects the loan underwriters because of GSE (i.e., Fannie Mae and Freddie Mac) policies regarding how to underwrite loans to people with outstanding student loans. Among other considerations, borrowers cannot get student loans discharged in bankruptcy under current law.

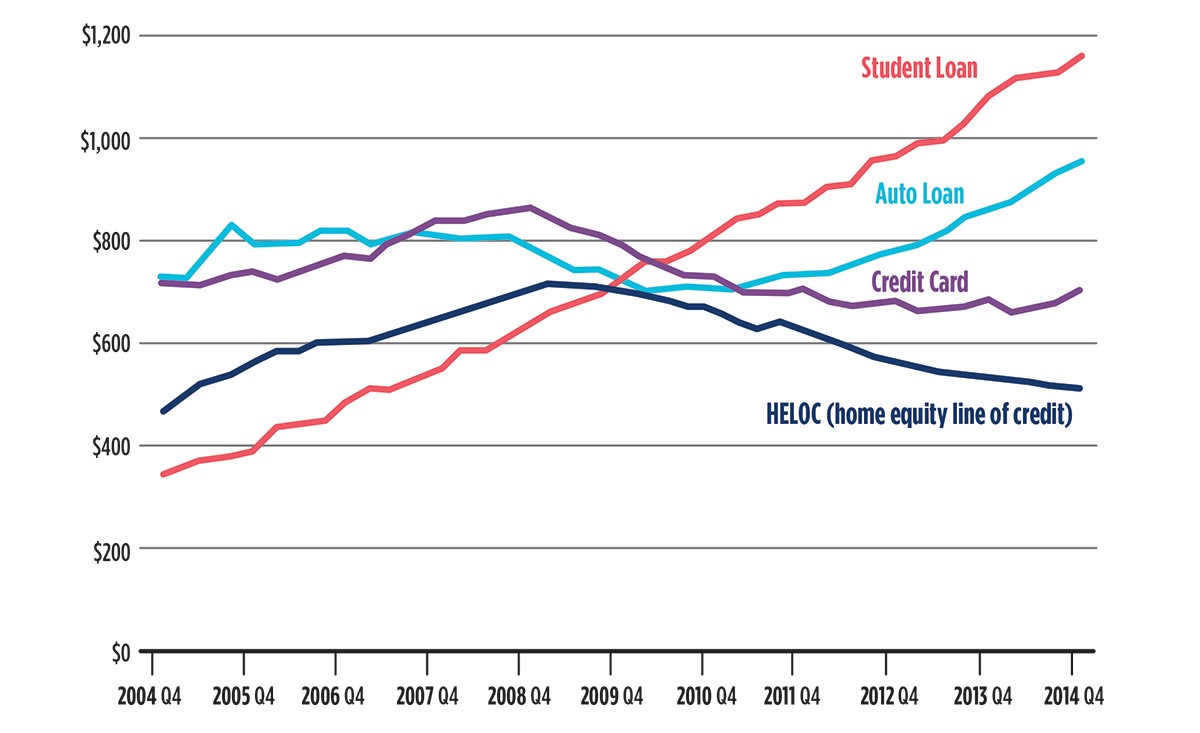

As illustrated by the chart below, student debt is the highest among the four categories of nonmortgage debt and it is steadily increasing.

2. Nonmortgage balances in millions of dollars

A few contacts also mentioned that some for-profit colleges may not consider students’ interests their top priority. One respondent said: “People think they are investing in themselves but are actually making a poorly informed decision.” Sometimes students drop out of the school before they are finished and have debt but no degree, which is even more of a problem. One contact did point out that “efforts like the federal government has made to publish more data and factors about colleges is a great step to helping the student consumer make a prudent choice. It's all about creating the savvy consumer and often people in low/mod neighborhoods are bombarded by advertising” (promoting mostly for-profit institutions).

One intervention mentioned by many survey participants was to refinance student loans at a lower rate. If this was ever an option, refinancing could help people lower their student debt payments and possibly invest in their communities, by buying property for instance, or starting a business.

The other issues impacted by student debt that contacts noted include saving for the future, starting businesses, getting married, and starting families.