Updates on the Midwest Economy and Fair Lending in a Social Media Context

The Federal Reserve Bank of Chicago's Community Development and Policy Studies Division regularly holds economic development forums around the 7th District that provide both a general economic overview and focus on topics of interest to stakeholders. On November 29 at a convening in Madison, WI, the topic was "Updates on the Midwest Economy & Fair Lending in a Social Media Context."

Economic overview

Thomas Klier, senior economist and research advisor at the Federal Reserve Bank of Chicago, made the following key points regarding the current state of both the U.S. and Midwest economy, as well as provided some comments regarding the impact of trade policy.

National economy

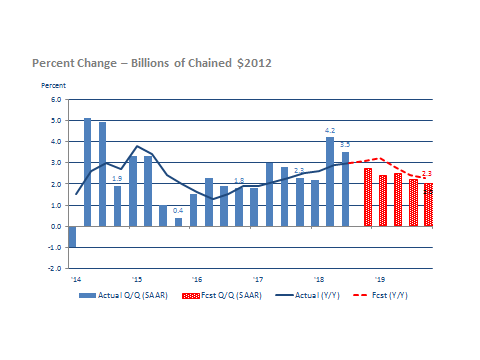

The U.S. economy has exhibited solid growth throughout 2018, particularly in the last two quarters of 2018. Expectations are for robust growth to continue, albeit at a slightly more moderate pace (figure 1).

Figure 1: U.S. Real GDP — September, 2018 Blue Chip forecast

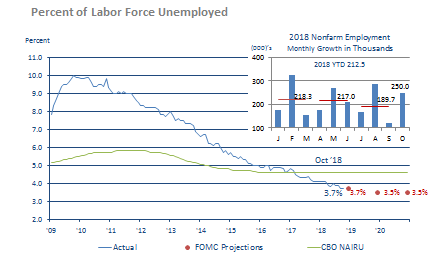

At the same time, labor markets are rather tight, showing low unemployment (figure 2) and signs of accelerating wage growth.

Figure 2: Unemployment rate

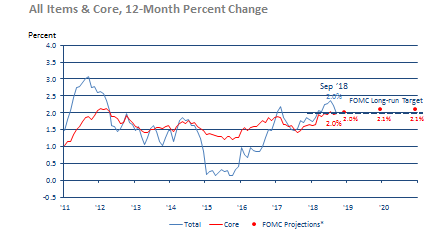

Yet, inflation remains under control; with core PCE (Personal Consumption Expenditures) Inflation near the target rate of 2 percent (figure 3).

Figure 3: PCE inflation

Source: U.S. Department of Labor; Bureau of Labor Statistics; Bureau of Economic Activity and the Federal Reserve.

Midwest economy

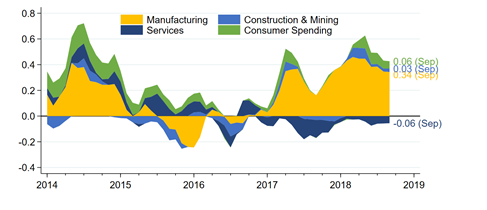

The Seventh District's economy continued to grow at a healthy pace. The 7th District’s economy continued to grow at a healthy pace. The Midwest Economic Index, an indicator of regional economic activity produced by the Chicago Fed, suggests that growth in the Midwest in 2018Q3 occurred at an above-trend pace. For some time now, the manufacturing sector has been driving that growth (figure 4). Corresponding to such growth, we find unemployment rates to be quite low across the Midwest.

Figure 4: MEI Sectoral contributions, std deviations

Trade Policy

Going forward, the emerging specifics of U.S. trade policy represent the most significant uncertainty, according to Thomas Klier, and businesses, consumers, and the agricultural community are making adjustments. The extent of the U.S.-China trade war and whether current tariffs will be permanent are some of the unanswered questions.

Fair lending in a social media context

Scott Grotewold, fair lending risk specialist at the Federal Reserve Bank of Chicago, made the following key points regarding fair lending as applied to social media.

Social media use by financial institutions has expanded access to current and prospective customers through ease of use and demand for instant access to information and banking services. Advertising products and services through social media allows financial institutions to reach a wider audience than traditional marketing strategies, and can target specific criteria or keywords to reach a specific audience.

However, targeting specific geographies or characteristics of individuals has fair lending implications that may violate the Fair Housing Act, which prohibits discrimination on a prohibited basis in all aspects of a real estate related transaction.

For example, in August 2018, the Department of Housing and Urban Development brought a lawsuit against Facebook alleging it allowed landlords and sellers to use targeted social media advertisements to discriminate against potential buyers or tenants. The advertisements excluded certain “Ethic Affinities” allowed by Facebook that resulted in the posts appearing only to men who were not interested in terms related to “disability,” or individuals who had not liked terms associated with the religion of Islam. Additional concerns were noted given that certain zip codes were excluded from the housing advertisements that could prevent the advertisements from being seen by minority individuals or in areas with higher concentrations of minority inhabitants.

To mitigate such risks, an effective fair lending risk management program should ensure that marketing staff have appropriate fair lending training to ensure fair lending considerations are included in social media use and marketing campaigns. Social media policies and controls should evaluate initiatives to prevent the use of prohibited bases in the distribution, filters, keywords, or any criteria used for targeted marketing. Financial institutions should evaluate strategic marketing plans for the reach, distribution method, and rationale for specific recipient criteria to ensure compliance with the Fair Housing and Equal Credit Opportunity Act.