Are U.S. and Seventh District business cycles alike?

This question is posed by Michael Kouparitsas and Daisuke Nakajima (K-N) in a current Economic Perspectives article. The answer, in general, is “yes,” and, in their analysis, many additional insights are gained about the structure and behavior of the Seventh District regional economy and its five component states of Illinois, Indiana, Michigan, Iowa and Wisconsin.

The so-called business cycle refers to the way that cyclical fluctuations of aggregate income relate to cyclical fluctuations of individual economic components, such as consumer spending, business investment, and job creation, and the ways that these components relate to each other. In this regard, academic economists have found that national economies around the world behave similarly, and a lesser body of evidence now suggests that sub-national or regional economies do, too.

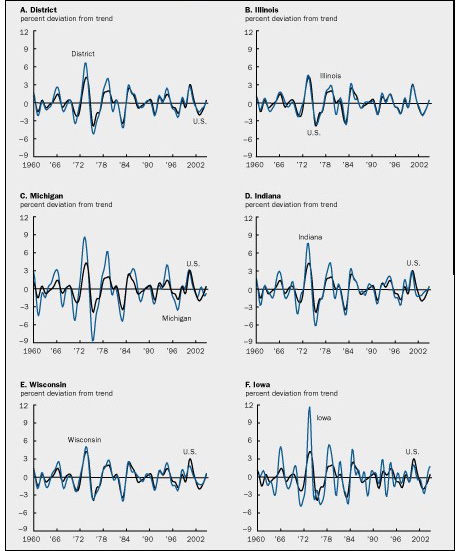

The K-N article gathers some long time series of data on the overall Seventh District economy along with component parts that are analogs to U.S. economic series. The figure below from K-N juxtaposes the aggregate business cycle of the Seventh District and each state with the overall U.S. economic cycle.

1. Aggregate business cycles

In their analyses, K-N show that the timing of swings in Seventh District state economies is very similar to the nation. Most likely, this is explained by the fact that the economies of the U.S. and the District are affected by common “shocks” such as energy price surges. One exception is a weak tendency for Michigan and Indiana economies to lead the direction of the overall Seventh District by one quarter of a year, perhaps because of those states’ sharp concentrations in durable goods production.

Behaviors of various components of the District economy also mimic their counterparts in the U.S. and world economies. Residential investment and consumption in general tend to lead business cycles. As a leading indicator, average weekly hours of workers in the manufacturing sector also tend to precede swings in aggregate income, as does initial claims for unemployment insurance. Total employment often is a coincident or lagging indicator.

Such information can be further used to construct economic indexes that lead, lag or are coincident with a region’s business cycle. These indexes can be useful for short-term planning and forecasting, especially because there is no timely measure of aggregate economic activity for states and regions that is akin to GDP for the nation.

While the timing of the swings in District state economies are similar to those of the nation’s, there are some differences in the behavior of the states. Iowa’s overall economy is less synchronous with the nation than other District states. Presumably, Iowa’s much larger economic concentration in agriculture means that its economy fluctuates with commodity prices to a greater extent. For Indiana and Michigan, the amplitude of their economic swings are more profound—something that Michiganders, for example, have long tried to consider in their mechanisms to fund state government.

Michael Kouparitsas has previously researched the relative coincidence of business cycles among regions of the U.S (EP article). From a policy perspective, such studies reveal those instances, such as in the U.S., where adjacent regional economies are closely aligned. This alignment indicates that there are gains to having a common currency for our national economy (which we do, the U.S. dollar) as well as gains to conducting a common monetary policy for the overall economy (which we do through the Federal Reserve System). In addition to these policy implications, such research is helpful in understanding particular regional economies such as the Seventh District.