Michigan automotive and white collar jobs

Loss of market share from the traditional Big Three automakers to global competitors has impacted Michigan’s economy, leading to some deep concerns about its future. To date, most attention to this issue has focussed on job loss related to automotive production activity. Auto assembly and parts production continues at a strong (though eroding) clip in the United States, but it is rapidly shifting away from Michigan. So far, the “new domestic” carmakers have avoided siting new production plants in Michigan, preferring to site them in the South, as well as in Ohio and Indiana, such as Honda’s recent announcement to build a plant in Greensburg, Indiana. However, another important employment component for Michigan also relates to the health and sales market share of the Big Three—that is, the nonproduction activities of these auto assembly companies. These activities include research and development (R&D), sales, finance, and management operations, which form an outsized economic engine for the state. In what ways does the survival (and growth) of Big Three companies go hand in hand with the nonproduction jobs located in Michigan?

Nonproduction employment of auto assembly companies typically amounts to a surprising 35%–45% of total employment and an even larger share of payroll. While Michigan is highly concentrated in automotive production—with 15 auto assembly plants—it is also the domicile of the Big Three’s headquarters along with significant company R&D and other operations. For this reason, it is not surprising in Michigan to find that nonproduction automotive employment is more concentrated than elsewhere. In counting Big Three nonproduction employment at their production plants, headquarters, R&D centers, and other auxiliary facilities in Michigan, nonproduction employment likely outnumbers production employment, making up a minimum of 55%–60% of total Big Three jobs in the state.

Moreover, additional Michigan personal income and jobs are generated from local services purchased by headquarters-type operations. As Chicago Fed economist Yukako Ono has found in recent studies, headquarters operations often purchase key services for the entire company network. These purchases may include financial services, R&D, information technology (IT) products and services, strategic management consulting, and many more. From the regional economy’s standpoint, these purchases are often sourced locally to a large extent. In fact, Ono discusses the possibility that the choice of location by headquarters may be influenced by the cost and availability of such business services.

Similar behavior of automotive headquarters makes Detroit and its surrounding environs much more than just a factory economy. Specifically, much of the value of Big Three automobiles derives from product development and design, and most of that R&D activity is conducted in Michigan. As derived demand from the domestic automotive industry, key business services are largely produced in Detroit. My blog entry from August 16 shows that the Detroit metropolitan area far and away tops other midwestern metropolitan areas in its concentration of professional and technical services employment. Among Detroit’s top sectors are engineering services (employment at 51,594 jobs in 2002) and scientific research and development (18,126 jobs in 2002).

Nationally, much R&D is funded and performed by automotive companies and their affiliates. According to the most recent survey of industry funds for research and development, which is conducted by the National Science Foundation, the automotive industry accounts for $14–$15 billion in annual R&D funding in the U.S. To be sure, in recent years, as auto assemblers have increasingly relied on their first-tier suppliers for entire components and automotive modules, some significant R&D responsibilities have been shifting away from assembly companies and toward automotive parts companies. Still, today, the lion’s share of this R&D is performed in-house, that is, largely by auto assembly companies themselves.

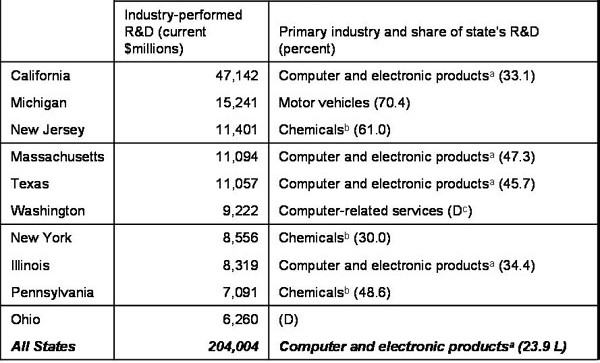

These practices have kept Ford, General Motors (GM), and Daimler-Chrysler among the largest R&D performers in the U.S., with Michigan at the hub of such activity. For this reason, Michigan ranks second only to California in funds for industrial R&D. And for 2003 as the figure below shows, the motor vehicle assembly and parts industries in Michigan accounted for $10.7 billion of the $15.2 billion industry-performed R&D in the state. The ties between these expenditures and local employment is apparent. According to a parallel survey by the National Science Foundation, the Detroit metropolitan area employed 102,500 research scientists and engineers in 2003—a concentration of 5.2% of the work force as compared to 3.9% nationally.

1. Top ten states in industry performance and share of R&D, 2003

a Includes R&D of professional and commercial equipment and supplies, including computers wholesale trade industry.

b Includes R&D of drugs and druggists' sundries wholesale trade industry.

c In 2002, computer-related services accounted for more than 50% of Washington's industry-performed R&D.

Notes: Rankings do not account for margin of error of estimates from sample surveys. Detail does not add to total because not all industries are shown.

Source: National Science Foundation, Division of Science Resources Statistics, Survey of Industrial Research and Development (2003).

Would Michigan retain this important function in the event that Big Three sales shares continued to decline? On the positive side, there are some indications that the Detroit area’s role in automotive research is in the process of growing beyond its historic roots. For example, the “new domestic” automakers have all sited research, development, and design facilities in the Detroit region, such as Toyota’s recently announced $150 million R&D center investment in Ann Arbor. Others, such as Hyundai and Nissan, have also recently expanded their facilities or announced plans for similar expansions.

So, too, Detroit’s attractiveness to automotive company headquarters operations displays some sparks of growth. Major automotive parts producer Borg Warner moved its headquarters from Chicago to the Detroit area last year. More generally, Chicago Fed economist Thomas Klier has documented an upswing in auto parts company headquarters moving to Michigan. The presence and growth of automotive parts headquarters in Michigan probably bodes well for company-sponsored R&D activity as well.

Still, competitive challenges are at play both here and abroad. Domestically, figures from the U.S. Bureau of Economic Analysis show that the annual R&D funding in the U.S. by Asia-domiciled automotive companies, at $125 million, makes up a very small share of automotive R&D in the U.S., amounting to less than 2 percent. And while the Detroit metropolitan area has so far attracted many of these transplant R&D activities, historically, it is not uncommon to find that attendant service activities eventually follow production in manufacturing. In this direction, the movement of U.S. automotive production from the Midwest toward the South is drawing the attention of those seeking R&D activities as well. For example, Clemson University in South Carolina has launched a research program and industrial park to foster technology development and transfer in cooperation with companies such as BMW and others.

And so, Michigan has several important economic activities at stake amidst the current upheaval among automotive companies.