Michigan Labor Market–Still Awaiting Recovery

Following the 2001 national recession, the labor market remained somewhat slack and slow-growing until mid-2003. Subsequently, the national economy accelerated, pulling along labor demand and employment growth. The year 2006 marks the third consecutive year of strong year-over-year employment growth (and falling unemployment) nationally.

Meanwhile, the Seventh District, which includes the state of Iowa and most of Michigan, Indiana, Illinois, and Wisconsin, also experienced an employment recovery. However, the pace of job growth in the Seventh District has fallen somewhat short of the nation over most of the post-recession period. From the fourth quarter of 2001 until the fourth quarter of 2006, payroll job growth is currently reported to have risen by 3.9 percent in the nation, versus 0.7 in the Seventh District states overall.

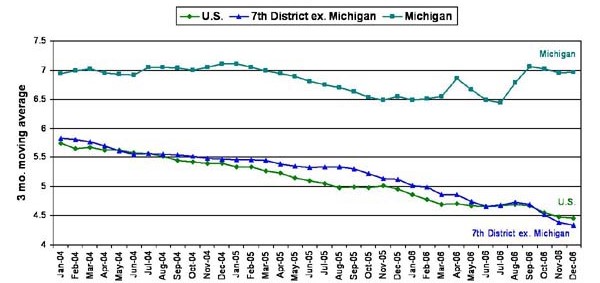

Much of the Seventh District weakness is confined to Michigan, and recent indications show little sign that the Michigan labor market performance is turning around. As illustrated below by a 3-month moving average of monthly unemployment rates, the U.S. and the rest of the Seventh District states (excluding Michigan) have reported a falling rate of unemployment over much of the past 3 years. Currently, the region’s unemployment rate lies very close to the nation at around 4.5 percent. In contrast, Michigan’s current unemployment rate, after improving in 2005, is now back where it was in 2004.

1. Unemployment rate

Unemployment rates are not fool-proof indicators of labor market performance because they are conducted by household surveys which are subject to sampling bias. However, other independent indicators tend to corroborate these survey indicators. Among the other indicators, the survey of payroll employment at business establishments is reported for states by the Bureau of Labor Statistics. It too is based on a survey, and it is revised later as more information becomes available.

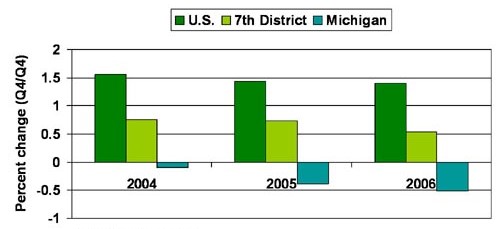

Below, year-over-year growth in payroll employment is shown for Michigan versus the District and the U.S. The payroll survey suggests that Seventh District job growth, though slower than the U.S., has shown steady growth over the past three years. Michigan’s year-over-year job growth has continued to decline—at an accelerating pace.

2. Job growth

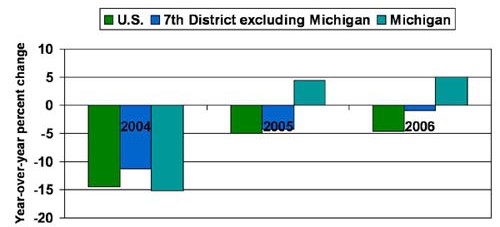

So too, reported information on initial claims for unemployment insurance by laid off (or otherwise severed) workers exhibits the same pattern: deterioration at an accelerated pace over the past three years in Michigan, and improvement outside the state.

3. Initial claims

In past decades, weak automotive-related performance in Michigan has sometimes been appraised as temporary or cyclical. However, this time around, as indicated by labor market performance in surrounding states, weak economic performance in Michigan appears to reflect structural problems for auto makers and automotive supply companies. Since early 2004, Michigan has lost 17.6 thousand net jobs at auto assembly establishments (a 24 percent decline) and 27.5 thousand jobs in motor vehicle parts production (a 15.8 percent decline).

Overall domestic automotive production is being eroded by imports and by enhanced production and sales of transplant automotive companies who largely produce outside the state of Michigan. Recent employee buyout programs at Ford, General Motors, and Delphi will result in a head count reduction of nearly 100,000 across the U.S. Approximately one-third of those jobs are situated in Michigan.

At least for the near future, the Michigan labor market situations does not yet look to be improving. The Michigan-domiciled auto assembly companies foresee or have announced continued employment reductions and facilities closings in both production and in administrative/R&D employees. Longer term, the Michigan economy’s sharp automotive concentration means that the labor market will continued to be driven by developments in the industry.