Manufacturing: Been down so long, it looks like up?

Those having keen interests in the U.S. manufacturing sector are somewhat encouraged by its performance over the past three years. The sector has bounced back sharply since the end of the severe 2008–09 recession. Job growth in manufacturing is running up 2 percent on a year-over-year basis, and the sector has recovered three-quarters of the output lost during the 2008-09 recession. Encouragement about manufacturing prospects derives not only from the recent bounce, but also from the possibility that the change in direction may represent a turnaround in manufacturing’s fortunes that will be sustained over the longer term. The previous peak in manufacturing jobs took place as far back as the 1990s, so this new direction, particularly if it holds up over a long horizon, would be a welcome change.

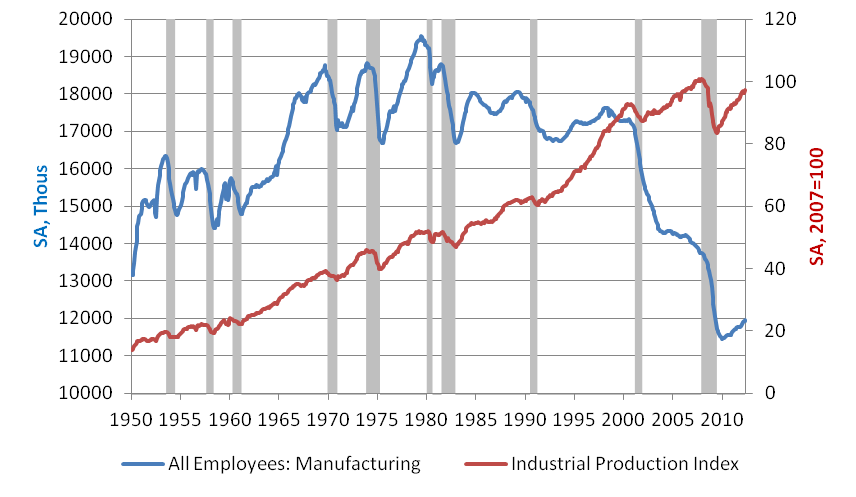

To put recent events into proper perspective, it is useful to examine the manufacturing sector’s long-term experience in the United States. Since the mid-twentieth century until the 2000s, the level of jobs in the manufacturing sector has stayed fairly constant, even while real output and productivity have risen briskly. The chart below shows the sector’s climbing real output, with the nation experiencing a five-fold growth in real manufacturing output since the early 1950s through today. Output growth here reflects both the increase in the quantity of goods produced and the improvements in the goods’ quality, such as durability and performance. Over most of this period in the United States, real output growth in manufacturing matched or exceeded the real growth in overall goods and services production1. In contrast with this hearty performance of real output growth in manufacturing, the sector’s levels of employment have remained steady over the latter half of the twentieth century—in the range of 17–19 million workers—and then moved much lower until very recently.

1. Manufacturing employment vs. IP index

Effectively, these gains in output with generally steady employment levels mean that productivity growth in the manufacturing sector has been quite robust. The application of more “know-how” and capital equipment has boosted manufacturing output, but with little need for more accompanying labor. Such productivity improvements, along with cheaper imports, have contributed to falling real prices for many manufactured goods sold in the United States. On the flip side of the same coin, falling prices of manufactured goods have boosted standards of living for U.S. households during the post-World War II era. The ability of American workers to produce more with greater efficiency—as well as to buy more—has translated into real wage gains.

But while such gains have benefited broad swaths of the U.S. population, it is also true that many manufacturing-oriented towns and cities have experienced decline and that manufacturing workers and firms have suffered dislocation. Such changes have led analysts to probe more deeply into the sources of both manufacturing progress and upheaval. Why haven’t rising standards of living done more to sustain manufacturing jobs?

For the most part, there are fundamental aspects to the ways we live that have prevented a large enough rise in our purchases of manufactured goods to outweigh falling labor content (and jobs) in the domestic manufacturing sector. For one, the rising incomes of U.S. households have not lifted the demand for manufactured goods sufficiently. Even with the introduction of new manufactured goods, such as televisions, medical equipment, home computers, and microwave ovens, households have tended to shift consumption toward services, such as medical care, education, and personal services. So too falling real prices for manufactured goods have not sufficiently induced consumer demand for standard manufactured goods, such as home furnishings and automobiles.

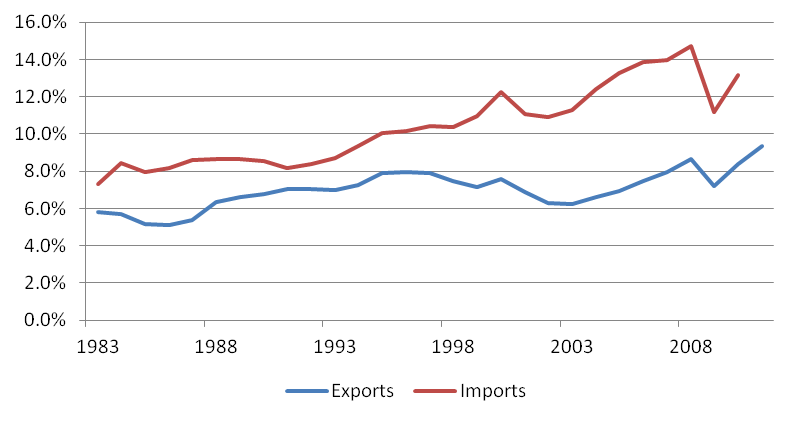

To be sure, exports of goods abroad have helped to lift employment in the manufacturing sector. The United States remains a global leader in innovation, as well as research and development (R&D), in many capital goods sectors, especially machinery and equipment. Rapid growth and development of nations throughout the world have raised the demand for U.S.-made capital equipment and certain high-tech products, such as farm equipment, pharmaceutical products, medical equipment, aerospace equipment, and earth-moving machinery. Manufactured goods continue to represent the largest share of U.S. exports abroad, and exports as a share of U.S. gross domestic product (GDP) have risen from 5.8 percent in 2001 to 9.3 percent in 2011.

However, at the same time, imports of manufactured products have also been rising. In fact imports of manufactured products have risen more rapidly than our exports of manufactured products abroad. Some imports become components of U.S.-produced goods that are exported abroad. But for the most part, rising imports displace manufactured goods that might otherwise be produced domestically.

2. Manufactured goods export and imports as percentage of GDP

3. Net manufactured goods exports and imports as percentage of GDP

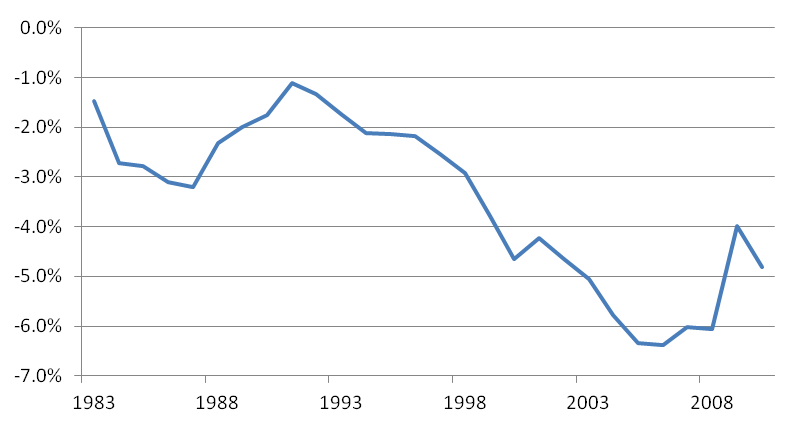

Given these mixed trends, some analysts have argued that the long-standing trend of nearly flat manufacturing job levels and rising production levels was interrupted by a decline in the number of manufacturing jobs beginning in the late 1990s, possibly accompanied by a slower pace of real output growth. From that time until recently, the United States experienced a rising trade deficit in manufactured goods. This was not the first time that the U.S. economy had experienced rising competition with other countries for sales both abroad and within its home markets. In particular, the rise of industrialization in Japan and other “Asian Rim” countries had a significant impact in the 1970s and 1980s on U.S. markets for major product segments in home electronics, steel, and automotive. Such developments were facilitated by globalization factors, including tariff reduction agreements and falling costs for transportation and communications.

The era from the late 1990s through the recent recession and recovery may represent a different order of magnitude in this regard. According to economist Robert Fry of Dupont, the large size of China and its low costs of production—coupled with the production capabilities of other “Asian tiger” nations—brought forward sharp competition for U.S. producers both in markets abroad and within the U.S. marketplace. One recent study conducted by David Autor, David Dorn, and Gordon Hanson lends weight to rising import competition as a significant cause for domestic manufacturing job loss over the past two decades. It does so by examining the varied experiences of many U.S. subregions and their relative exposure to rising imports from low-wage countries. In their most conservative estimates, the authors attribute one-quarter of the decline in U.S. manufacturing employment over the period 1990–2007 to changes in Chinese imports.

Since 1998, U.S. manufacturing employment fell precipitously from the levels that had prevailed through the 1960s, 1970s, 1980s, and the early part of the 1990s. Manufacturing employment fell from its peak in 1998 by over 3 million jobs by 2007 (by one fifth) and then by another 2 million jobs by 2010.

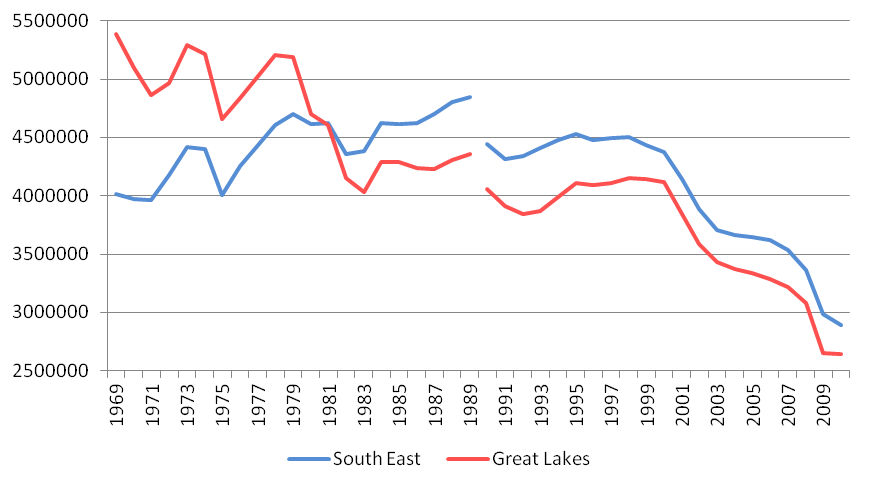

Regional trends in manufacturing also shifted during this time. Whereas job losses had been previously concentrated in the traditional industrial belt extending from western Pennsylvania and New York through the Great Lakes states, manufacturing job losses showed no favorites this time around. As seen below, states of the Southeast had been gaining manufacturing jobs versus the Great Lakes states from the late 1960s through the late 1990s. In contrast, jobs in both regions have fallen in tandem since that time.

4. Manufacturing employment — SIC: 1969-1989 NAICS: 1990-2010

As mentioned before, a recent rebound in manufacturing activity and jobs has followed on the heels of the severe 2008–09 recession. To some observers, the recent bounce is a harbinger of a change in direction for the manufacturing sector in terms of employment. Since last year’s tsunami and aftermath in Japan, some multinational corporations are rethinking their supply chains overseas in favor of North American production sites. Similarly, falling energy prices for domestic natural gas are enticing some chemical/plastics production operations back to U.S. shores. And as fundamental operational costs are rising in China and the rest of Asia, it may be the case that, at the very least, the strong wave of production relocation toward developing countries is beginning to slow. However, given the sustained decline that the U.S. manufacturing sector has experienced since the 1990s and during the recent recession, along with many cross currents underway general business activity and structure, analysts will not know for at least several years into the future whether manufacturing activity has truly bottomed out.

Meanwhile, in the near term, overall economic growth has entered a soft patch around the world over the past several months. And as usual, when overall growth slows, the trend tends to be magnified for manufacturing activity. And so, the informational signals on whether U.S. manufacturing has turned around in a major way have become more difficult to read.

Footnotes

1 Some analysts have challenged the veracity of recent output gains from the manufacturing sector. Output gains may be overstated as final goods are produced here with an increasing amount of foreign content, especially purchased inputs and intermediate parts and components. Susan Houseman notes that such inputs are undercounted (so that final U.S. output as recorded is then overcounted). In a 2009 paper, Houseman and co-authors found that “from 1997 to 2007 average annual multifactor productivity growth in manufacturing was overstated by 0.1 to 0.2 percentage points, and real value added growth by 0.2 to 0.5 percentage points.”