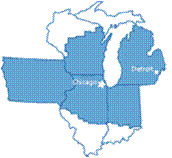

Seventh District Update

A summary of economic conditions in the Seventh District from the latest release of the Beige Book:

- Overall conditions:Economic activity in the Seventh District continued to expand at a moderate pace in late February and March.

- Consumer spending: Consumer spending increased significantly, as retailers reported unseasonably warm temperatures boosted sales.

- Business Spending: Business spending continued to increase and inventories were generally indicated to be at comfortable levels. Labor market conditions continued to improve, although hiring remained selective in many industries.

- Construction and Real Estate: Construction activity increased as demand continued to be strong for multi-family construction and single-family construction edged up some from its depressed levels.

- Manufacturing: Growth in manufacturing production leveled off, but activity continued to increase. The auto industry remained a source of strength, and demand for heavy equipment was boosted by the need to replace ageing equipment.

- Banking and finance: Credit conditions were slightly improved. Volatility and risk premia edged lower, and credit availability for households improved, particularly for auto loans and credit cards.

- Prices and Costs: Cost pressures increased, particularly for energy. Wage pressures also increased, but continued to be moderate. Contacts indicated difficulties in passing on higher costs to customers.

- Agriculture: Unseasonably warm weather jumpstarted field work and corn planting and soybean and cattle prices increased while corn, milk, and hog prices decreased.

The Midwest Economy Index (MEI) increased to +0.36 in January from +0.20 in December, reaching its highest level since May 2011. Midwest growth continued to outperform its historical deviation with respect to national growth, but the relative MEI decreased to +0.31 in January from +0.45 in December.

The Chicago Fed Midwest Manufacturing Index (CFMMI) increased 1.0% in February, to a seasonally adjusted level of 91.7 (2007 = 100). Revised data show the index was up 2.1% in January. The Federal Reserve Board’s industrial production index for manufacturing (IPMFG) increased 0.4% in February. Regional output in February rose 10.1% from a year earlier, and national output increased 5.4 %.