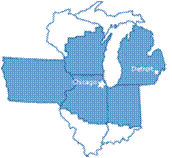

Seventh District Update, June 2016

First, a (repeat) special announcement: As a Midwest Economy blog reader, you may also want to sign up to follow our new Chicago Fed Survey of Business Conditions (CFSBC), which is a survey of business contacts conducted to support the Seventh Federal Reserve District’s contribution to the Beige Book. The Chicago Fed produces diffusion indexes based on the quantitative questions in the survey. Click here to sign up for email alerts and click here to view the latest release.

And now, a summary of economic conditions in the Seventh District from the latest release of the Beige Book and from other indicators of regional business activity:

- Overall conditions: Growth in economic activity in the Seventh District slowed to a modest pace in April and early May, tempering contacts’ optimism about growth over the next 6 to 12 months.

- Consumer spending: Growth in consumer spending picked up to a moderate pace. Retailers in Michigan indicated that sales were the best they had seen in over a year. Auto sales remained robust.

- Business Spending: Most retailers and manufacturers reported comfortable inventory levels. Current capital outlays and plans for future outlays slowed to a modest pace. Hiring also slowed to a more modest rate, as did expectations for future hiring.

- Construction and Real Estate: Residential construction rose slightly, and residential rents and home prices rose moderately. Demand for nonresidential construction was little changed and commercial real estate activity rose modestly.

- Manufacturing: Manufacturing production grew at a modest pace. Activity remained strong in autos and aerospace, but was slower in most other industries.

- Banking and finance: On balance, financial conditions improved marginally. Market volatility decreased, high yield debt issuance rebounded, and upgrades outpaced downgrades for credit ratings of U.S. public financial firms. Business and consumer loan demand was little changed on balance.

- Prices and Costs: Cost pressures again tightened some, but remained mild overall. Most energy and metals prices increased (steel in particular), but the level remained low. Retail prices increased slightly, as did wage costs. Growth in non-wage labor costs was steady.

- Agriculture: Corn and soybean prices rose, improving farmers’ earnings prospects.

The Midwest Economy Index (MEI) was unchanged at +0.25 in April. The relative MEI increased to +0.71 in April from +0.67 in March. April’s value for the relative MEI indicates that Midwest economic growth was moderately higher than what would typically be suggested by the growth rate of the national economy.

The Chicago Fed Survey of Business Conditions (CFSBC) Activity Index decreased to –23 from zero, suggesting that growth in economic activity slowed to a modest pace in April and early May. The CFSBC Manufacturing Activity Index declined to –23 from +27, while the CFSBC Nonmanufacturing Activity Index decreased to –24 from –15.