Seventh District Update, November 2016

First, a different special announcement: The Federal Reserve announced on November 30, 2016, changes that will be incorporated into its Beige Book report starting in 2017. For more information, see the press release.

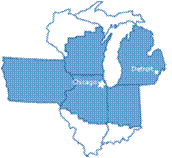

And now, a summary of economic conditions in the Seventh District from the latest release of the Beige Book and from other indicators of regional business activity:

- Overall conditions: Growth in economic activity in the Seventh District slowed to a modest pace in October and early November, but contacts expect growth to return to a moderate pace over the next six to twelve months.

- Consumer spending: Consumer spending increased slightly over the reporting period, primarily reflecting gains at middle-market retailers. Sales of new light vehicles remained strong in the District.

- Business Spending: Growth in business spending continued at a moderate pace. Retail and manufacturing inventories were generally at desired levels. Current capital expenditures and employment both grew at a moderate pace.

- Construction and Real Estate: Activity increased slightly overall. Demand for residential construction, residential real estate, nonresidential construction, and commercial real estate all edged up.

- Manufacturing: Growth in manufacturing production continued at a moderate pace in October and early November, with strong increases in autos and aerospace (though slowing a bit again in autos) and modest gains overall among other industries.

- Banking and finance: Conditions were little changed. While U.S. Treasury bond yields were up after the U.S. elections, corporate bond spreads declined. Loan demand from small and middle market businesses was little changed, as was consumer loan demand.

- Prices and Costs: Cost pressures increased modestly, but remained mild. Energy prices remained low, but industrial metals prices rallied. Retail prices changed little, wage pressures were steady overall, and non-wage labor costs picked up some.

- Agriculture: Record corn and soybean yields, combined with stable corn prices and rising soybean prices, implied that more crop operations than previously expected would at least break even this year.

The Midwest Economy Index (MEI) rose to −0.01 in October from −0.11 in September. The relative MEI increased to +0.25 in October from +0.16 in September. October’s value for the relative MEI indicates that Midwest economic growth was somewhat higher than what would typically be suggested by the growth rate of the national economy.

The Chicago Fed Survey of Business Conditions (CFSBC) Activity Index decreased to −20 from +9, suggesting that growth in economic activity slowed to a modest pace in October and early November. The CFSBC Manufacturing Activity Index remained at +3, and the CFSBC Nonmanufacturing Activity Index decreased to −33 from +12.