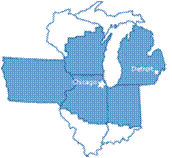

Seventh District Update, October 2016

First, our ongoing special announcement: As a Midwest Economy blog reader, you may also want to sign up to follow our new Chicago Fed Survey of Business Conditions (CFSBC), which is a survey of business contacts conducted to support the Seventh Federal Reserve District’s contribution to the Beige Book. The Chicago Fed produces diffusion indexes based on the quantitative questions in the survey. Click here to sign up for email alerts and click here to view the latest release.

If you are a Seventh District business leader and would like to share your perspective on current economic conditions with us, you are welcome to participate in the CFSBC. Please send an email with your contact information to thomas.walstrum@chi.frb.org.

And now, a summary of economic conditions in the Seventh District from the latest release of the Beige Book and from other indicators of regional business activity:

- Overall conditions: Growth in economic activity in the Seventh District continued at a moderate pace in late August and September, and contacts expect growth to remain moderate over the next six to twelve months.

- Consumer spending: Growth in consumer spending increased only slightly and store traffic remained low. The sales pace of autos in the District remained strong, but slowed slightly.

- Business Spending: Growth in business spending remained at a moderate pace. Retail and manufacturing inventories were generally at desired levels. Current capital expenditures and employment both grew at a moderate pace.

- Construction and Real Estate: Activity increased modestly overall. Residential construction was little changed, while nonresidential construction, residential real estate, and commercial real estate activity all increased slightly.

- Manufacturing: Growth in manufacturing production picked up to a moderate pace. Activity continued to be strong in autos and aerospace, while gains remained modest overall among other industries.

- Banking and finance: Conditions were little changed. Equity prices declined slightly and volatility was low. Loan demand from small and middle market businesses continued to rise. Consumer loan demand increased modestly.

- Prices and Costs: Cost pressures were unchanged and remained mild. Most energy and metals prices were flat and remained low, though steel prices fell some. Retail prices changed little and wage pressures were steady.

- Agriculture: Low expectations for farm incomes continued, with contacts expecting that a profitable soybean harvest would not be enough to offset an unprofitable corn harvest.

The Midwest Economy Index (MEI) increased to –0.04 in August from –0.16 in July. The relative MEI moved up to +0.11 in August from +0.01 in July. August’s value for the relative MEI indicates that Midwest economic growth was slightly higher than what would typically be suggested by the growth rate of the national economy.

The Chicago Fed Survey of Business Conditions (CFSBC) Activity Index increased to +7 from −16, suggesting that growth in economic activity picked up to a moderate pace in late August and September. The CFSBC Manufacturing Activity Index increased to +6 from +3, and the CFSBC Nonmanufacturing Activity Index increased to +8 from −27.