Seventh District Update, July 2017

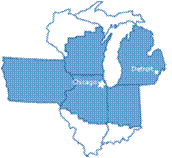

A summary of economic conditions in the Seventh District from the latest release of the Beige Book and other indicators of regional business activity:

- Overall conditions: Growth in economic activity in the Seventh District picked up to a moderate pace in late May and June and respondents’ outlooks for growth over the next 6 to 12 months also improved some.

- Employment and Wages: Employment growth continued at a moderate rate. While contacts indicated that the labor market was tight, wage growth was only modest.

- Prices: Prices again rose modestly. Retail and freight prices increased slightly and materials prices were little changed.

- Consumer spending: Consumer spending increased modestly. Non-auto retail sales were up modestly, but auto sales changed little on net.

- Business Spending: Growth in capital spending continued at a moderate pace and inventories were generally at comfortable levels.

- Construction and Real Estate: Residential construction, home sales, and commercial real estate activity increased slightly, while nonresidential construction was little changed.

- Manufacturing: Manufacturing production continued to grow at a moderate rate. Growth was widespread across industries, though auto production declined some.

- Banking and finance: Financial participants noted that volatility continues to be low. Business loan demand ticked up and consumer loan demand was little changed.

- Agriculture: The sector continued to operate under financial stress. The crop harvest is expected to be about average. Hog prices moved up, but cattle and milk prices were lower.

The Chicago Fed Survey of Business Conditions (CFSBC) Activity Index increased to +1 from –8, suggesting that growth in economic activity picked up to a moderate pace in late May and June. The CFSBC Manufacturing Activity Index declined to +3 from +20, while the CFSBC Nonmanufacturing Activity Index rose to a neutral value from –24.

The Midwest Economy Index (MEI) decreased to +0.51 in May from +0.72 in April. Three of the four broad sectors of nonfarm business activity and four of the five Seventh Federal Reserve District states made positive contributions to the MEI in May. The relative MEI moved down to +0.09 in May from +0.65 in April. Three of the four sectors and three of the five states made positive contributions to the relative MEI in May.