The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

On Monday, October 19, 1987, more than $500 billion of corporate equity disappeared in less than 7 hours. The Dow-Jones Industrial Average lost 508 points in a single day. But this was only the most dramatic day in a week that saw the financial markets literally restructure themselves. This essay examines changes in the way financial markets should be interpreted in the post-crash environment.

Risk is always an important factor in the analysis of financial markets. It is also the hardest to get a handle on. However, there is little question that risk moves markets. And in some cases, such as the futures and options markets, it creates them. Between October l3 and October 19, investor perceptions of risk changed. This change in the perception of risk has altered price and return relationships throughout the financial markets. Put into the simplest terms, a 5% three-month Treasury bill rate (or a $100 share of stock) does not mean the same thing it did before October 19.

When investors are scared, they look for safety. They adjust their portfolios to include more safe assets and fewer risky assets. Since the number of assets in the market as a whole does not change very quickly, that adjustment takes place initially through changes in the relative value of safe and risky assets. This kind of movement is usually referred to as a “flight to quality.” Government bond prices go up, stocks prices fall. As a result, even though there are just as many stocks and bonds as before, bonds now make up a larger percentage of the value of the nation’s investment portfolio.

In reality, the shift is much more complicated, affecting the relative price and future growth rates of nearly every type of financial asset. Such a shift poses significant difficulties for monetary policy. Policymakers use the financial markets both as a measure of what is going on in the economy and as a tool for the execution of policy. A massive shift in risk and its perception, such as occurred on October 19, acts upon the financial markets like a giant earthquake. Not only has the overall level of the market shifted but the relative position of every asset price and every interest rate is now different than it was before.

This essay attempts to draw a map of the current terrain of the financial markets and thus to provide some guidance both for the policymaker and market observers in general. The map is both tentative and temporary. It will be sometime before the terrain truly settles down. Yet, it is important to understand that much is already known about the nature of the shifts that have occurred; that knowledge can be used to help negotiate the new terrain.

Risk, asset prices, and interest rates

The key to understanding how the fall in the stock market and the concurrent reevaluation of risk on the part of investors affects the financial markets is the notion of a risk premium. If an investor is willing to bear risk, that investor receives a bonus—a higher return. The more risk. the higher the return. On the other side, if an investment is largely free of risk, investors will be willing to pay a premium for that investment. Put in terms of return, they will be willing to accept a lower return on low-risk investments. In periods where risk is especially disliked or especially high, these risk premiums can increase significantly.

Thus, when investors are trying to avoid risk: 1) risky investments will lose value; 2) low-risk investments will gain value; 3) interest rates on high-risk investments will be abnormally high; and 4) interest rates on low-risk investments will lie abnormally low.

What actually happened

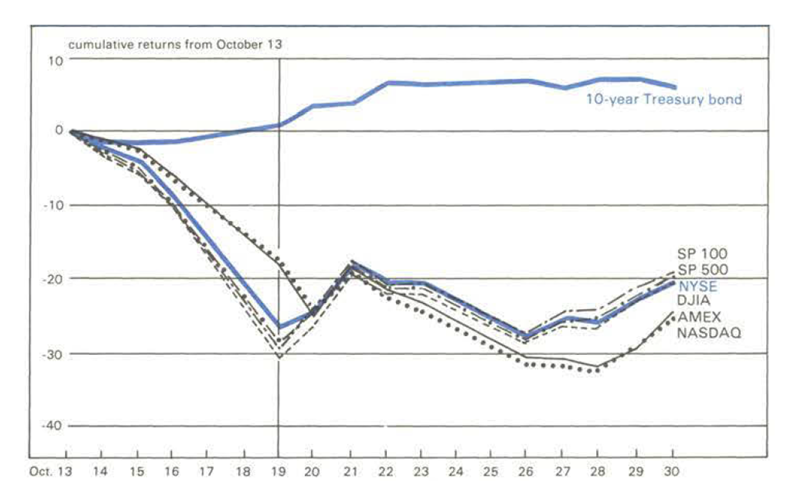

The first and most obvious event was that the stock market fell in value. This was certainly not due, in its entirety, to changes in risk perceptions. Yet, clearly, risk played a significant part. Figure 1 shows the cumulative fall in market value for a number of stock market indexes. It also shows the increase in value of a ten-year government bond. If the shift in the market had been purely one of lower expected economic output or reduced confidence in economic policies, it is unclear why the bond market should have rallied. Yet, it rallied strongly in response to the stock market crash; from the opening bell on Monday, October 19, to market close on Tuesday, the bond market rose nearly 5.2% and rose another 2.8% by Friday—a gain of 8% in just one week. This illustrates the first major risk response: the flight from equities to bonds.

1. U.S. stock market and Treasury bond returns

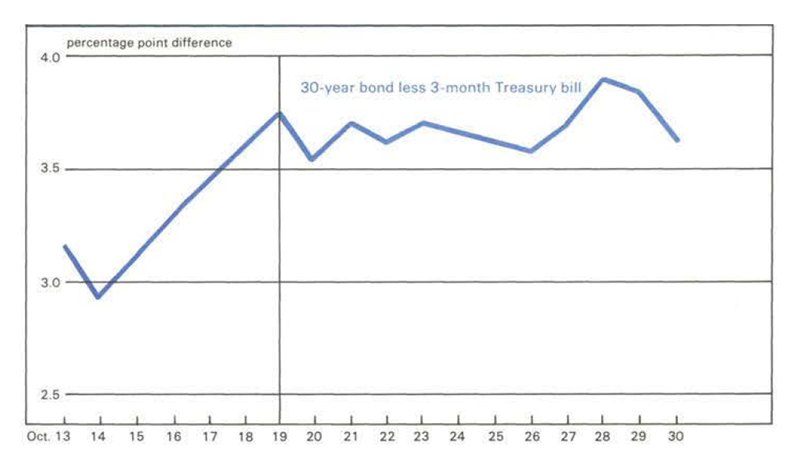

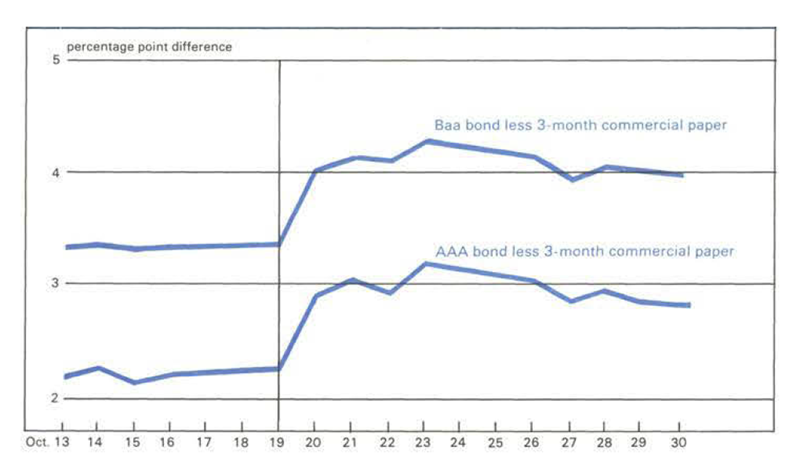

The second response can be seen in figure 2. Investors wanting to avoid the risk inherent in long-term assets shift to shorter-term assets. The effects of this are to push short-term rates down with respect to long-term rates. Figure 2 shows the difference between the yields on 3-month government securities and the yields on 30-year securities. Clearly, investors were willing to pay a significant premium to avoid the risk inherent in longer-term assets. From October 14 to October 28 the premium went from 2.9 percentage points to 4.0 percentage points, an increase of 25%. As can be seen in figure 3, the shift was even more abrupt for corporate borrowers. Until October 19 the premium for AAA-rated company bonds was a little over 2 percentage points. By October 23 it had jumped to over 3 percentage points—about a third.

2. U.S. government bonds spread

3. U.S. corporate bond spread

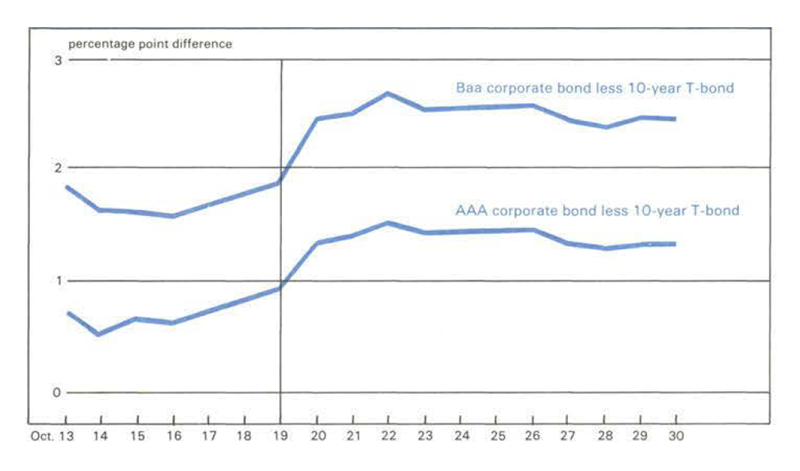

There was also a general quality response. Investors shifted to higher quality assets of the same type. Figure 4 shows the difference between yields on AAA and Baa corporate bonds and government bonds. The premium on AAA bonds increased 0.8 percentage points and the premium on Baa bonds increased 0.9 percentage points by October 22.

4. Quality spread

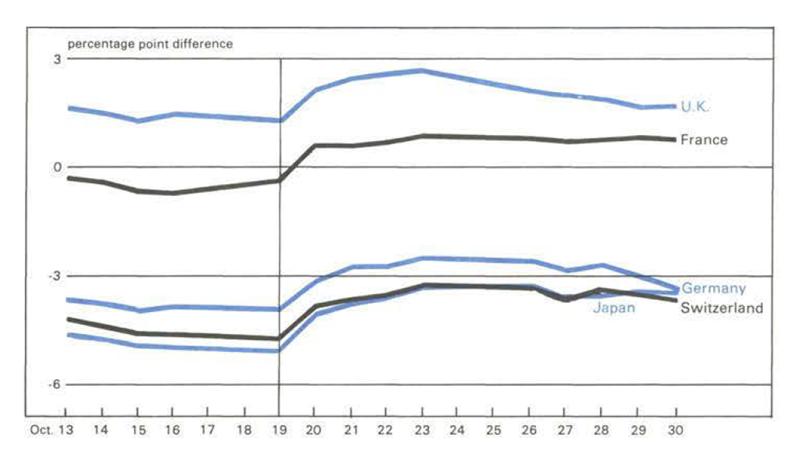

There are also risk-related effects in the international markets, with investors shifting to countries that are viewed as less risky. In recent months, some concern has been expressed about the vulnerability of U.S. financial markets to international markets; however, during the crisis the U.S. was once again a safe haven. Figure 5 shows the movements of foreign 3-month CD rates relative to U.S. 3-month CD rates. As can be seen, there was a rather significant shift to U.S. securities. U.S. rates fell an average of 1 full percentage point more than the comparison countries by October 20 and another 2/3 of a point by Friday, October 23.

5. CD rates, spread between foreign and U.S.

All four of the risk shifts discussed above pushed down the rates on short-term U.S. securities. This is important since it is typically these short-term government rates that are used by forecasters and other analysts as a measure of current credit conditions. In the current environment, misreading this shift could lead to a substantial misestimate of the overall thrust of monetary policy and of credit conditions in general.

Risk and the value of government guarantees

Another way of viewing financial markets is to look at the quantities of various types of assets issued. It will be some time before actual data appear on new issues, but a few useful things can be said now.

First and most important, short-term government-backed assets will have substantially higher growth in the near future than they would have had in the absence of a stock market crash. This means that government-insured bank deposits should see significant increases over the next few months. The largest impact will be in late October and early November as investors make portfolio adjustments. But even after the initial adjustments, there will still be significant economic incentives for people to put more dollars into bank accounts. Essentially, investors value FDIC and FSLIC insurance more and as a result bank accounts represent better investments than before.

Beyond the increase in bank deposits, there will be a tendency for firms to rely more on debt than on equity financing for new investments. Further, there will be incentives for firms to use short-term rather than long-term credit. Put more generally, quantities will increase in those types of assets where risk is lowest and decrease where risk is highest. This is really just the other side of the risk premium argument made above. It will simply take longer for quantities to adjust than it did for prices.

Conclusions

The clearest conclusion that comes from the analysis is that neither interest rates nor monetary growth rates ran be used, in and of themselves, as a measure of monetary policy or of credit market conditions after the types of events that took place on and around October 19. Even if policy had not adjusted to the new conditions at all, rates would have fallen. Likewise, as the atmosphere of crisis dissipates, rates will tend to move upward again. On the monetary side, there will be shifts into safe short-term assets. These shifts will cause a significant increase in the growth of money measures, such as M2. This too will pass as time proceeds. Policy in such an environment must remain open to change. It is an odd observation that though crisis often demands stable policies, the policymaker must often allow large changes in all the usual measures of policy to achieve that stability.

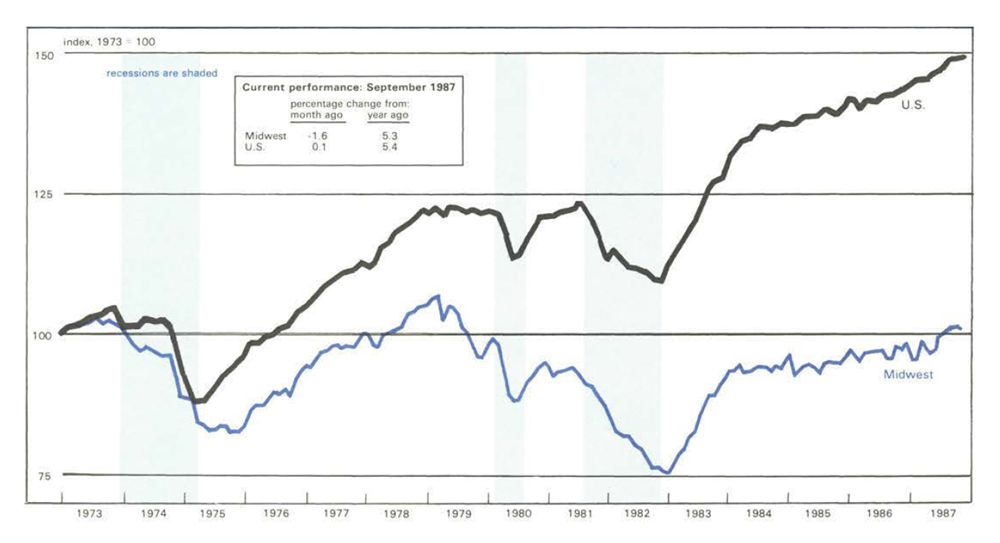

MMI—Midwest Manufacturing Index

A slowing in the expansion of industrial activity nationwide over the last three months may have caught up with the Midwest economy in September. The Midwest Manufacturing Index (MMI) dropped 1.6 percent in September, compared to a negligible advance in the Federal Reserve Board’s Index. The MMI recorded declines in both labor and capital usage, and food-processing and electrical-equipment industries were off substantially from a month ago.

The impact of the stock market collapse on manufacturing is uncertain and is not reflected in the September data. To the extent that consumer durables and capital goods will be hardest hit, the Midwest could bear the brunt of any weakening of demand because of its concentration in autos, appliances, and capital goods.