The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Two proposals currently crossing the desks of policymakers are viewed by some market participants as a direct response to the highly publicized derivatives-related losses of the last few years. The Securities and Exchange Commission (SEC) is currently reviewing responses to its proposal on the disclosure requirements of accounting policies and market risk for derivatives.1 This proposal specifies the rules that firms should follow in disclosing the derivatives they use and why, the risks are associated with these instruments, and the accounting treatment for these instruments and how it affects the accounting statements of the firm. At the same time, the Financial Accounting Standards Board (FASB) has proposed a set of accounting standards for derivatives used for hedging and risk management.2 The proposal provides definitions of financial contracts that qualify as derivative instruments, explains which types of transactions involving the use of derivatives qualify for hedge accounting, and specifies the accounting procedures that need to be followed with respect to these instruments.

While some take for granted the need for such disclosure requirements and accounting standards (collectively referred to here as standards), others view them as totally unnecessary.3 These discussions typically focus on the details of a given proposal, thereby obscuring the economic principles that underlie the discussion of appropriateness. In this Chicago Fed Letter, we examine the basis for such standards by first examining the problems they are trying to rectify. We do this by identifying the market failures that must exist in order for any regulations to be justified, which also provides a sense of the scope that these regulations should encompass. We then focus attention on the ideal properties of these standards, given the problems they are trying to resolve. This approach represents an important first step in any debate over the appropriateness of specific aspects of the accounting proposals currently under consideration.

The need for regulation of corporate disclosures

In a frictionless capital market, information is available without cost to all participants. Under these circumstances, regulations mandating desired levels of disclosure are not required, since all market participants already have full access to relevant information. Further, there is no need for intermediaries that generate and verify information (like rating agencies and accountants). Hence, the foundation of disclosure regulation has to be that it is costly for market participants to obtain necessary information.

However, if the acquisition of such information is costly, why don't firms voluntarily reveal this information? Doing so is in the interest of the firm's stakeholders, and any firm that is tardy in its disclosure policy would be appropriately disciplined by the market— facing some combination of a higher cost of capital, a lower valuation, and an increased likelihood of a takeover. If these mechanisms of market discipline work perfectly, there is no need for regulatory intervention.

The problem with this reliance on voluntary disclosure and market discipline is one of time consistency. Even though the management of the firm might be perfectly willing to promise ex ante to disclose information on a timely basis, the same incentives may not exist ex post. Management will attempt to manipulate this information to its advantage: Positive information will be reported promptly, while the disclosure of bad news will be delayed in the hope that the arrival of offsetting good information in the near future will mitigate the effect of the bad news. Market discipline could obviously weaken the incentive to disclose information strategically. However, recent derivatives debacles suggest some inability of market discipline to serve consistently as an effective deterrent. The failure of the market to discipline nondisclosing firms provides a positive role for regulations that require the firm to disclose useful information, which might not otherwise be revealed, to the market on a timely basis.

The SEC and FASB proposals can be interpreted as setting the standards that determine the form and content of the firm's disclosures, as a function of the information that it possesses. At the same time, they also serve as the mechanism for correctly conveying information into the firm's disclosure statements, thereby discouraging manipulation and time inconsistency. This ensures that firms have a commitment to timely disclosure and that the process of transforming firms' information into disclosure messages is well understood.

Consequently, the two proposals under consideration are based on the beliefs that (1) the information is not available without cost to the market, and (2) firms do not possess incentives to voluntarily disclose this information on a timely basis. Below, we examine the general characteristics that standards meant to address these problems must satisfy.

Properties of disclosure requirements for derivatives

The regulations that are put into place should attempt to communicate the private information that is relevant to the market, both by revealing it directly (what do you have, and why do you have it?) and by making sure that the manner in which this private information is used in disclosure reports (like SEC filings and accounting statements) is well understood and verified by an intermediary (how do what you have and why you have it affect the reported numbers?). Given this role, however, standards need to be designed so that they do not create problems that are worse than those they are attempting to resolve. We emphasize the following considerations in the design of such standards.

1. Regulation should minimize measurement errors in filings (noise) to the extent possible, while simultaneously providing unbiased information to the market. Regulations should recognize that increasing the accuracy of the information conveyed to the market is costly. The generation and reporting of these numbers can represent a significant burden for firms. As a consequence, the benefits associated with increased precision should be traded off against the costs of increasing the accuracy before requiring firms to follow these procedures. The need to establish that there is a net benefit is reflected in comments from several exchanges:

“We believe that the additional cost of the increased disclosure to the registrant will significantly outweigh the potential (and unproven) benefits to the investor.”4

If a noisy disclosure system is the best that can be achieved, what additional features might be desirable? When procedures such as mandated disclosures or accounting standards are put in place that provide noisy information about the status of the firm, one needs to ensure that this information is correct on average. Economic activity occurs continuously. Accounting attempts to depict this activity with periodic snapshots. A comparison of these snapshots by the analyst should provide information about the direction of firm activity. Accountants develop reporting conventions to ensure that these snapshots are accurate representations of the underlying economic behavior. When this goal is met, analysts can make reasonable projections of the firm's future prospects; otherwise, these projections become less reliable. However, any standard may lead to mismeasurement. When snapshots are accurate projections on average, we say that, on average, measurement errors are nil. A statistician refers to this as an unbiased procedure. However, being unbiased is not enough. A reporting procedure can make large errors which are nil, on average. The effect of this is to require the analyst to report ranges of possible outcomes. As these ranges become large, their usefulness is reduced. The statistician refers to this as the efficiency of the procedure.

A good reporting procedure is both unbiased and reasonably efficient. The distinction between these two concepts is an important one. Random guessing can produce an unbiased measure of activity, but the measure has little bearing on what the firm is actually doing, so the measure has little value because it is inefficient. Increasing efficiency is costly. The trade-off is the added value implied by improving the procedure and the cost of producing a more representative measure. Concerns about the failure of existing proposals to reflect this can be seen in the comments from Amoco Corporation:

“While the current release contains a number of potential improvements in disclosure requirements, we believe the proposed amendments, without modification, would limit the effectiveness of disclosures by obscuring salient information with less useful cash flow data that would confuse and even mislead the users of the financial information.”

2. Regulations should consider what information the market would find useful, and why. Perfect disclosure is not necessarily a desirable outcome. As noted earlier, the design of regulations to convey the information to the market is likely to impose costs. Consequently, some consideration of the trade-off between social benefits and social costs is necessary in selecting a desired level of disclosure. Even absent cost considerations, it is not appropriate to assume that investors always prefer more disclosure. For example, the revelation of proprietary information might put the firm at a competitive disadvantage. In this case, investors in the firm would rather this information not be made available to other market participants. Standards mandating excessive disclosure hamper the firm's ability to conduct normal operations efficiently and are counterproductive from the perspective of both the shareholders and the firm. As pointed out by Hershey Foods.“We are concerned that the amendments would require disclosure of highly proprietary information and put the company at a competitive disadvantage. Since we are a huge purchaser of cocoa in the United States, if we are required to make disclosures anticipated by the amendments, our primary competition may be able to determine a major portion of the cost structure of the corporation's business, thereby achieving a significant advantage.”

It is also useful to recognize that the information that might be considered useful by the market probably varies considerably across firms as a function of the nature of their operations. Thus, requiring one-size-fits-all procedures may impose inappropriate disclosure requirements on some firms. This is highlighted by the comments on the SEC proposal by Ford Motor Co.:

“Our most serious concern is that market risk of derivatives at Ford is largely secondary to our primary business risks, yet the proposed disclosure will give the user the impression that market risk with derivatives is the most important of the company's business risks.”

Disclosure standards must distinguish between information about the firm that is useful to market participants and proprietary information that is crucial to the firm's remaining competitive. This distinction is likely to depend on the nature of the firm's operations, and standards should take this into account instead of following a one-size-fits-all design.

3. Disclosure standards should treat equivalent economic situations similarly. There are at least three distinct reasons for requiring that proposed standards conform to this requirement: to make the process as transparent as possible, to prevent the standards from influencing corporate decision-making, and to prevent unintended spillover effects. First, recall that the motivation behind these standards is to convey information to the market. It is hard to justify procedures that result in different disclosures being made to the market, even though the economic outcomes are identical. At one extreme, it is possible that market participants are not fooled and can see through this to the underlying reality. Even under these circumstances, the standards introduce a level of noise that is both unnecessary and avoidable.The more serious consequence of this differential treatment for similar situations is that it could have real effects on the operating strategies of the firm, especially when this asymmetric treatment is not perfectly transparent to market participants. Specifically, it biases decision-making toward corporate strategies that are associated with the least-cost regulatory procedures and reports that reveal the firm in the most favorable light, although these might not represent choices that can be economically justified.

These distortions in corporate decision-making can have spillover effects to the rest of the economy as well. For example, consider what happens if the standards effectively preclude the use of certain types of instruments or transactions, despite their being economically equivalent to other situations that are subject to more lenient standards. Unless a rigorous cost–benefit analysis can justify that discriminating against specific transactions results in societywide benefits that outweigh the costs, the standards that were originally motivated to resolve specific externalities are clearly having some unintended consequences of their own.

This issue was addressed in a recent article by Ira G. Kwaller about the perceived bias against futures contracts in the current FASB proposal.5 The source of this bias is the requirement that any hedging instrument have a maturity that is “on or about the same date as the projected date of each forecasted transaction.” Since futures contracts have standardized maturity dates, this creates the possibility that an instrument with an identical maturity date cannot be found. Market participants typically respond to this by rolling over the futures position. Kwaller argues that the FASB “... will preclude use of legitimate hedging tactics using futures contracts.” Furthermore, he notes that the proposal creates “... disincentives for the use of one class of instruments versus others that serve the same economic function.”

Conclusion

The imposition of regulations and other standards on corporations leads to frequent debates about the need for such restrictions, as well as complaints about the problems caused by specific features. In this Chicago Fed Letter, we have addressed these issues in the context of disclosure requirements for derivatives. The need for such regulations has to be based on the belief that market discipline is not adequate to force firms to disclose this information voluntarily. Taking this as a starting point, we have outlined some general properties that any standards in this area must satisfy. Many of the concerns expressed by market participants about the current proposals by the SEC and FASB are consistent with these participants believing, implicitly at least, that these properties are being violated. Subsequent versions of these proposals should better communicate the way in which they fit these properties or be modified so that they are consistent with these properties.

Tracking Midwest manufacturing activity

Manufacturing output indexes (1987=100)

| July | Month ago | Year ago | |

|---|---|---|---|

| MMI | 128.9 | 128.3 | 12.3 |

| IP | 128.6 | 128.1 | 123.3 |

Motor vehicle production (millions, seasonally adj. annual rate)

| August | Month ago | Year ago | |

|---|---|---|---|

| Cars | 6.7 | 7.0 | 6.2 |

| Light trucks | 5.6 | 6.0 | 5.8 |

Purchasing managers' surveys: net % reporting production growth

| August | Month ago | Year ago | |

|---|---|---|---|

| MW | 63.6 | 50.9 | 55.3 |

| U.S. | 57.1 | 52.7 | 50.9 |

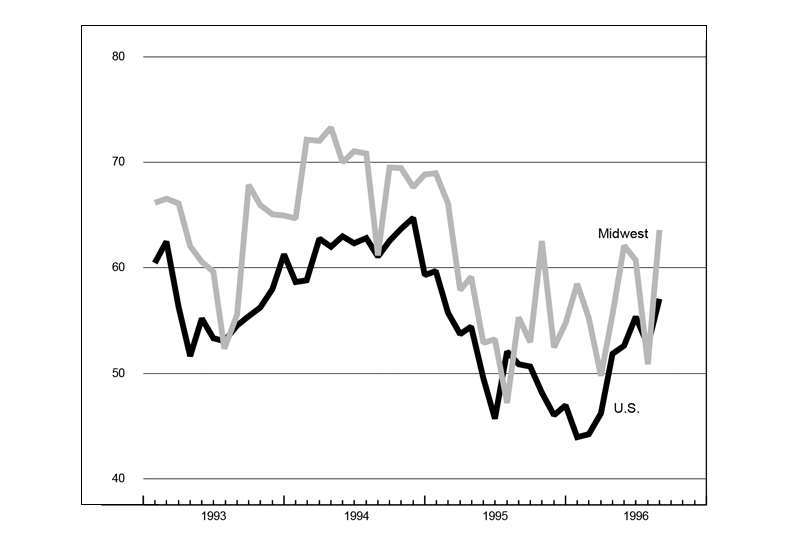

Purchasing managers' surveys (production index)

Midwest manufacturing activity appears to have surged in August, after being relatively flat in July, according to the latest purchasing managers' surveys. All three major metropolitan areas in the Midwest posted large gains, moving their purchasing managers' indexes from the low 50s in July to the high 50s and low 60s in August. The composite index for the three regions jumped from 50.9 in July to 63.6 in August.

In contrast, auto assemblies has their largest gain in July, hitting an expansion high of 13 million units (saar). In August assemblies dropped back roughly in line with June's 12.2 million pace. Given the importance of the region's auto sector, the July gain in auto assemblies may have triggered a large part of the gains registered in the August purchasing managers' surveys for the region.

Notes

1 Securities and Exchange Commission, “Proposed amendments to require disclosure of accounting policies for derivative financial instruments and derivative commodity instruments and disclosure of qualitative and quantitative information about market risk inherent in derivative financial instruments, other financial instruments, and derivative commodity instruments,” March 1996.

2 Financial Accounting Standards Board, “Accounting for derivative and similar financial instruments and for hedging activity,” June 20, 1996.

3 See, for example, the editorial page article by Merton Miller and Christopher Culp, “The SEC's costly disclosure rules,” Wall Street Journal, (6/25/96), and the responses to it, as well as the comments made by firms in Donald Horowitz and Robert Mackey, “SEC's proposed rules on derivative disclosures: The comment letters,” Journal on the Law of Investment and Risk Management Products, Vol. 16, No. 5, (1996).

4 This quote and all subsequent quotes in this Fed Letter are from Donald Horowitz and Robert Mackey, “SEC's proposed rules on derivative disclosures: The comment letters,” Journal on the Law of Investment and Risk Management Products, Vol. 16, No. 5, (1996).

5 Ira G. Kwaller, “The latest FASB hedge accounting proposal: Implications for futures users,” Journal on the Law of Investment and Risk Management Products, Vol. 16, No. 5, (1996).