On November 18, 2024, the Financial Markets Group (FMG) of the Federal Reserve Bank of Chicago hosted its 11th annual Fall Conference. This year’s conference, titled U.S. Treasury Clearing: Opportunities, Challenges, and Financial Stability Considerations, featured a range of participants in financial markets and regulatory policy with a focus on the Securities and Exchange Commission’s (SEC) rule mandating that most Treasury cash and repurchase agreement (repo) transactions be centrally cleared. After welcome remarks from Chicago Fed President Austan Goolsbee, the conference kicked off with a speech from Treasury undersecretary for Domestic Finance Nellie Liang. She provided an overview of the interagency efforts made in recent years to strengthen the resilience of the U.S. Treasury securities market, which includes the Treasury clearing mandate. In addition, the program included two fireside chats with keynote guests. Chicago Fed senior policy advisor Robert Steigerwald hosted the first discussion with Haoxiang Zhu, director of the Division of Trading and Markets at the SEC. And vice president and head of the Financial Markets Group of the Chicago Fed Cindy Hull hosted a fireside chat with Randall Kroszner, Norman R. Bobins Professor of Economics at the University of Chicago’s Booth School of Business and external member of the Financial Policy Committee of the Bank of England.

The conference also featured three panel discussions. Hull moderated the first panel discussion on the implementation mechanics of the Treasury clearing mandate. Ketan B. Patel, Chicago Fed policy advisor and head of financial markets risk analysis, led the second panel discussion covering the market structure challenges and opportunities posed by the mandate. Lastly, Gene Amromin, Chicago Fed senior vice president and director of financial policy, moderated the third and final panel on the financial stability implications of expanded central clearing.

The conference was held under the Chatham House Rule, with no press in attendance. Below, we highlight some themes and conclusions from the conference.

Key takeaways from the conference:

- There has been substantive progress toward the implementation of the clearing mandate, including some initial groundwork to enable done-away1 trading, progress on accounting rules, and market participants’ early shift into clearing of Treasury repo trades well ahead of the implementation deadline. However, much work remains, including establishing pre-trade credit checks, identifying potential margin efficiencies, and finalizing necessary legal agreements between counterparties.

- A Treasury market supported by multiple central counterparties (CCPs) may improve operational resilience, but may also have far-reaching implications that are not yet understood. Key concerns include the potential for higher transaction costs and potentially fragmented pricing across active CCPs. This could lead to unforeseen effects on large and leveraged trades such as the Treasury cash-futures basis trade, which plays a large role in promoting Treasury market functioning during normal times but can exacerbate liquidity issues during of market stress events.

- Centrally cleared markets are highly interconnected and concentrated. To mitigate systemic risk from Treasury markets as firms adopt central clearing amid high Treasury issuance volumes, policymakers may wish to consider advancing initiatives to increase transparency of large positions across markets, encourage new entrants into clearing intermediation, and promote all-to-all trading.

- A market structure change that results in central clearing of the bulk of Treasury securities and repo trades may have implications for monetary policy implementation. For some, it raises questions of whether the Federal Reserve should consider centrally clearing open market operations and whether nonbank entities should be considered as counterparties for backstop liquidity support.

Mandate implementation status and outstanding work

Conference participants consistently noted that much work remains before the initial implementation deadlines in 2025. Industry capacity constraints and outstanding questions on the SEC guidance remain key hurdles to progress. However, the growth in cleared repo transactions in recent years, even before the first SEC mandate was announced, suggests that such a market structure shift is feasible. Panelists and other participants focused on the following outstanding items that require resolution before the first set of deadlines in 2025:

- Accounting: One panelist highlighted that accounting for both done-with and done-away sponsored activity is well established and that accounting for agent clearing of Treasury securities, which is akin to clearing by futures commission merchants (FCMs) in derivatives markets, is proceeding in a positive direction.

- Credit checks: Credit checks are widely conducted in centrally cleared derivatives markets prior to a trade to ensure the creditworthiness of counterparties. It is generally agreed that pre-trade credit checks will be a necessary component in facilitating done-away trading in the Treasury market post-implementation. Participants noted several open questions regarding how credit checks would operate in the Treasury market, including whether pre-trade checks would be required for a trade to execute, whether post-trade credit checks would be allowed, the speed at which credit checks must be completed, and the workflow if a credit check fails. A few participants argued that, to be most useful, Treasury market credit checks should be dynamic and update in real-time, reflecting the amount of risk actively being cleared.

- Margin efficiencies: The prospect of large increases in margin requirements as more Treasury activity becomes centrally cleared illustrates the importance of cross-margining benefits being available between different CCPs and to end-users. Many conference participants emphasized that new opportunities for cross-margining and other potential margin efficiencies would be crucial to grow clearing capacity to meet the demand for clearing created by the mandate. Some participants also argued that cross-margining would help support liquidity in the Treasury market, particularly in crowded trades like the Treasury cash-futures basis, as it would enable risk assessment more at the portfolio level, which would be more capital efficient.

- Legal documentation: Panelists discussed recent work from the Securities Industry and Financial Markets Association (SIFMA) to develop standardized documentation for done-with trading but agreed that standard documentation for done-away transactions was still needed. Participants agreed that they must first converge on new business process norms and standards, such as how credit checks function in a typical trade workflow. After this, it would be possible for firms to draft the appropriate legal documentation.

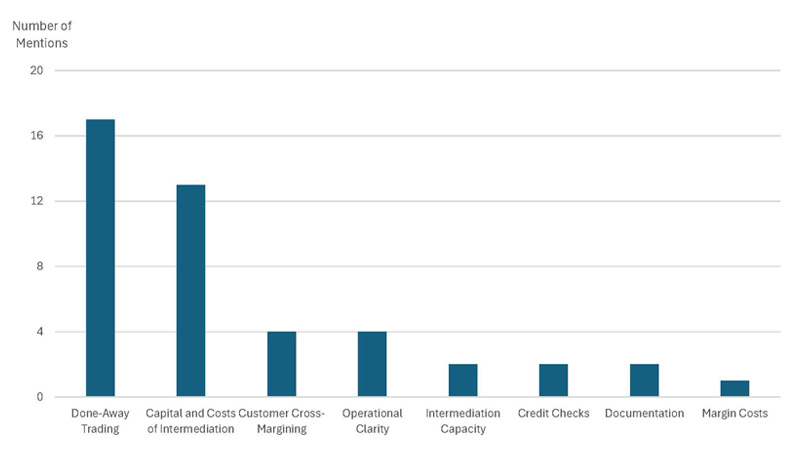

During the event, the audience was asked which operational or legal issue would be the biggest hurdle to implementation of the new mandate. Figure 1 shows that the bulk of responses mentioned either concerns over done-away trading or intermediation costs.

1. Which operational or legal issue is the biggest hurdle to implementation of the SEC Treasury clearing mandate?

Participants also discussed several open questions around whether certain transactions would be covered by the mandate. One example is mixed-CUSIP repos, or repos in which the delivered collateral can either include Treasuries or other non-Treasury securities. Another open question was the scope of the exemption for inter-affiliate trades, those conducted between two affiliated entities. These trades are commonly conducted to move collateral to cover an affiliate’s position or margin requirements. While the SEC has created exemptions for this activity under certain conditions, one panelist argued that market participants remain uncertain if this scope will be changed. Participants cited a third area of uncertainty regarding cross-border trades, and whether Treasury activity that is conducted on platforms outside the U.S. will be in scope for the mandate.

Several participants also noted that much of the implementation mechanics of the mandate, as well as the structure that these markets will take once the mandate deadlines arrive, will have to be determined by the market given some areas lacking detail in the SEC rule. These panelists largely agreed that this dynamic contrasted with the experience of the 2012 Commodity Futures Trading Commission (CFTC) derivatives clearing mandate, which was more prescriptive in how the clearing regime should be designed. While most market participants did not anticipate more clarity on implementation design choices by the public sector, many agreed this would help facilitate a faster transition to a new steady-state market structure across a wider set of participants.

Market implications of the mandate

Throughout the day, conference participants discussed the impacts that the mandate would have on the overall health and resilience of the Treasury market post-implementation. Of primary focus was whether the mandate could either enhance or impair Treasury market liquidity. Several participants agreed that the mandate would improve liquidity, with a few qualifying that it could take some time for this benefit to be realized after some initial frictions during a transition period. However, there was also some agreement that trading costs would increase, with wider bid-ask spreads given constraints in the intermediation of Treasury clearing. Key topic areas included differences in new versus seasoned Treasury securities, impacts on the cash-futures basis trade, and liquidity implications if clearing services are available from multiple CCPs.

One panelist emphasized that, while liquidity is currently robust in the Treasury market overall, there are some areas of the market that trade less often, particularly in more seasoned off-the-run securities. The participant argued that, by eliminating counterparty risk in these trades, the mandate should at least partially improve liquidity in off-the-run securities. Another market structure change that could also improve liquidity would be to adopt all-to-all trading in the Treasury market.2

In her remarks, Liang noted that the capacity of dealers to intermediate Treasury securities has not grown at the same pace as the volume of Treasury securities outstanding. A key potential benefit of expanded central clearing in Treasuries would be the ability of bank-affiliated dealers to net down more of their transactions, providing expanded capacity to intermediate Treasury transactions for a given firm’s balance sheet size. Another conference participant emphasized that netting would be particularly beneficial for risk-weighted capital charges. Liang also highlighted that, outside of benefits related to balance sheet capacity, expanded central clearing would lead to better and more standardized risk management practices, including margin levels that better reflect market risk and the concentration of positions.

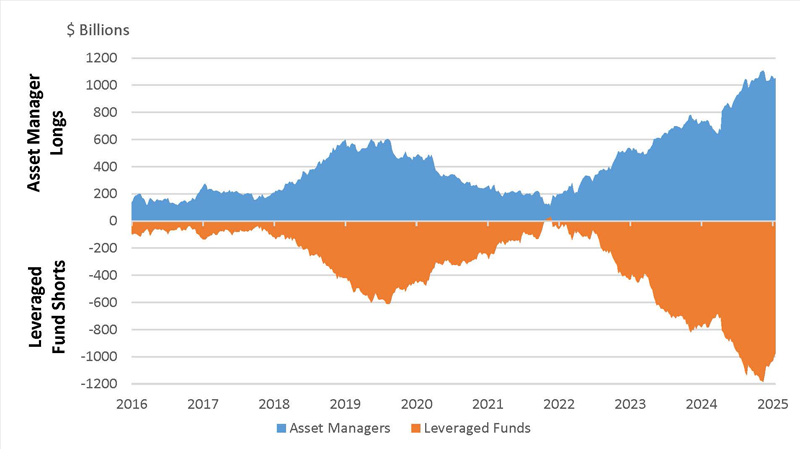

Another area of focus was the implication of the mandate for the Treasury cash-futures basis trade, the size of which has grown significantly in recent years. The chart in figure 2, used as a discussion prompt during the conference, shows long positioning of asset managers in Treasury futures alongside short positions from leveraged funds, a common proxy of the size of the basis trade.

2. Net futures positions of asset managers and leveraged funds

Liang noted that the basis trade supports Treasury market functioning during normal times but that it can pose significant risks during market stress events in which the trade may be quickly unwound, as the trade tends to be highly leveraged and, per recent official sector collection of non-centrally cleared repo data, have zero haircuts. One panelist noted that the expansion of central clearing could lead to an increase in the cost of the basis trade. However, another argued that this might not be the case if cross-margining benefits were to be introduced for end users. Depending on how cross-margining is designed, expanded central clearing could lead to a decrease in the cost of the basis trade.

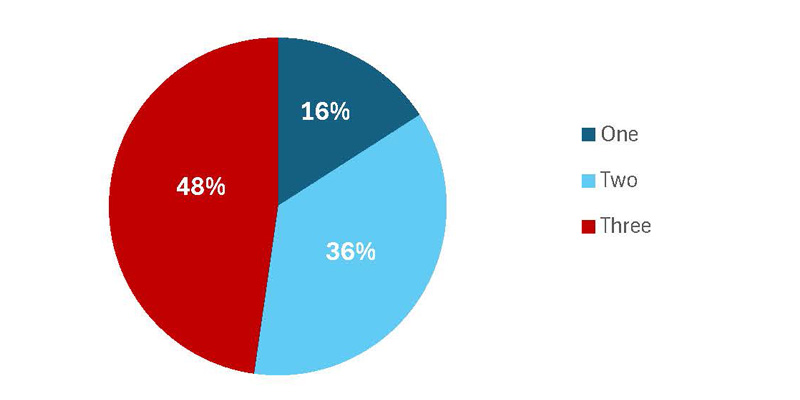

Given the prospect of at least three CCPs eventually being active in the Treasury market, conference attendees were asked what number of CCPs would best serve the market. Figure 3 shows that the vast majority preferred a market structure with more than one CCP. During the conference, participants cited the size and critical importance of the Treasury market as justifying multiple CCPs, as well as the potential for innovation that could be spurred through competition in the sector.

3. Do you think the U.S. Treasury market would be best served by one or more CCPs?

However, several panelists raised potential risks associated with a market structure in which multiple CCPs offer Treasury securities and repo clearing services. One key concern regarded the design of clearing in a multiple-CCP environment. Unlike the more prescriptive approach used in the 2012 CFTC rule on methods for clearing over-the-counter derivatives transactions, the SEC rule leaves many decisions to market participants. For instance, a few participants emphasized that the SEC rule does not specify what should happen to a trade if it fails to clear. Another participant emphasized that the rule does not address how instantaneous clearing should be, which was a point of focus in the CFTC rule and is currently the norm in today’s cleared derivatives market.

Another issue raised regarding competition between multiple CCPs was the prospect of fragmentation in a multi-CCP Treasury market at trade execution, with a basis potentially arising between different CCPs. End-users may have to contend with a much more complicated array of pricing for clearing services than in the current market, with the potential for discrete pricing across different access models at each CCP creating confusion in normal trading activity. Some also highlighted potential complications in member obligations to CCPs, asking if the same assets could be pledged to multiple CCP default funds.

Financial stability

The implementation of the clearing mandate has notable implications for financial stability. It can reduce vulnerabilities because CCPs can standardize risk management processes and reduce counterparty risk. However, it can also increase vulnerabilities by encouraging increased concentration and interconnectedness of intermediaries and end-users and creating single points of failure in the CCPs themselves.

Interconnectedness of firms in centrally cleared markets was a particular focus in the discussion. A few participants emphasized that CCPs may not have sufficient insight into the exposures of their clearing members or end users to other CCPs. Academic research focused on the euro area, where granular data on derivatives transactions are collected by official sector entities, has shown that European centrally cleared markets are highly interconnected, which may pose significant contagion risk between seemingly unrelated markets during times of stress, a dynamic which needs to be adequately addressed.

Clearing services have also grown increasingly concentrated in recent decades alongside a decline in the number of clearing intermediaries. Several panelists argued that there was a significant risk that Treasury clearing could become highly concentrated if certain aspects of the mandate were not implemented in a way that encouraged greater intermediation. Given the size of the Treasury market, which is expected to grow significantly more given anticipated net borrowing in the coming years, excessive concentration could result in insufficient capacity for the level of activity that will need to be centrally cleared. Panelists agreed that several steps could be taken to help prevent this dynamic, including ensuring that done-away trading becomes an option in these markets, as this would help shift activity away from only the largest firms. Some panelists also argued that the introduction of all-to-all trading would further reduce the concentration of intermediation.

Another concern that was raised was the idea that, in a multiple CCP environment, competing CCPs might have incentives to compete down their margin requirements to attract business, creating greater risk in the case of large defaults. A few participants argued that there should be minimum required haircuts for cleared Treasury transactions.

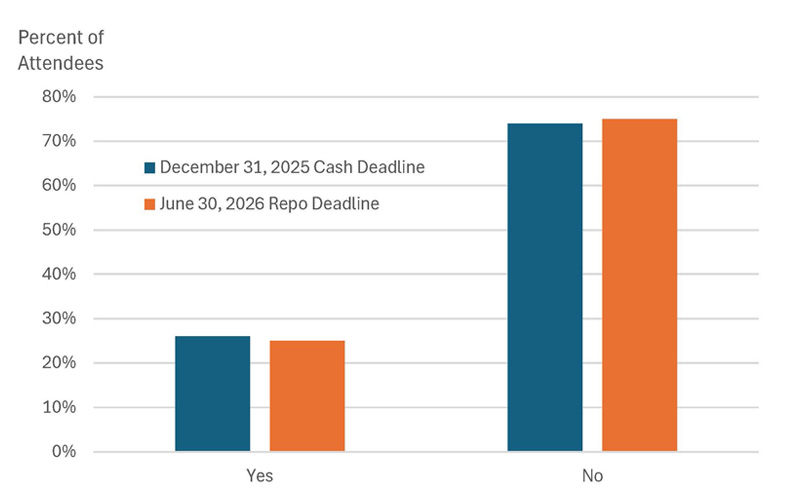

Participants also noted risks in the implementation timeline as creating potential financial stability risks, with several participants emphasizing risks around the repo deadline. One panelist qualified that they believed that CCPs in these markets would be ready to clear activity by the mandate deadlines, but that there was greater uncertainty that end users would be ready to clear, given documentation needed to be onboarded with intermediaries. Indeed, conference attendees were asked whether there was sufficient time for all industry participants to meet the current deadlines for Treasury cash and repo transactions. Figure 4 shows that roughly 75% agreed that there was not enough time for either requirement.

4. Is there sufficient time for all required parties to comply?

Implications for the public sector

While much of the conference focused on industry considerations and challenges in the implementation of the clearing mandate, it also raised several considerations for the Federal Reserve and other policymakers. Indeed, President Goolsbee posed a series of questions at the beginning of the conference, including one where he asked whether attendees thought the Fed’s own operational activity should evolve alongside the market structure changes underway in the Treasury market. This question bears examination as the Fed has historically conducted monetary policy operations primarily via the Treasury market. One item that participants raised on this topic was that Federal Reserve operations, in particular the Standing Repo Facility (SRF), might become less effective if dealers are not able to net down their positions with the Federal Reserve along with all of their other counterparties. Regarding the SRF, one participant argued that another way to bolster the effectiveness of the SRF would be to expand access to smaller broker-dealers that are active in the Treasury market. Another participant argued that the Federal Reserve should be attentive not only to the level of aggregate reserves but also to their distribution across the banking system, as reserve holdings are concentrated in large banking institutions. As expanded central clearing increases liquidity and capital demands on banks, the participant argued that the transmission of monetary policy could be impaired as the cost of conducting repo increases and suggested that policymakers consider ways to encourage greater cash provision from large reserve holders in the repo market.

Participants also discussed the growth of non-bank financial institutions and the risks posed by these entities. These firms do not typically have access to backstop central bank liquidity support in the U.S. during stress events. One participant emphasized that some foreign central banks have prearranged liquidity access and standing facilities meant to support these non-bank entities, including CCPs, and another participant noted that as centrally cleared activity continues to grow, policymakers should examine whether similar liquidity support should be introduced for U.S. CCPs.

A third item participants raised was the potential benefits of the Federal Reserve and other public sector entities collecting more detailed data on participant transactions and exposures in centrally cleared markets. This could help policymakers better understand interconnections across markets and the risks they pose in spreading financial contagion. Relatedly, a participant argued that the official sector should work more closely with international counterparts in sharing available data to study how systemic risk can materialize and spread across borders during stress events.

According to participants, another area where official entities could play a proactive role is in helping to build intermediation capacity in Treasury markets. Several participants argued that full or partial exemption of Treasury securities from the Supplemental Leverage Ratio would incrementally increase capacity in Treasury intermediation. One participant also argued for the easing of banks’ risk-weighted capital constraints, which are highly sensitive to an institution’s level of repo activity, noting that regulatory changes to these requirements would be needed to ensure expansion of repo intermediation capacity as well as for dealers to pass on cross-product netting to clients. Similarly, several participants raised concerns about clearing capacity once the mandate is fully implemented, noting that the official sector needs to encourage the entry of a greater number of clearing intermediaries, as well as to help foster new market designs such as all-to-all trading in the Treasury market. A few participants also noted that the official sector should do more to help support done-away trading, as this would help grow clearing capacity and would prevent further concentration of clearing intermediation among the largest clearing members in the case that done-with trading remains the prominent clearing model.

Conclusion

The 2024 FMG Fall Conference facilitated rich discussion on the details of the implementation and impacts of the Treasury clearing mandate. The participants raised many questions about how the mandate would benefit, and potentially create new risks for, financial market stability, and convened many of the experts that will build the post-mandate Treasury market. FMG will continue to support and contribute to this ongoing conversation.

Notes

1 Under a done-with model, an intermediary executes a trade with a client and also clears the trade for the client at the CCP. Under a done-away model, clients can execute a trade with one counterparty and clear with another counterparty. Currently, centrally cleared Treasury trades are transacted under the done-with model.

2 All-to-all trading would involve a market participant directly trading with another market participant, without the need of a dealer intermediary, avoiding issues of dealer capacity constraints and potentially lowering trading costs.