The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Debt in the 1980s was often pictured as a type of high-octane gasoline supercharging the economy by providing investment funds and motivating management. In the 1990s, debt’s image is less glamorous, more like sludge in the crankcase than hi-test in the gas tank. Since the stock market crash of 1987, when the debt craze began to falter, GDP growth has only averaged 1.8%. Even if the recession is excluded, GDP averaged only 2.5%, well below the average nonrecession growth rate of 4.4% experienced in the post-war era.

By the late 1980s, firms and individuals had used up more of their capacity to borrow than they could hope to maintain. Precarious financial positions, slow growth, and a new era of enforced frugality were the result. By the encl of 1992, the resulting restrictions on activity finally appeared to ease. GDP growth rose to 4.7%, retail sales were up 8% from the previous Christmas, and new claims on unemployment finally began to fall.

Did the economy really clear some magic hurdle in dealing with the debt burden, or was the pickup due to some unrelated improvement in attitudes? At least superficially, the debt story seems plausible. Certainly, newspapers have been full of stories about corporations and consumers finally repairing their balance sheets. Reality is, however, more complicated.

The basic facts are that consumers and businesses recently have paid down certain forms of debt while they have increased other types. No universal trends cut across all parts of the balance sheet. To understand how the size and character of the debt overhang have changed since the onset of the recession in the third quarter of 1990, it is necessary to define exactly what is meant by debt burden and clearly track the complete balance sheet, not just selected subcomponents. It is especially important over this period to distinguish between leverage, which is measured by the ratio of total indebtedness to income, and the debt service burden, which is measured by the ratio of total payments due on debt to income. For instance, if a consumer takes out a home equity loan at a low interest rate to pay off high interest rate credit card debts and to provide a small cash cushion for the future, that consumer’s debt service ratio will fall, while the total debt-to-income ratio will rise.

This Chicago Fed Letter analyzes a set of leverage and debt service burden measures for both the household and the corporate sectors. Our basic conclusion is that the debt buildup, to close approximation, has not been eliminated or even significantly reduced. Thus, total leverage is largely the same as it was in 1990. What has changed over this period is that the large reduction in interest rates during the recession has allowed borrowers to reduce their interest expenses to more normal levels, while leaving their debt-to-income ratios largely untouched.

This suggests that, while interest rate reductions have helped the economy deal with the debt buildup of the 1980s, the economy remains vulnerable to large swings in interest rates. This vulnerability is mitigated to some extent by the fact that much of the recent debt restructuring has been toward longer-term instruments, thus reducing the immediate impact of a rise in interest rates.

The household sector

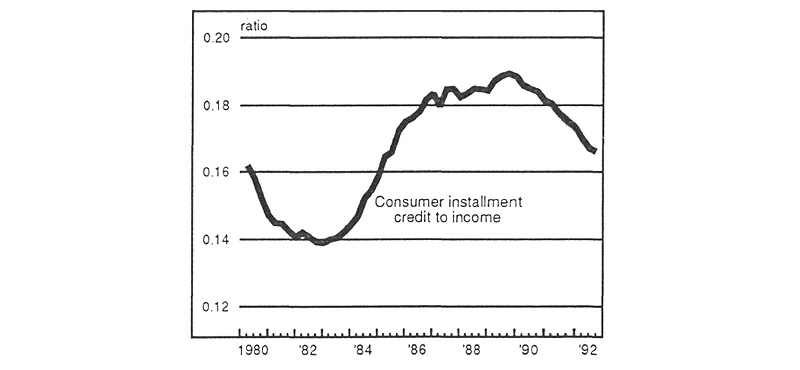

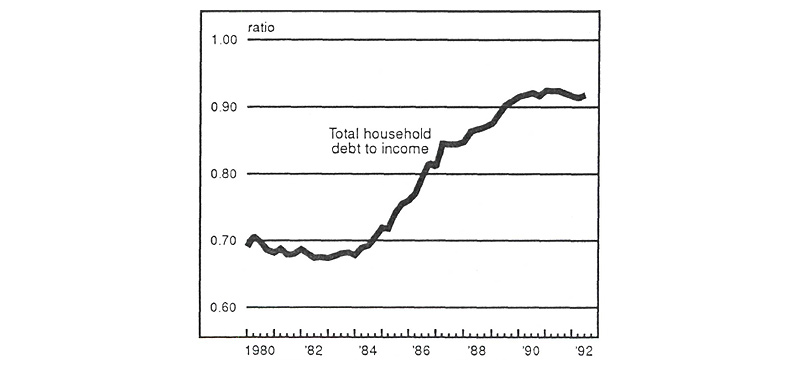

When the ratio of consumer installment credit to disposable personal income fell to a seven-year low of .167 in the second quarter of 1992, analysts shared a sense of relief, as consumers apparently had begun to reduce their indebtedness to more manageable levels and would be able to increase spending in the near future. As shown in figure 1, this ratio rose steadily throughout the 1980s, as consumers embarked on a credit card debt binge, and then started to decline steadily in the early 1990s, as consumers paid down some of their outstanding credit card balances, personal loans, and auto loans. However, other components of household debt must be considered in order to assess the true magnitude of the improvement in consumer indebtedness. As figure 2 shows, total household debt as a share of personal income has not declined very much from its peak in 1991, and still remains at historically high levels in the third quarter of 1992.

1. Household leverage: installment

2. Household leverage: total

The contrast between figures 1 and 2 is explained by the fact that consumers have been replacing traditional credit card debt and personal loans with less expensive home equity loans and lines of credit, which are classified under home mortgage debt.1 Therefore, while consumer installment credit has declined at an average annual rate of 0.4% since the third quarter of 1990, home mortgage debt has grown at a 5.6% rate, causing total household debt to rise at a 4.4% rate. Thus, even though the accumulation of total household debt slowed down in the early 1990s compared to the 1980s, consumers have not appreciably reduced their debt levels.

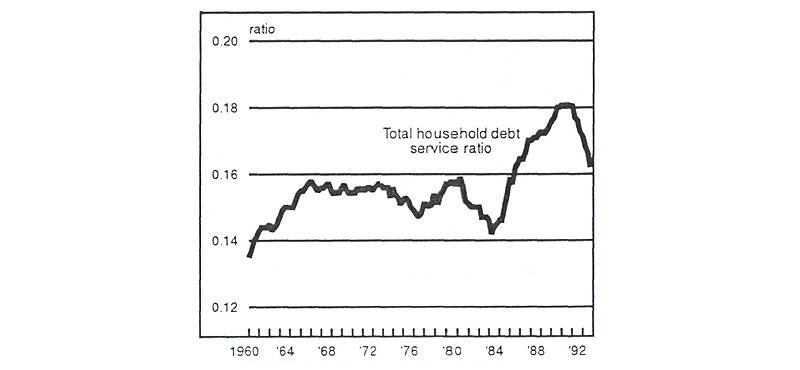

Changes in consumer debt service burdens tell a very different story. As shown in figure 3, debt service payments as a share of personal income increased rapidly throughout the l980s, stood at historically high levels from 1989 through 1990, and then fell sharply thereafter.2 The debt service ratio’s path over the last eight quarters clearly differs from that of the total leverage ratio depicted in figure 2. This is because the improvement in the total debt service ratio is due to interest rate reductions and not to a decline in the level of total household debt.

3. Household debt service burden

To clearly understand why figures 2 and 3 tell such sharply different stories, it is necessary to delineate the sources of improvement in debt service burdens. The remainder of this section examines the relative importance of changes in debt levels, income, and interest rates to changes in debt service ratios. Figure 4, panel (a), explains the recent decline in household debt service burdens, calculated as the ratio of estimated interest payments on consumer installment credit, mortgage debt, and total debt to disposable personal income.3

4. Debt service ratios*

(a) Household sector |

|||

|---|---|---|---|

| Installment Credit | Home Mortgages | Total | |

| Ratio in 90:3 | 0.027 | 0.064 | 0.090 |

| Ratio in 92:3 | 0.022 | 0.051 | 0.073 |

| Improvement | 0.005 | 0.013 | 0.017 |

| Debt at 92:3 levels | |||

| Ratio in 92:3 | 0.027 | 0.071 | 0.098 |

| Improvement | 0.000 | –0.007 | –0.008 |

| $ equivalent (billion) | –1.9 | –30.1 | –32.1 |

| Debt & income at 92:3 levels | |||

| Ratio in 92:3 | 0.024 | 0.065 | 0.089 |

| Improvement | 0.003 | –0.001 | 0.001 |

| $ equivalent (billion) | 10.3 | –5.7 | 4.5 |

| Debt, income, & interest rates at 92:3 levels | |||

| Ratio in 92:3 | 0.022 | 0.051 | 0.073 |

| Improvement | 0.005 | 0.013 | 0.017 |

| $ equivalent (billion) | 18.4 | 51.2 | 69.6 |

(b) Nonfinancial corporate sector |

|||

| Short term | Long term | Total | |

| Ratio in 90:3 | 0.098 | 0.158 | 0.255 |

| Ratio in 92:3 | 0.040 | 0.150 | 0.190 |

| Improvement | 0.058 | 0.008 | 0.065 |

| Debt at 92:3 levels | |||

| Ratio in 92:3 | 0.088 | 0.172 | 0.260 |

| Improvement | 0.010 | –0.014 | –0.005 |

| $ equivalent (billion) | 7.0 | –12.1 | –5.1 |

| Debt & cash flow at 92:3 levels | |||

| Ratio in 92:3 | 0.084 | 0.164 | 0.248 |

| Improvement | 0.014 | –0.006 | 0.007 |

| $ equivalent (billion) | 11.2 | –3.8 | 7.5 |

| Debt, cash flow, & interest rates at 92:3 levels | |||

| Ratio in 92:3 | 0.040 | 0.150 | 0.190 |

| Improvement | 0.058 | 0.008 | 0.065 |

| $ equivalent (billion) | 47.2 | 15.2 | 62.5 |

*See text for data definitions and sources.

Figure 4, panel (a), is divided into four sections. The first section simply reports the actual values of the three ratios in 1990:Q3 and 1992:Q3 and the change over that time period (1990:Q3 values minus 1992:Q3 values). In the other three sections, the 1992:Q3 ratios are analyzed under three alternative assumptions: 1) only the debt level changes, while income and interest rates are held at 1990:Q3 levels; 2) both debt and income levels change, while interest rates are kept at 1990:Q3 levels; and 3) debt, income, and interest rates are all at 1992:Q3 levels.

The dollar equivalent amounts under each assumption represent either a decline in interest payments, if positive, or an increase in interest payments, if negative. For example, a value of $10 billion means that the decline in the debt service ratio was equivalent to a $10 billion “rebate” on the interest payments.

As shown in the first section of panel (a), all three debt service ratios for the household sector improved in 1992:Q3 compared with 1990:Q3. For example, the total debt service ratio fell from .090 in 1990:Q3 to .073 in 1992:Q3, an improvement of .017. The second section of panel (a) shows that debt level changes alone caused debt service burdens to worsen or at best level off, not decline, between 1990:Q3 and 1992:Q3. The implied increase in the total debt service ratio is equivalent to an increase in interest payments of $32.l billion. Moreover, although consumer installment credit outstanding declined somewhat over this period, the higher interest rates typically charged on revolving credit offset the decline in debt outstanding, leaving the debt service ratio unchanged. The worsening in the mortgage debt service ratio reflects a substantial increase in mortgage debt outstanding and is equivalent to a $30.1 billion increase in interest payments.

As shown in the third section of panel (a), debt and income changes considered together leave the debt service ratios little changed from their 1990:Q3 values, which indicates that income growth was just about enough to offset the changes in debt levels over this period. The increase in income combined with both a decline in installment credit and an increase in mortgage debt resulted in a total rebate in interest payments of $4.5 billion.

Finally, when the changes in debt levels, income, and interest rates are considered together, all three debt service ratios decline, as shown in the fourth section of panel (a). The improvement in the total debt service ratio under this last scenario is equivalent to an interest payments rebate of $69.6 billion, compared to a $4.5 billion rebate when only income and debt level changes are considered. This suggests that the interest rate reduction alone was equivalent to $65.l billion in rebates.

The corporate sector

Developments in the corporate sector bear a strong resemblance to those of the household sector. Debt levels and, to a lesser extent, debt service burdens, rose in the 1980s, and recent quarters show dramatic declines in the debt service ratio with quite modest declines in the leverage ratio.

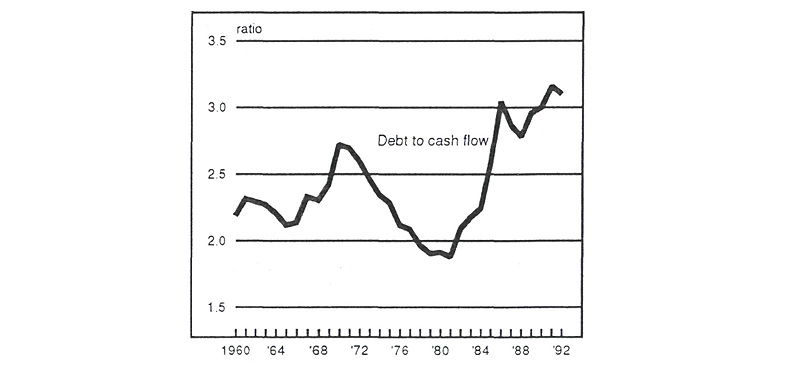

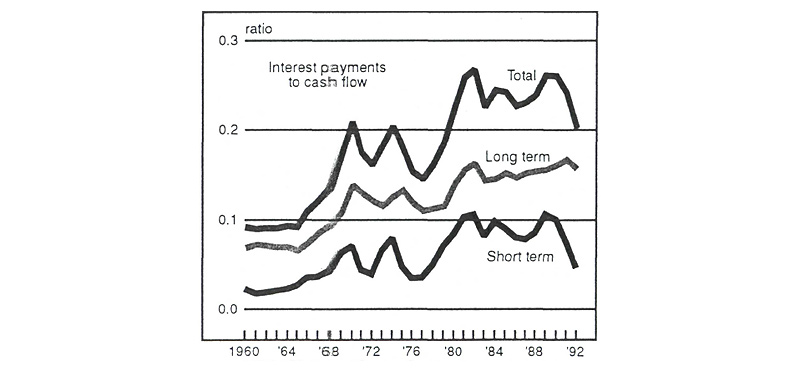

Figure 5 shows that the leverage ratio, total debt outstanding to cash flow, rose to historically high levels in the 1980s and has declined very little since its peak in 1991. Figure 6, which plots the ratios of interest payments to cash flow, indicates that the real runup in debt service burdens occurred in the late 1970s and early 1980s, as interest rates reached unprecedented high levels.4 Debt service burdens remained at or near these high levels until the end of the decade, as rates fell but debt issuance increased. Since 1990, debt service burdens have declined markedly, as interest rates have fallen and debt growth rates have tapered off or even become negative.

5. Corporate leverage

6. Corporate debt service burdens

Figure 4, panel (b), presents estimates of the relative importance of debt level reduction, cash flow growth, and interest rate reduction in explaining recent declines in corporate debt servicing burdens, and it should be read as panel (a) for the household sector. The first section of panel (b) shows the actual values of three debt service ratios for the corporate sector, and their improvement between 1990:Q3 and 1992:Q3.

As shown in the second section of panel (b), debt level changes alone would have caused a decline in the short-term debt service ratio equivalent to an interest payments rebate of $7.0 billion, while they would have increased the long-term debt service ratio, equivalent to an increase in interest payments of $12.l billion. Similar calculations for the total debt service burden show a worsening in the total ratio equivalent to a $5.l billion increase in interest payments.

The third section of panel (b) shows that debt level and cash flow changes together would have improved the short-term ratio, since short-term debt levels fell and cash flow grew.5 However, the long-term ratio would still have worsened, since cash flow growth was not enough to offset the increase in long-term debt. These same factors would have slightly decreased the total servicing burden, equivalent to an interest payments rebate of $7.5 billion.

The fourth section of panel (b) summarizes the actual changes in debt service burdens as debt levels, cash flow, and interest rates have changed. The improvement in the total debt servicing burden is equivalent to a rebate in interest payments of $62.5 billion, compared to $7.5 billion when only debt level and cash flow changes are considered. This implies that the interest rate reduction alone has accounted for $55 billion in interest payments rebates.

This Chicago Fed Letter suggests that, although both the household and corporate sectors have carried lighter debt burdens in recent quarters, leverage ratios remain near historical highs. Moreover, our calculations show that the marked decline in debt service ratios is due to interest rate reductions, not to debt level declines or income growth. Thus, balance sheet restructurings are likely to remain an important factor for some time.

Notes

1 For a discussion of consumer debt and data sources see Francesca Eugeni, “Consumer debt and home equity borrowing,” Economic Perspectives, Federal Reserve Bank of Chicago, March/April 1993, pp. 2-13.

2 These are estimates by staff of the Federal Reserve Board of scheduled repayments of principal and interest on total household debt outstanding.

3 These calculations abstract from principal repayments. Also, total debt service burden is the sum of interest payments on consumer installment credit and mortgage debt.

4 Cash flow is defined as the sum of before tax profits, depreciation, and interest payments on debt service burden ratios. For data sources and details see Paula Worthington, “Recent trends in corporate leverage,” Economic Perspectives, Federal Reserve Bank of Chicago, May/June 1993, pp. 24-31.

5 Here, cash flow growth denotes growth in the sum of pretax profits and depreciation.